Title: Understanding Mississippi Letters to Credit Reporting Company Regarding Known Imposter Identity Theft Introduction: Identity theft continues to be a prevalent concern in today's digital age, posing significant risks to individuals' personal and financial wellbeing. One of the crucial steps to combat this issue is reporting the incident to credit reporting companies or bureaus promptly. In the state of Mississippi, several types of letters can be crafted to address known imposter identity theft cases. This article will delve into the details of Mississippi letters to credit reporting companies or bureaus pertaining to known imposter identity theft, providing valuable insights and guidelines to victims. Keywords: Mississippi letters, credit reporting company, credit bureaus, known imposter identity theft, reporting, guidelines. Types of Mississippi Letters: 1. Mississippi Identity Theft Letter to Credit Reporting Company: — This type of letter is written to inform the credit reporting company about the known imposter identity theft incident affecting an individual. — It should include specific details about the fraudulent accounts, unauthorized transactions, or any other relevant information. — The letter should request that the credit reporting company block all fraudulent information from the individual's credit report and initiate an investigation. 2. Mississippi Letter to Credit Bureau Regarding Known Imposter Identity Theft: — Similar to the previous type, this letter targets credit bureaus instead of individual reporting companies. — It should state the known imposter identity theft circumstances, including the fraudulent accounts or activities that need to be rectified. — The letter should request a comprehensive investigation into the matter, removal of false information from credit reports, and a freeze on the victim's credit file. Key Considerations for Crafting Mississippi Letters: 1. Personal Information: — Include personal details such as full name, address, contact number, email, and Social Security Number (SSN) in the letter. — This information will help credit reporting companies or bureaus identify the victims' accounts and initiate appropriate actions swiftly. 2. Statement of Identity Theft: — Clearly state that the purpose of the letter is to report known imposter identity theft and provide a detailed account of the incident. — Explain how the identity theft occurred, such as fraudulent credit applications, unauthorized transactions, or misuse of personal information. 3. Documentation and Supporting Evidence: — It is crucial to attach relevant supporting documents to the letter, such as copies of police reports, affidavits of identity theft, and any other evidence available. — These documents will help substantiate the claim and speed up the investigation process. 4. Request for Action: — Specify what actions the credit reporting company or bureau should take, such as blocking fraudulent accounts, removing false information, or initiating an investigation. — Request a written confirmation of the steps taken and the resolution of the issue. Conclusion: Mississippi individuals affected by known imposter identity theft need to communicate their cases effectively to credit reporting companies or bureaus. Crafting a comprehensive and detailed letter is essential to initiate prompt action, protect one's credit standing, and restore financial stability. By understanding the different types of Mississippi letters regarding known imposter identity theft, victims can take proactive steps to mitigate the impact of identity theft. Keywords: Mississippi letters, credit reporting company, credit bureaus, known imposter identity theft, reporting, guidelines.

