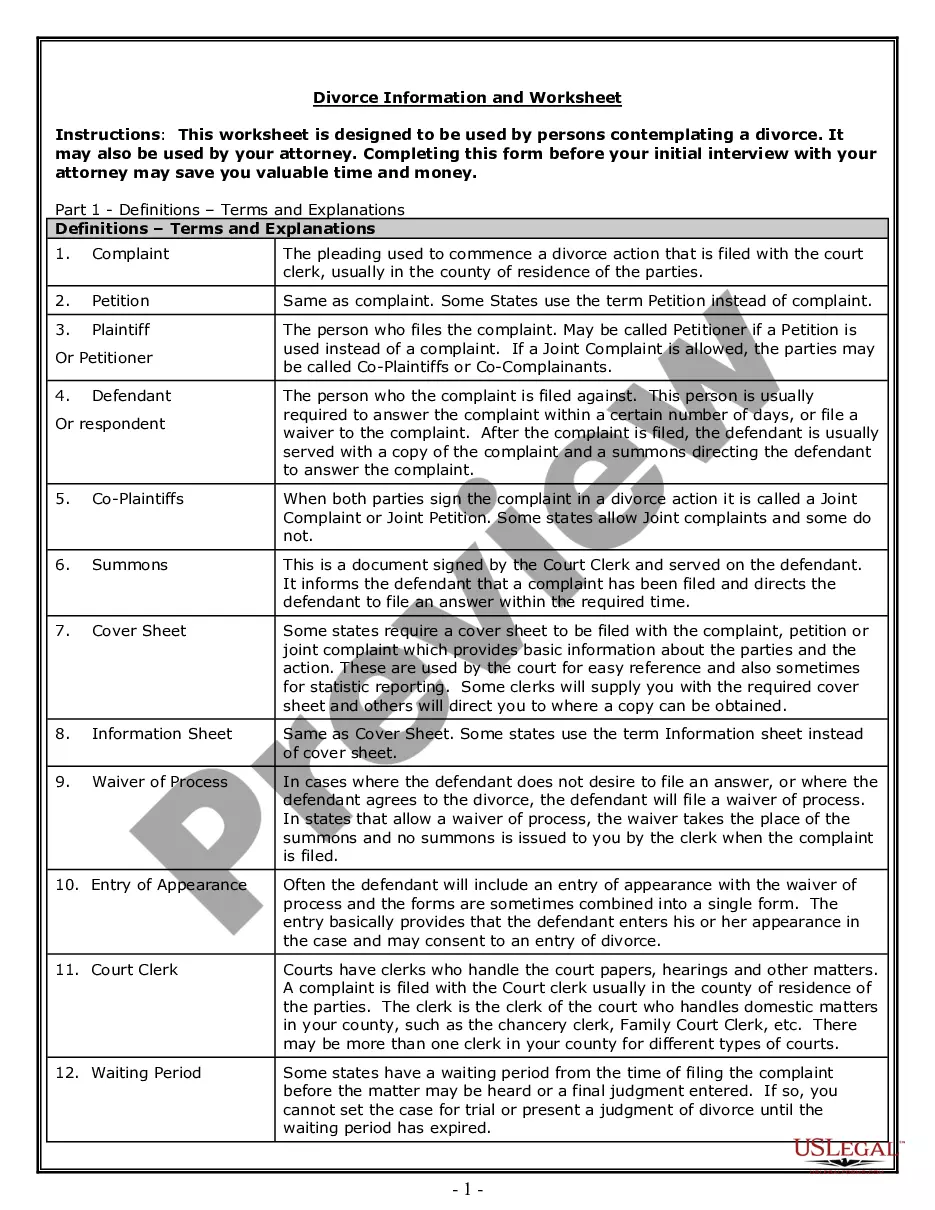

A Mississippi Rental Lease Agreement for Business is a legally binding contract between a landlord and a business tenant that outlines the terms and conditions governing the rental of a commercial property in the state of Mississippi. This agreement establishes the rights and responsibilities of both parties involved, ensuring a smooth and transparent rental process. The Mississippi Rental Lease Agreement for Business covers various essential aspects related to the commercial lease, including the lease term, rent amount, payment schedule, security deposit, maintenance responsibilities, and permitted use of the premises. It also outlines any additional provisions specific to the business lease, such as signage restrictions, parking arrangements, and any utilities to be included in the rent. Different types of Mississippi Rental Lease Agreements for Business may exist depending on the specific needs and nature of the business. Here are a few common types: 1. Triple Net Lease (NNN): This type of lease places the responsibility of paying property taxes, insurance, and maintenance costs on the tenant, in addition to the base rent. The tenant would be responsible for these additional expenses, along with their proportionate share of common area expenses, making it suitable for larger businesses or those seeking long-term stability. 2. Gross Lease: In a gross lease, the landlord covers most, if not all, of the property expenses. The tenant pays a fixed rent that includes utilities, property taxes, insurance, and maintenance fees. This type of lease is often preferred by smaller businesses that prioritize simplicity and predictable expenses. 