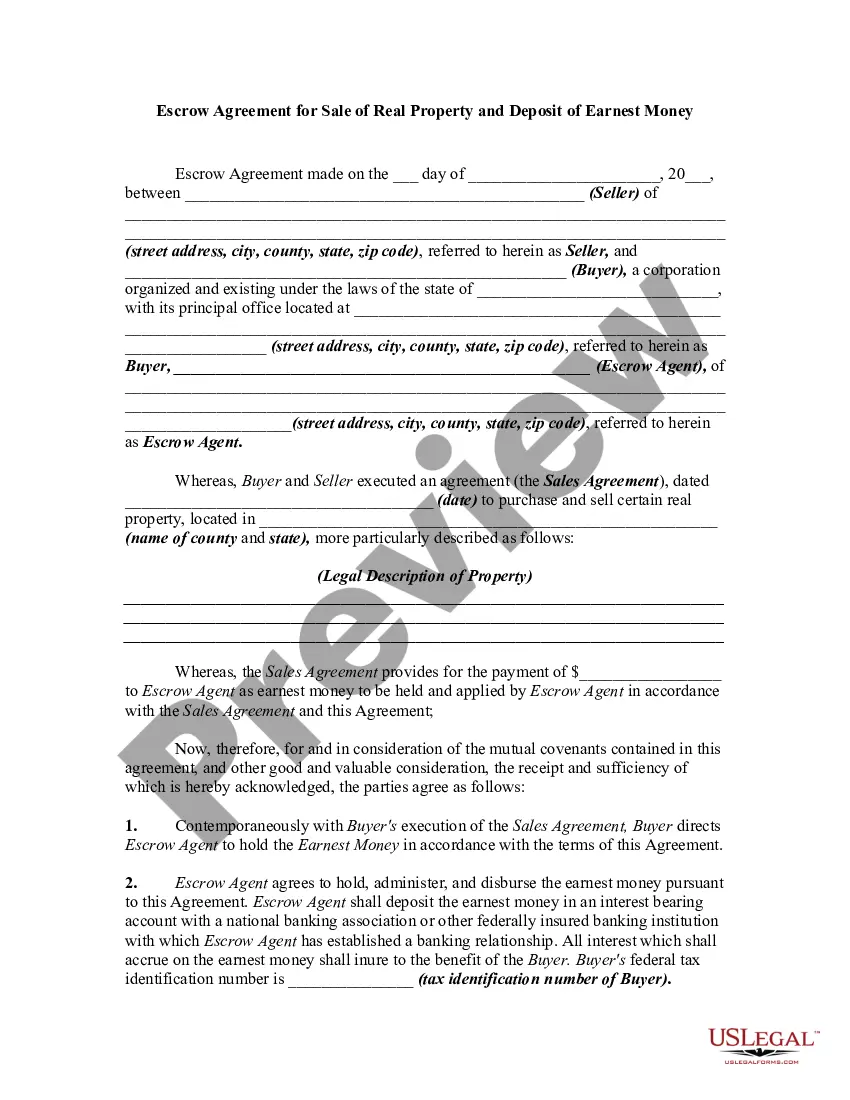

An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow in this form is to protect the purchaser of real property from having to pay for a possible defect in the real property after the sale has been made.

