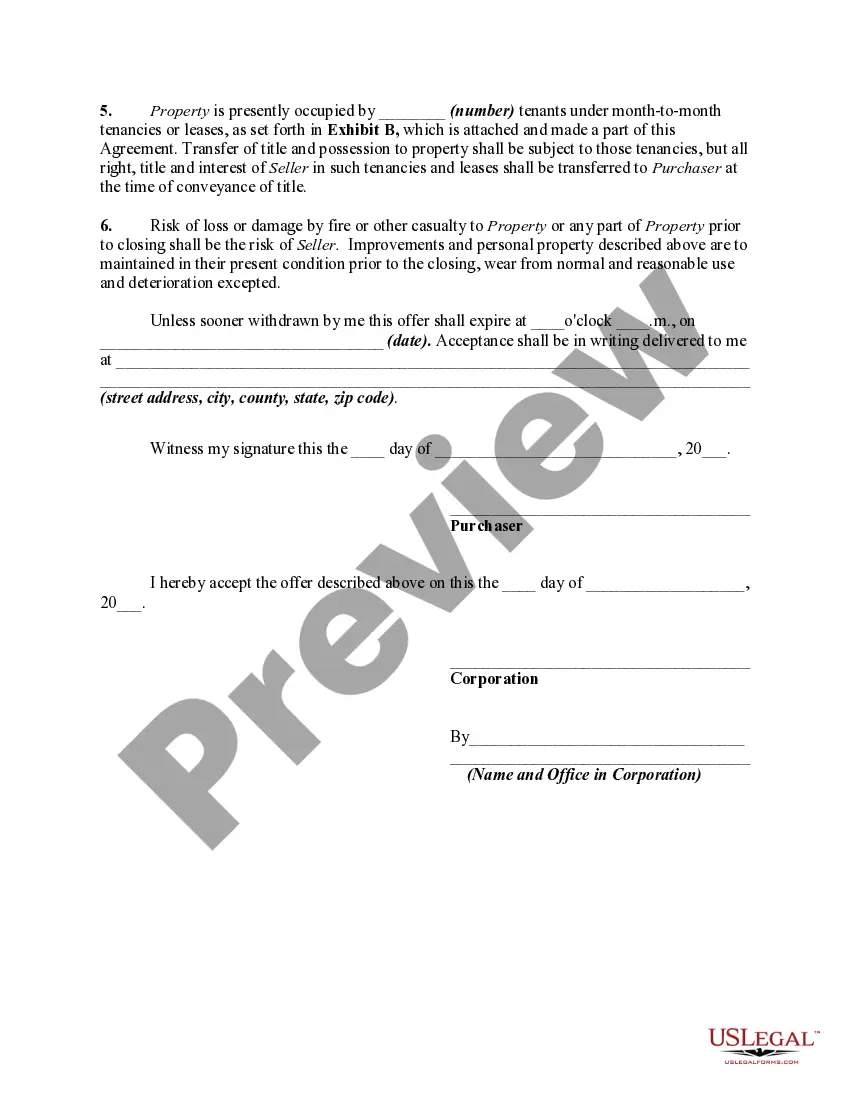

A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Mississippi Offer to Purchase Commercial Property: A Comprehensive Guide Introduction: In the state of Mississippi, an Offer to Purchase Commercial Property serves as a crucial legal document during the process of buying or selling commercial real estate. It outlines the terms and conditions under which a buyer proposes to purchase a commercial property from a seller. This detailed description will provide an overview of Mississippi Offer to Purchase Commercial Property, its significance, and shed light on different types of offers available. Keywords: Mississippi, Offer to Purchase Commercial Property, buying, selling, real estate, terms and conditions I. Understanding the Mississippi Offer to Purchase Commercial Property 1. Definition: The Mississippi Offer to Purchase Commercial Property is a legally binding agreement between a buyer and a seller, providing the terms for the sale of commercial real estate. 2. Intent: This document demonstrates the buyer's serious interest in purchasing the property and initiates negotiations. 3. Key Provisions: The offer typically includes essential details such as purchase price, financing terms, contingencies, inspection provisions, closing date, and any additional conditions relevant to the transaction. Keywords: legally binding agreement, buyer, seller, negotiations, purchase price, financing terms, contingencies, inspection provisions, closing date, additional conditions II. Types of Mississippi Offer to Purchase Commercial Property: 1. Cash Offer: A cash offer involves the buyer submitting an all-cash payment without any financing contingencies. This type of offer is preferred by sellers seeking a quick and hassle-free transaction. 2. Financing Contingency Offer: This offer includes conditions that enable the buyer to back out of the agreement if they fail to secure suitable financing within a specified timeframe. 3. Lease Option Offer: A lease option offer combines elements of a lease and a purchase option. It allows the buyer to lease the property for a specific period before deciding whether to exercise the option to buy. Keywords: cash offer, financing contingency offer, lease option offer, lease, purchase option, financing, back out, exercise III. Elements of a Mississippi Offer to Purchase Commercial Property: 1. Purchase Price: The offer outlines the amount the buyer is willing to pay for the commercial property. 2. Earnest Money Deposit: This deposit, paid by the buyer, signifies their commitment to the purchase and is typically held in escrow until the transaction is finalized. 3. Contingencies: These provisions specify conditions that must be met to proceed with the purchase, such as satisfactory property inspections, zoning approvals, or environmental assessments. 4. Title Examination: This clause ensures that the seller has clear and marketable title to the property. 5. Closing Date: The expected date for the completion of the transaction, including the transfer of ownership and any financial settlements. Keywords: purchase price, earnest money deposit, escrow, contingencies, property inspections, zoning approvals, environmental assessments, title examination, closing date, transfer of ownership, financial settlements Conclusion: The Mississippi Offer to Purchase Commercial Property plays a pivotal role in the buying and selling of commercial real estate in Mississippi. It provides a framework for negotiations and enables both parties to agree upon the terms of the transaction. Understanding the different types of offers available and their key components is vital for successfully navigating the complexities of commercial property transactions in Mississippi. Keywords: pivotal role, negotiations, terms of transaction, types of offers, components, commercial