3. Percentage Lease: This type of commercial lease includes a base rent along with an additional percentage of the tenant's gross sales. It is commonly used in retail or commercial spaces located within shopping centers or malls. This arrangement allows the landlord to benefit directly from the tenant's success. 4. Short-Term Lease: Suitable for businesses with temporary needs or those starting out, a short-term lease typically spans a few months or a year. It offers flexibility and allows businesses to test the market before committing to a longer-term lease. 5. Sublease Agreement: This agreement occurs when the original tenant leases the property to a third party (subtenant) for a portion of the lease term. The subtenant pays rent to the original tenant, who, in turn, pays rent to the landlord. This arrangement can be useful for businesses seeking to share the rent burden or for those looking to sublet excess space. Creating a thorough Mississippi Rental Lease Agreement for Business is crucial to protect the interests of both parties. It is advisable to consult with legal professionals or use reliable online resources to ensure compliance with state laws and incorporate relevant clauses tailored to the specific business requirements.

Mississippi Rental Lease Agreement for Business

Description

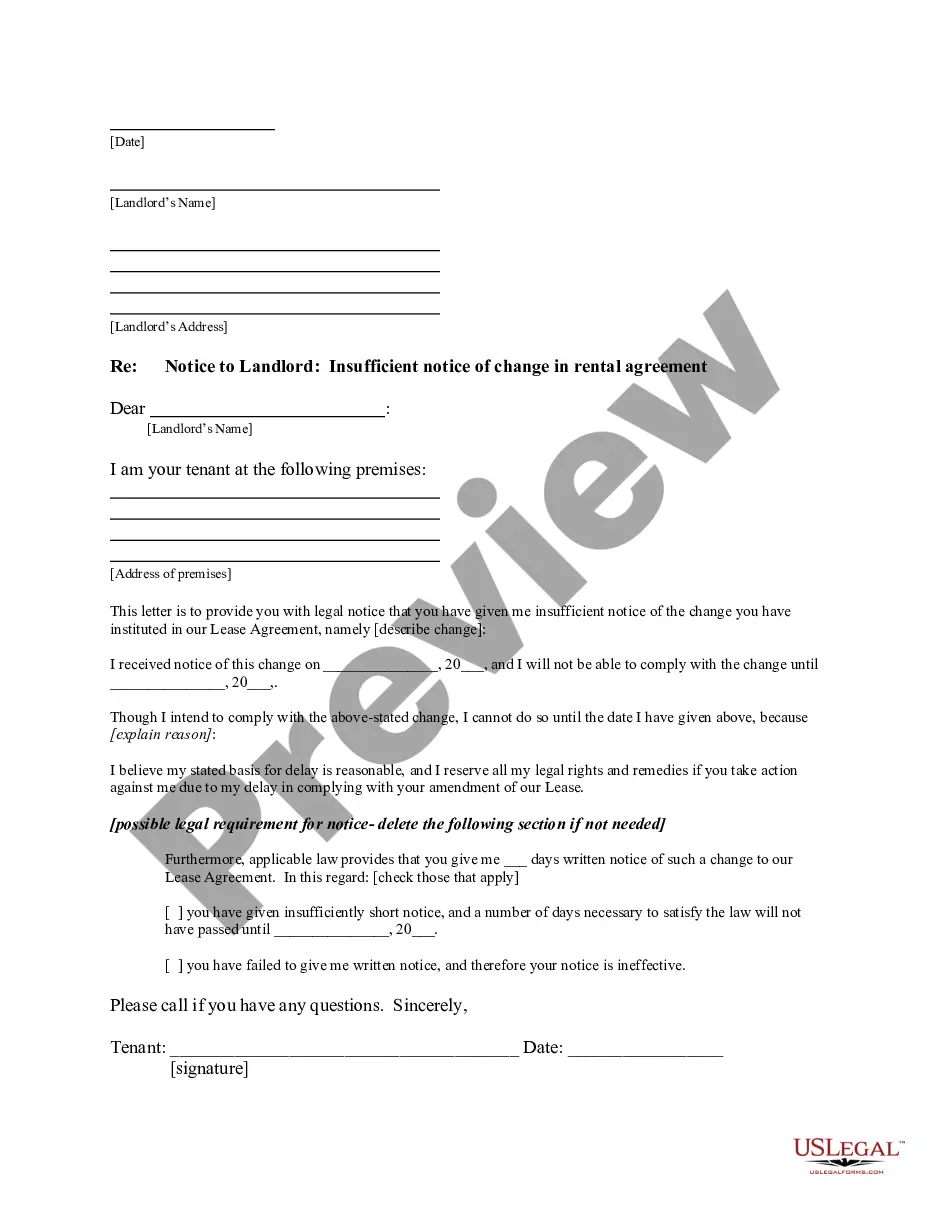

How to fill out Mississippi Rental Lease Agreement For Business?