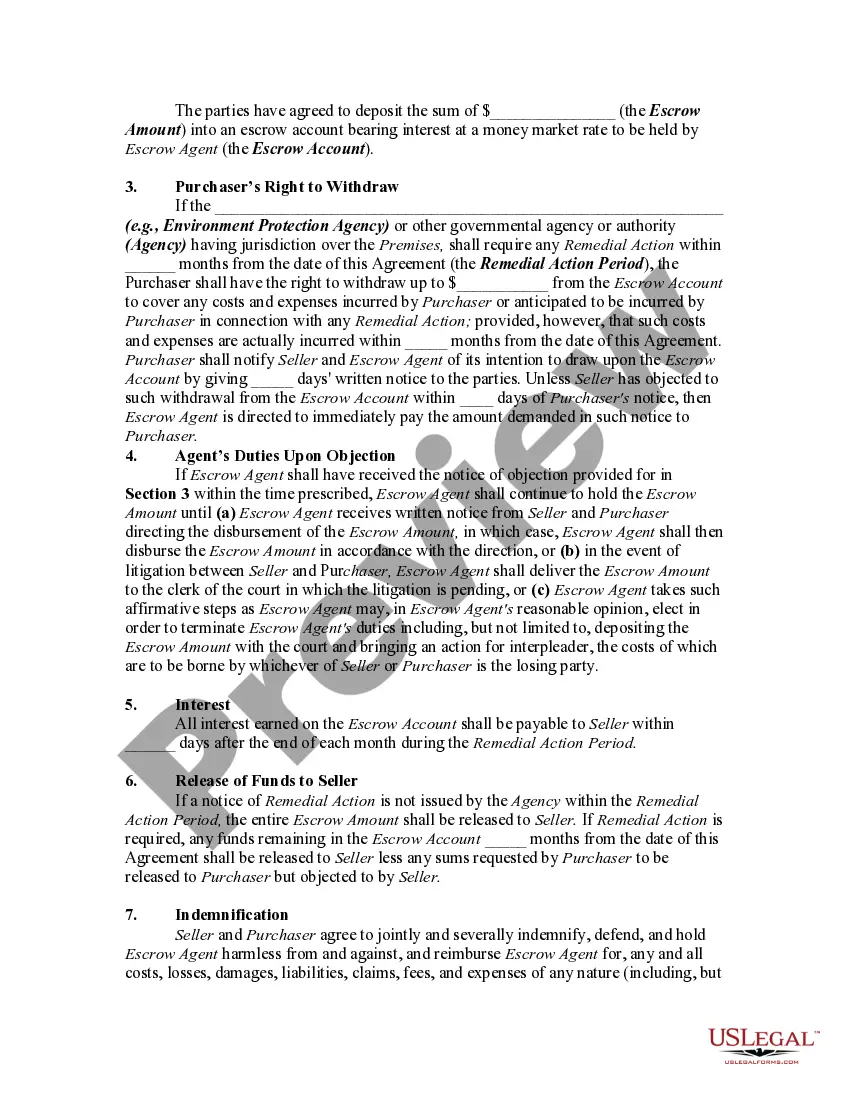

Mississippi Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action

Description

How to fill out Escrow Agreement For Sale Of Real Property And Deposit To Protect Purchaser Against Cost Of Required Remedial Action?

Selecting the optimal legal document format may pose a challenge. Clearly, there are numerous templates available online, but how do you locate the legal document you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Mississippi Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action, suitable for both business and personal needs. All forms are verified by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Mississippi Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action. Use your account to review the legal forms you have previously acquired. Visit the My documents section of your account to access another version of the document you need.

Choose the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the obtained Mississippi Escrow Agreement for Sale of Real Property and Deposit to Protect Purchaser Against Cost of Required Remedial Action. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain well-crafted documents that meet state standards.

- First, ensure that you have selected the appropriate form for your city/region.

- You can review the form using the Preview button and read the form description to confirm it suits your needs.

- If the form does not satisfy your requirements, utilize the Search feature to locate the right form.

- Once you are confident that the form is appropriate, click the Buy now button to acquire the form.

- Select the pricing plan you desire and enter the necessary information.

- Create your account and pay for the order using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

