Mississippi Sale and Leaseback Agreement for Commercial Building

Description

How to fill out Sale And Leaseback Agreement For Commercial Building?

Selecting the appropriate legal document template can be a challenge. Naturally, there are countless templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website.

The service offers thousands of templates, including the Mississippi Sale and Leaseback Agreement for Commercial Property, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with federal and state requirements.

If you are already registered, Log In to your account and click the Obtain button to access the Mississippi Sale and Leaseback Agreement for Commercial Property. Use your account to search through the legal forms you may have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

Complete, modify, print, and sign the received Mississippi Sale and Leaseback Agreement for Commercial Property. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted paperwork that adheres to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

- First, ensure that you have selected the correct form for your local area.

- You can review the form using the Preview button and read the form description to confirm that it is suitable for your needs.

- If the form does not meet your requirements, use the Search box to find the appropriate form.

- Once you are confident that the form is correct, click the Acquire now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary details. Set up your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template onto your system.

Form popularity

FAQ

While a sale and leaseback can provide immediate liquidity, it may lead to higher long-term costs due to lease payments. Property owners lose equity in the building and may face financial strain if rental rates increase. Understanding the Mississippi Sale and Leaseback Agreement for Commercial Building can help mitigate potential downsides. Therefore, thorough consultation before entering such agreements is advisable.

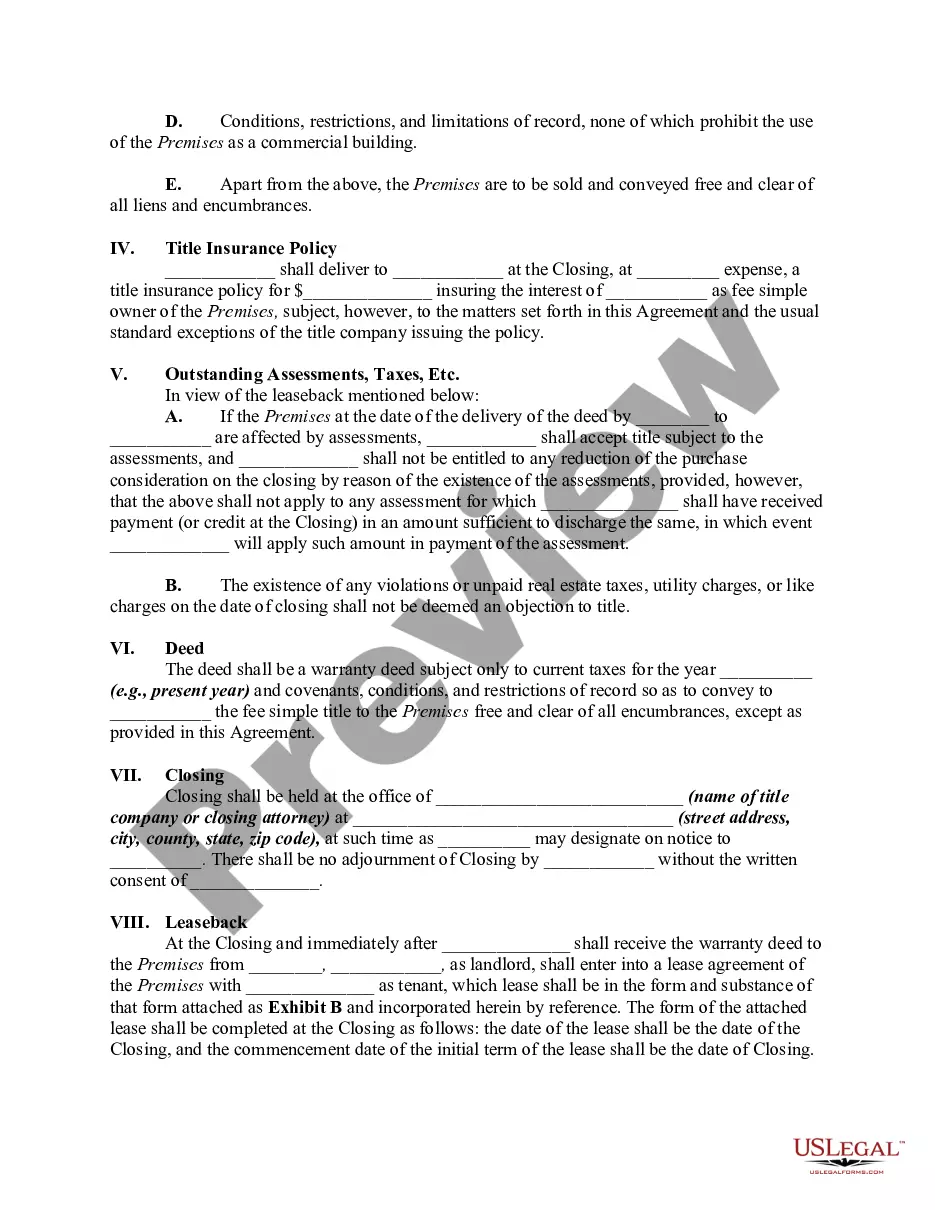

The sale and leaseback process involves a property owner selling their commercial building while simultaneously leasing it back from the buyer. This arrangement allows the original owner to access capital while retaining the use of the property for their business operations. Utilizing a Mississippi Sale and Leaseback Agreement for Commercial Building can clarify expectations and responsibilities during this transaction. Therefore, clear documentation is crucial.

