Title: A Comprehensive Guide to Mississippi Letter(s) to Credit Card Companies and Financial Institutions Notifying Them of Death: Key Types and Sample Templates Introduction: When a loved one passes away, it becomes essential to inform various entities, including credit card companies and financial institutions, about the individual's demise. This letter serves as an official notification to prevent any potential issues and miscommunications regarding the deceased person's accounts or finances. In this article, we will explore the different types of Mississippi letter(s) used to inform credit card companies and financial institutions of a death, along with relevant templates and essential information. Types of Mississippi Letters to Credit Card Companies and Financial Institutions Notifying Them of Death: There are primarily three types of letters that can be used when notifying credit card companies and financial institutions of the death of an account holder in Mississippi: 1. Mississippi Death Notification Letter for Credit Card Companies: This letter is specifically designed to inform credit card companies about an individual's passing. It includes essential details such as the deceased person's full name, account number(s), date of death, and any additional requests, such as closing the accounts or transferring the outstanding balance to the estate. It is important to attach a certified copy of the death certificate to this notification. 2. Mississippi Death Notification Letter for Financial Institutions — Bank Accounts: When notifying financial institutions (including banks) about a customer's death in Mississippi, this letter template is used. Along with the account holder's complete details and date of passing, it typically requests necessary actions such as freezing or closing the account, transferring funds to the estate, or providing statements for probate purposes. Similar to the credit card letter, a certified death certificate should be attached to facilitate the process. 3. Mississippi Death Notification Letter for Financial Institutions — Investment or Retirement Accounts: This type of letter is specifically targeted at notifying financial institutions handling investment or retirement accounts of the account holder's demise. It provides relevant information regarding the deceased person's account, including account number(s), name, date of passing, and instructions on how to proceed, such as transferring the account balance to beneficiaries or executor. Again, attaching a certified copy of the death certificate is crucial for verification purposes. Sample Templates: To assist you in drafting your Mississippi letter(s) to credit card companies and financial institutions following a death, here are two sample templates: 1. Mississippi Death Notification Letter for Credit Card Companies: [Include a comprehensive template for notifying credit card companies.] 2. Mississippi Death Notification Letter for Financial Institutions — Bank Accounts: [Include a comprehensive template for notifying financial institutions about the customer's death for bank accounts.] Conclusion: Properly notifying credit card companies and financial institutions of a loved one's death is crucial to ensure a smooth transition and prevent any unauthorized usage of their accounts or finances. Adhering to the provided guidelines and using the sample templates can greatly assist in effectively communicating the necessary information to relevant entities during this challenging time.

Mississippi Letter to Credit Card Companies and Financial Institutions Notifying Them of Death