Mississippi Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

Description

How to fill out Mississippi Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

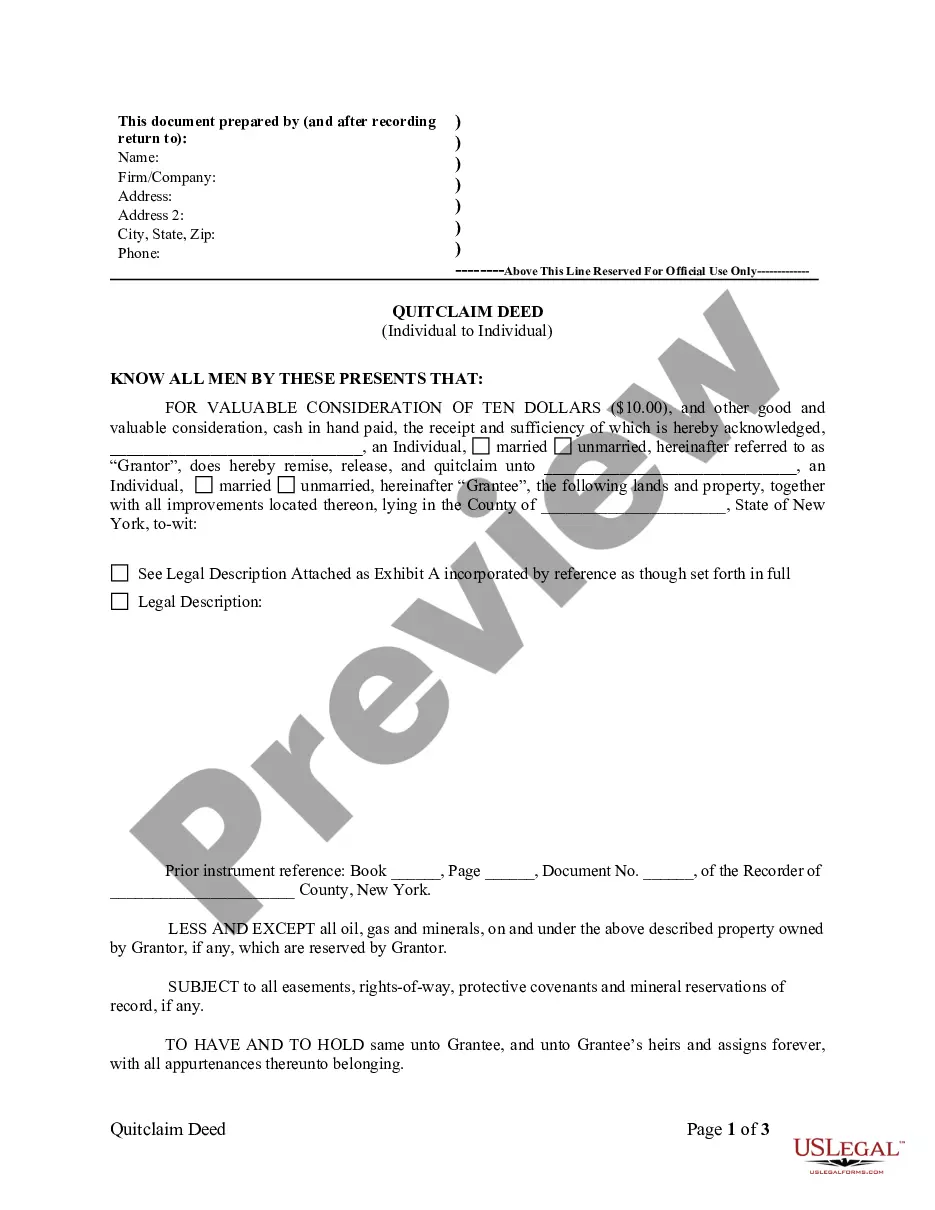

Choosing the best lawful papers format might be a battle. Of course, there are a lot of templates available online, but how will you obtain the lawful develop you require? Take advantage of the US Legal Forms web site. The support provides a huge number of templates, like the Mississippi Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft, that can be used for enterprise and personal demands. All of the types are examined by experts and fulfill federal and state needs.

If you are currently listed, log in in your account and click the Down load switch to obtain the Mississippi Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft. Use your account to check throughout the lawful types you have bought earlier. Visit the My Forms tab of your own account and obtain another duplicate in the papers you require.