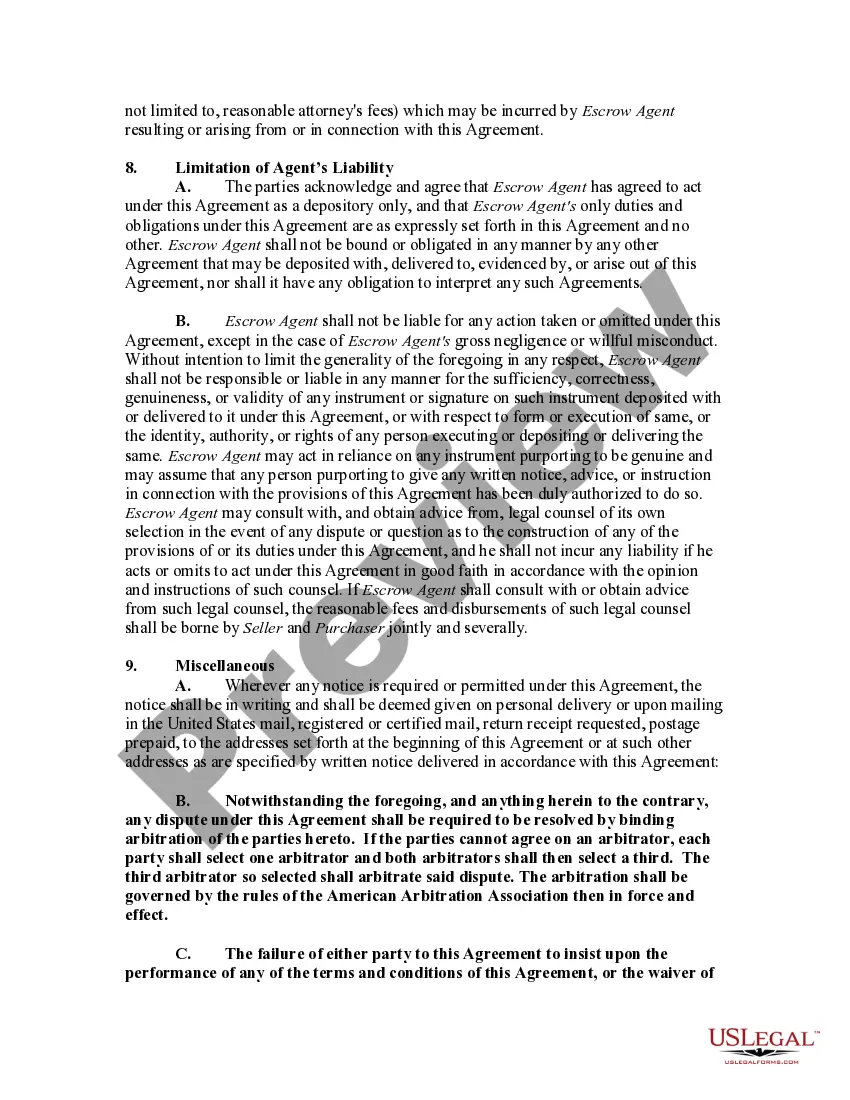

In a real estate escrow agreement, the buyer and seller agree to have a neutral third party an escrow agent hold the buyer's funds while the contractual conditions and obligations of each party are fulfilled. Escrow accounts provide protection to all parties involved in the transaction.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

How to Protect Your Earnest Money DepositNever give an earnest money deposit directly to the seller.Make the deposit payable to a reputable third party, such as a well-known and established real estate brokerage, legal firm, escrow company, or title company.More items...

Reasons you can lose earnest money Two scenarios that may lead to the forfeiture of your good faith deposit are: Waiving your contingencies. Financing and inspection contingencies protect your earnest money if your mortgage doesn't go through or the house is beyond repair.

In an escrow agreement, one partyusually a depositordeposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

Tip: It is possible for sellers to negotiate for earnest money to become non-refundable after inspection. If buyers are looking for ways to strengthen their offer, they might consider this option. Non-refundable deposits, common with new construction, differ from earnest money.

Here's how to hold money in escrow:The buyer and seller agree to the terms of the transaction.Payment is sent to the escrow company.Seller ships the goods or provides the service to the buyer.Buyer accepts the goods or services.More items...

When making an offer on real estate in Mississippi, the buyer offers earnest money to demonstrate that they are serious about the purchase. The amount of earnest money is negotiable and can be deposited into an account owned by the listing broker, buyer's broker, or a title company.

A Standard Clause providing for an escrow of a portion of the purchase price in an M&A transaction to satisfy the seller's obligations to pay any adjustments to the purchase price and any potential indemnification claims. It can be used in connection with a private stock purchase, asset purchase, or merger.

The typical new construction deposit is 5% to 10% of the purchase price. If the buyer is paying all cash for the home, the earnest money deposit is usually higher. Most new home builders will allow the buyer to personalize the home to be built with specific options and upgrades.