property transactions, MississippiTitle: Mississippi Offer to Purchase Commercial Property: A Comprehensive Guide Introduction: In the state of Mississippi, an Offer to Purchase Commercial Property serves as a crucial legal document during the process of buying or selling commercial real estate. It outlines the terms and conditions under which a buyer proposes to purchase a commercial property from a seller. This detailed description will provide an overview of Mississippi Offer to Purchase Commercial Property, its significance, and shed light on different types of offers available. Keywords: Mississippi, Offer to Purchase Commercial Property, buying, selling, real estate, terms and conditions I. Understanding the Mississippi Offer to Purchase Commercial Property 1. Definition: The Mississippi Offer to Purchase Commercial Property is a legally binding agreement between a buyer and a seller, providing the terms for the sale of commercial real estate. 2. Intent: This document demonstrates the buyer's serious interest in purchasing the property and initiates negotiations. 3. Key Provisions: The offer typically includes essential details such as purchase price, financing terms, contingencies, inspection provisions, closing date, and any additional conditions relevant to the transaction. Keywords: legally binding agreement, buyer, seller, negotiations, purchase price, financing terms, contingencies, inspection provisions, closing date, additional conditions II. Types of Mississippi Offer to Purchase Commercial Property: 1. Cash Offer: A cash offer involves the buyer submitting an all-cash payment without any financing contingencies. This type of offer is preferred by sellers seeking a quick and hassle-free transaction. 2. Financing Contingency Offer: This offer includes conditions that enable the buyer to back out of the agreement if they fail to secure suitable financing within a specified timeframe. 3. Lease Option Offer: A lease option offer combines elements of a lease and a purchase option. It allows the buyer to lease the property for a specific period before deciding whether to exercise the option to buy. Keywords: cash offer, financing contingency offer, lease option offer, lease, purchase option, financing, back out, exercise III. Elements of a Mississippi Offer to Purchase Commercial Property: 1. Purchase Price: The offer outlines the amount the buyer is willing to pay for the commercial property. 2. Earnest Money Deposit: This deposit, paid by the buyer, signifies their commitment to the purchase and is typically held in escrow until the transaction is finalized. 3. Contingencies: These provisions specify conditions that must be met to proceed with the purchase, such as satisfactory property inspections, zoning approvals, or environmental assessments. 4. Title Examination: This clause ensures that the seller has clear and marketable title to the property. 5. Closing Date: The expected date for the completion of the transaction, including the transfer of ownership and any financial settlements. Keywords: purchase price, earnest money deposit, escrow, contingencies, property inspections, zoning approvals, environmental assessments, title examination, closing date, transfer of ownership, financial settlements Conclusion: The Mississippi Offer to Purchase Commercial Property plays a pivotal role in the buying and selling of commercial real estate in Mississippi. It provides a framework for negotiations and enables both parties to agree upon the terms of the transaction. Understanding the different types of offers available and their key components is vital for successfully navigating the complexities of commercial property transactions in Mississippi. Keywords: pivotal role, negotiations, terms of transaction, types of offers, components, commercial property transactions, Mississippi