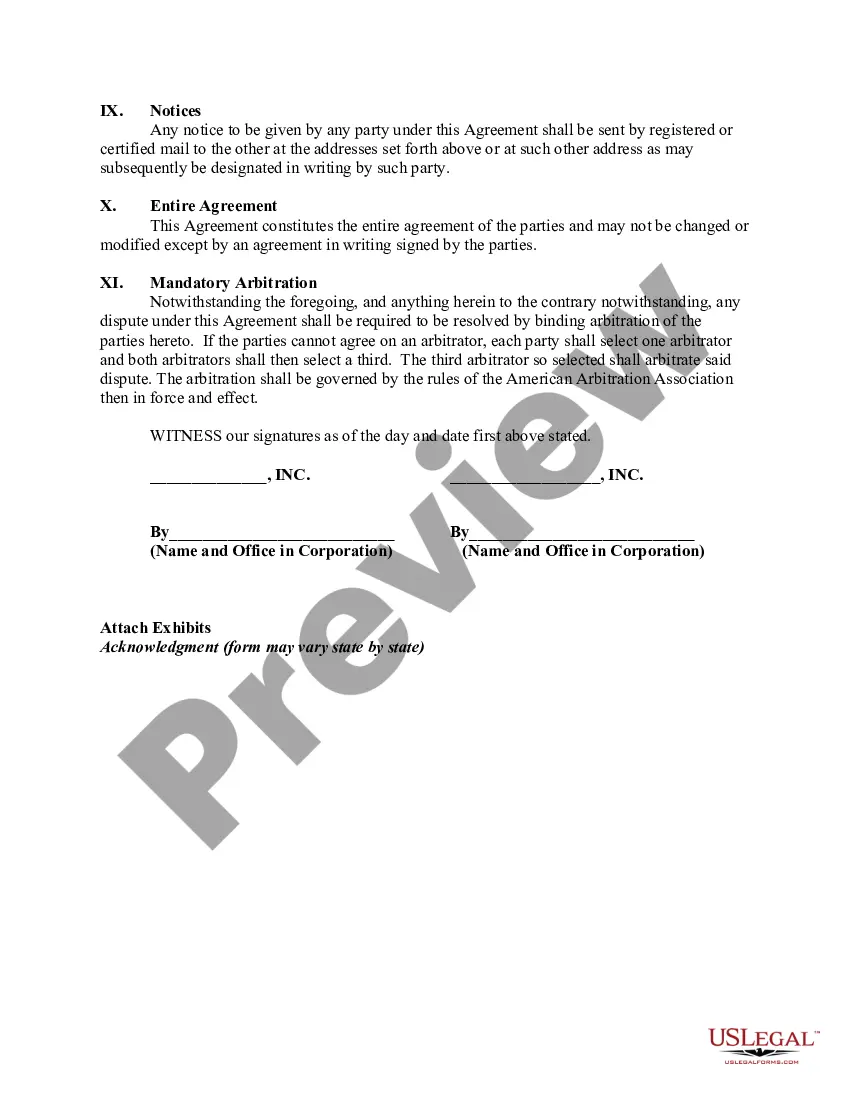

NNN, or triple net, refers to a lease structure where the tenant pays rent plus all operating expenses, including property taxes, insurance, and maintenance costs. This arrangement often benefits landlords by ensuring they receive a stable income stream without the burden of management. If you're considering a commercial transaction, understanding the NNN terms within the Mississippi Sale and Leaseback Agreement for Commercial Building is essential.

The two main types of sale and leaseback leases are 'single net' and 'triple net' leases. In a single net lease, the tenant pays rent plus a portion of property taxes, while in a triple net lease, the tenant also covers insurance and maintenance costs. Understanding these distinctions is vital for making informed leasing decisions. The Mississippi Sale and Leaseback Agreement for Commercial Building provides clarity on these lease types.

To lease a commercial building, you typically need a clear business plan, financial statements, and credit references. You should also gather any personal guarantees if required by the landlord. Having a comprehensive understanding of the Mississippi Sale and Leaseback Agreement for Commercial Building helps illustrated compliance with necessary lease terms, ensuring all parties are on the same page.

When a commercial building is sold, the existing lease usually remains intact. The new owner typically steps into the role of landlord and is bound by the terms of the original agreement. This ensures that tenants can continue their operations without disruption. Being familiar with the Mississippi Sale and Leaseback Agreement for Commercial Building can help clarify these transitions.

Determining whether a sale and leaseback qualifies as a sale involves examining the terms of the agreement. The transaction should transfer ownership of the property while establishing a leaseback arrangement. Proper structuring, as outlined in the Mississippi Sale and Leaseback Agreement for Commercial Building, ensures that both parties meet their financial objectives and legal obligations.

While sale and leaseback arrangements offer benefits, they also have downsides. One potential negative is the loss of asset ownership, which can impact a company's balance sheet. Additionally, lease payments may exceed previous mortgage obligations over time, resulting in higher costs for the business. Understanding these factors is essential in the context of a Mississippi Sale and Leaseback Agreement for Commercial Building.

A failed sales leaseback occurs when the anticipated benefits of the sale and leaseback transaction do not materialize. This situation may arise if the seller cannot fulfill lease obligations or if the property value declines significantly. It is crucial to understand the terms of the Mississippi Sale and Leaseback Agreement for Commercial Building to avoid potential pitfalls and ensure a successful outcome.

Sales and leaseback refer to a financial transaction where the owner of a commercial building sells the property to a buyer and simultaneously leases it back. This type of agreement is often used to improve liquidity for a business, allowing it to reinvest the sale proceeds into the company. The Mississippi Sale and Leaseback Agreement for Commercial Building serves as a standard structure for these types of transactions.