Description

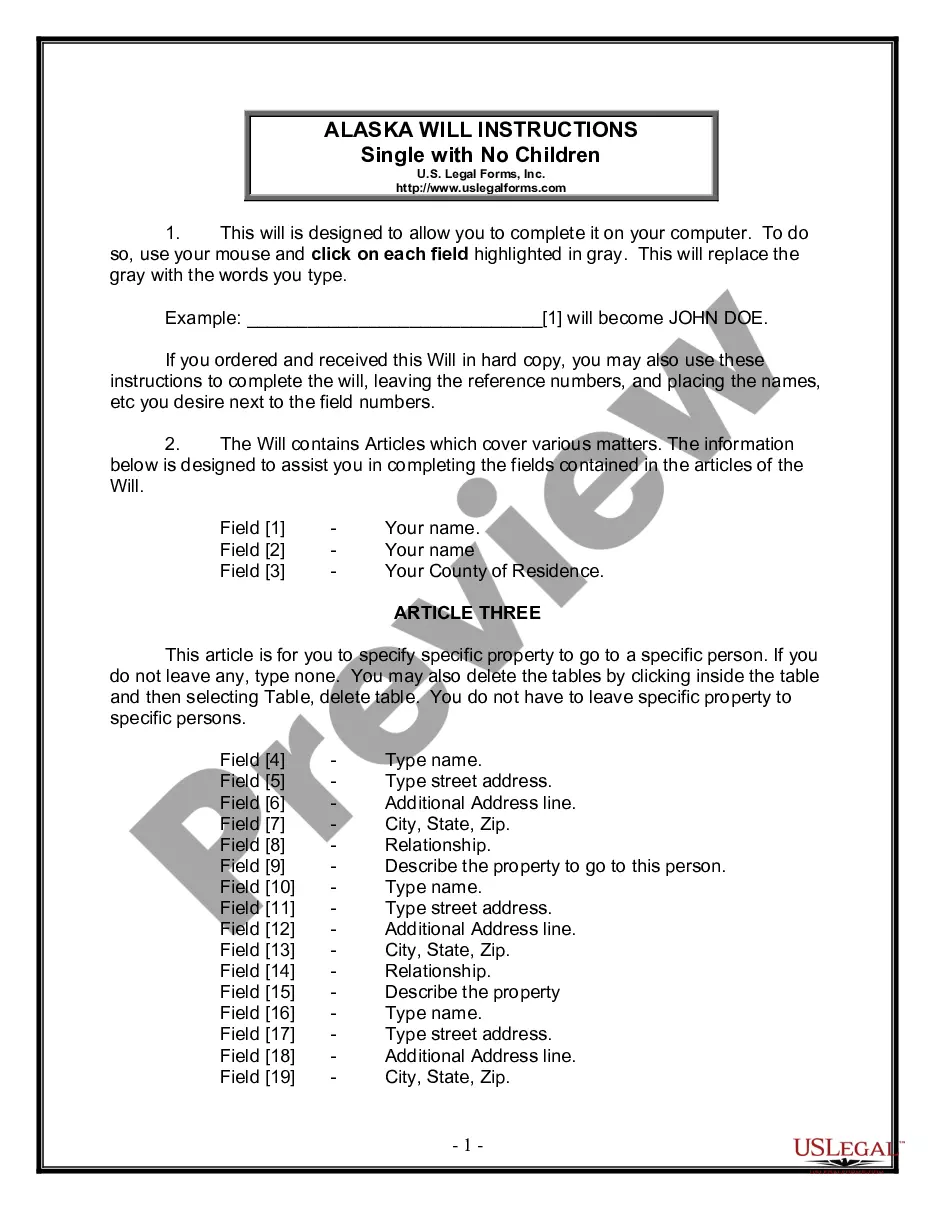

How to fill out Mississippi Letter To Credit Card Companies And Financial Institutions Notifying Them Of Death?

It is possible to invest hours on the Internet trying to find the legal document format that fits the federal and state demands you need. US Legal Forms offers thousands of legal varieties which can be examined by experts. It is possible to down load or produce the Mississippi Letter to Credit Card Companies and Financial Institutions Notifying Them of Death from our assistance.

If you already possess a US Legal Forms bank account, you can log in and then click the Acquire option. Afterward, you can total, revise, produce, or sign the Mississippi Letter to Credit Card Companies and Financial Institutions Notifying Them of Death. Every legal document format you acquire is your own forever. To have one more duplicate of the obtained kind, visit the My Forms tab and then click the related option.

If you are using the US Legal Forms site the first time, adhere to the straightforward directions listed below:

- Initially, be sure that you have chosen the right document format for that county/town that you pick. Browse the kind description to ensure you have picked the correct kind. If readily available, take advantage of the Review option to look throughout the document format too.

- In order to locate one more variation of your kind, take advantage of the Search field to discover the format that meets your needs and demands.

- Once you have identified the format you want, just click Buy now to carry on.

- Pick the prices plan you want, enter your accreditations, and register for a free account on US Legal Forms.

- Total the deal. You can utilize your bank card or PayPal bank account to cover the legal kind.

- Pick the formatting of your document and down load it to the gadget.

- Make changes to the document if needed. It is possible to total, revise and sign and produce Mississippi Letter to Credit Card Companies and Financial Institutions Notifying Them of Death.

Acquire and produce thousands of document templates making use of the US Legal Forms site, which offers the biggest variety of legal varieties. Use professional and express-particular templates to tackle your organization or specific demands.

Form popularity

FAQ

When a loved one passes away, you'll have a lot to take care of, including their finances. It's important to remember that credit card debt does not automatically go away when someone dies. It must be paid by the estate or the co-signers on the account.

If there's no money in their estate, the debts will usually go unpaid. For survivors of deceased loved ones, including spouses, you're not responsible for their debts unless you shared legal responsibility for repaying as a co-signer, a joint account holder, or if you fall within another exception.

In the unfortunate event of the user's demise, the credit card issuer cannot issue notices in the deceased's name to ensure repayment. Hence, they hold the next of kin or legal heirs responsible for repaying the outstanding amount.

When someone dies, their debts are generally paid out of the money or property left in the estate. If the estate can't pay it and there's no one who shared responsibility for the debt, it may go unpaid. Generally, when a person dies, their money and property will go towards repaying their debt.

Credit reporting companies regularly receive notifications from the Social Security Administration about individuals who have passed away, but it's better to also notify them on your own to ensure no one applies for credit in the deceased's name in the meantime.

Unfortunately, ?(Detail Deceased's name) ?passed away on ?(Detail Date)?. I enclose a copy of their death certificate. They didn't leave behind any assets and there is no money to pay what they owe. Please consider writing off this debt because there is no prospect of you ever recovering any money towards it.

Credit card debt doesn't follow you to the grave. It lives on and is either paid off through estate assets or becomes the joint account holder's or co-signer's responsibility.