Finding the appropriate legal document template can be challenging.

Certainly, there are numerous formats accessible online, but how do you locate the legal form you require.

Make use of the US Legal Forms site. The service offers a vast array of templates, including the Mississippi Rental Lease Agreement for Business, applicable for both business and personal use.

Firstly, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm it is suitable for your needs. If the form does not meet your requirements, utilize the Search feature to find the correct form. Once you are confident that the form is appropriate, click the Buy now button to acquire the form. Select the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Mississippi Rental Lease Agreement for Business. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- All forms are verified by experts and comply with state and federal regulations.

- If you are already registered, Log Into your account and click the Download button to access the Mississippi Rental Lease Agreement for Business.

- You can use your account to search through the legal forms you have previously acquired.

- Navigate to the My documents section of your account and obtain an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

Form popularity

FAQ

Writing a business contract proposal involves outlining the service or terms you intend to provide clearly. Start with an introduction about your business, detail the terms of the contract, and specify any benefits to the other party. Including a solid Mississippi Rental Lease Agreement for Business can give your proposal more substance and clarity.

To write a business proposal for a lease, outline your business needs and how they align with the property you intend to lease. Highlight your financial capability, proposed rental terms, and duration of the lease. By addressing specific needs in your Mississippi Rental Lease Agreement for Business, you can create a compelling case for property owners.

Yes, Microsoft Word offers various lease agreement templates that users can customize to fit their needs. These templates can streamline the process of drafting documents by providing a structured format. For a Mississippi Rental Lease Agreement for Business, using these templates can save time and ensure you include all necessary components.

Writing a commercial real estate proposal involves specifying property details, outlining your terms, and addressing the needs of the property owner. Start with an introduction, detail your offer and its benefits, then conclude by reinforcing your interest. A well-structured Mississippi Rental Lease Agreement for Business will enhance your chances of success in securing the lease.

To write a proposal for real estate, start by clearly defining your goals and objectives. Include essential information such as property details, proposed terms, and any conditions that may apply. When drafting your Mississippi Rental Lease Agreement for Business, be sure to be clear and concise to avoid misunderstandings.

In Mississippi, notarization is not a strict requirement for a residential or commercial lease. However, it is beneficial to have a lease agreement notarized to ensure its legality and enforceability in case of disputes. If you are creating a Mississippi Rental Lease Agreement for Business, having the document notarized can provide an extra layer of protection.

A lease proposal is a document that outlines the terms and conditions a potential tenant proposes to a property owner for leasing a space. It typically includes essential details such as the proposed lease duration, rental amount, and any special requests from the tenant. When dealing with a Mississippi Rental Lease Agreement for Business, this proposal can help both parties reach a mutually beneficial agreement.

In Mississippi, you can evict a tenant without a formal lease, but you must still follow legal procedures. If a tenant occupies the property and payment has been made, they may have certain rights. As a landlord, it's crucial to document all communications and maintain a clear record. Using a Mississippi Rental Lease Agreement for Business can help establish ground rules and clarify terms to reduce misunderstandings and potential eviction issues. Platforms like uslegalforms can assist in creating a comprehensive lease document.

Renters in Mississippi have specific rights, including the right to a habitable home, privacy, and protection against unlawful eviction. Understanding these rights helps you ensure a fair rental experience. When creating a Mississippi Rental Lease Agreement for Business, be sure to include clauses that respect these rights to foster a positive landlord-tenant relationship. Resources available at uslegalforms can guide you in outlining renters' rights effectively.

In Mississippi, a lease agreement does not legally need to be notarized to be valid. However, having a notarized Mississippi Rental Lease Agreement for Business can provide an extra layer of security and proof of the agreement's existence. It may also help with future disputes or claims, as notarization verifies the identities of the parties involved. Consider using platforms like uslegalforms to create a notarized agreement easily.

Interesting Questions

More info

The content on this site is provided for general reference to those who are new to the industry, however, it is not a substitute for legal, accounting, tax, or investment advice.