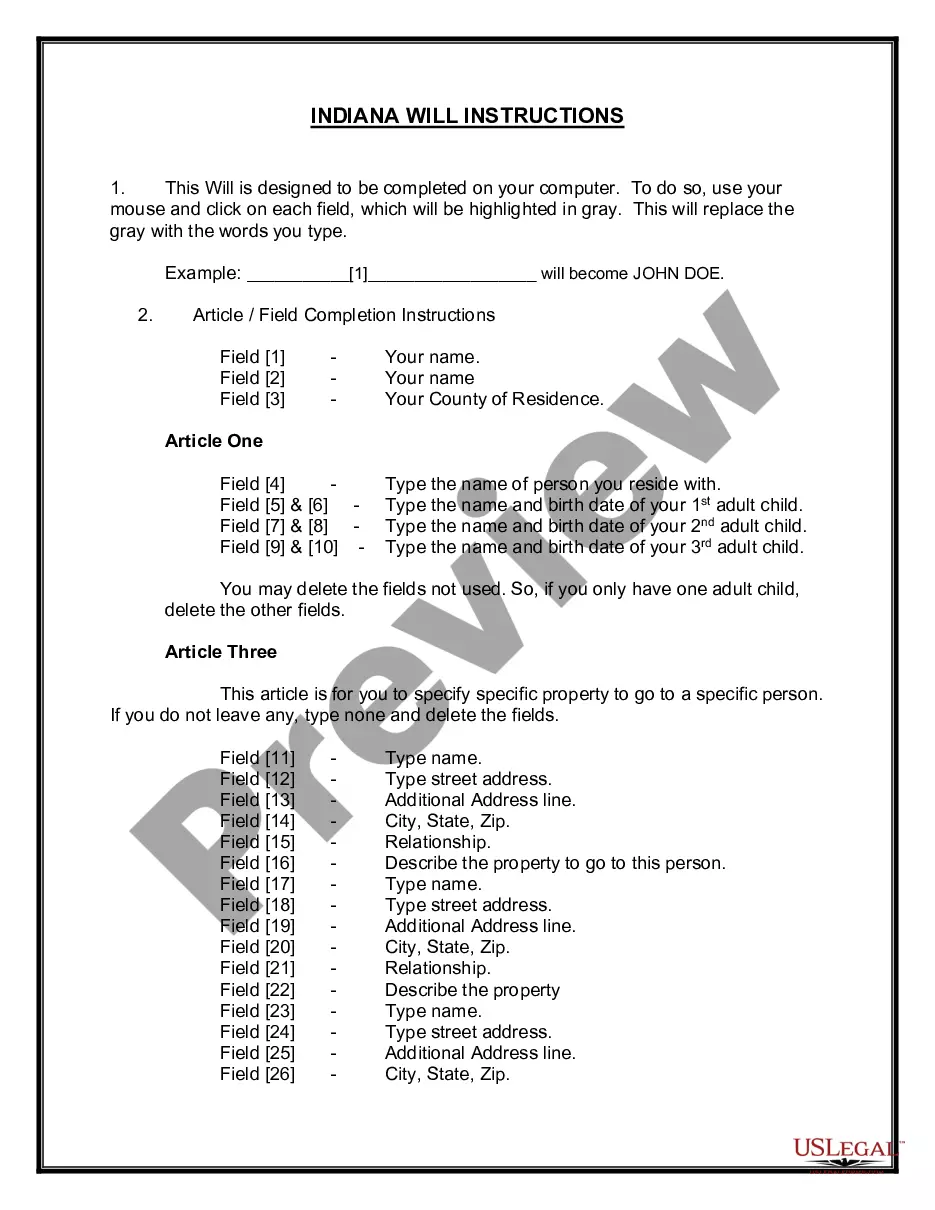

If you are a new consumer of US Legal Forms, allow me to share straightforward directions for you to adhere to:

- Initially, be sure you have chosen the proper develop for your metropolis/county. It is possible to check out the shape making use of the Review switch and read the shape information to make certain this is the right one for you.

- In the event the develop will not fulfill your expectations, utilize the Seach discipline to get the proper develop.

- When you are certain that the shape is acceptable, click the Purchase now switch to obtain the develop.

- Choose the rates plan you want and type in the required information. Make your account and pay money for the transaction with your PayPal account or Visa or Mastercard.

- Choose the submit structure and acquire the lawful papers format in your product.

- Comprehensive, modify and printing and signal the received Mississippi Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft.

US Legal Forms is the biggest catalogue of lawful types that you can see numerous papers templates. Take advantage of the company to acquire professionally-created paperwork that adhere to condition needs.

Form popularity

FAQ

If You're a Victim of Identity Theft? Contact your local police department and file a report of the theft. ... Contact the fraud department of one of the three major credit bureaus. ... File a report with the Federal Trade Commission.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

If you've been a victim of identity theft, you can also get credit reporting companies to remove fraudulent information and debts from your credit report, which is called blocking. To do this, you must send the credit reporting companies: An identity theft report, which can be done through IdentityTheft.gov.

File a report with your local police department. Place a fraud alert on your credit report. ... Consumer Reporting Agencies (CRA's) Close the accounts that you know or believe have been tampered with or opened fraudulently. ... Report the theft to the Federal Trade Commission. ... File a police report.

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation. - Request these companies to place a fraud alert in your file as well as a credit freeze.