A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor.

The contract of guaranty may be absolute or it may be conditional. An absolute guaranty is a contract by which the guarantor has promised that if the debtor does not perform the obligation or obligations, the guarantor will perform some act (such as the payment of money) to or for the benefit of the creditor.

A line of credit is an arrangement in which a lender extends a specified amount of credit to borrower for a specified time period.

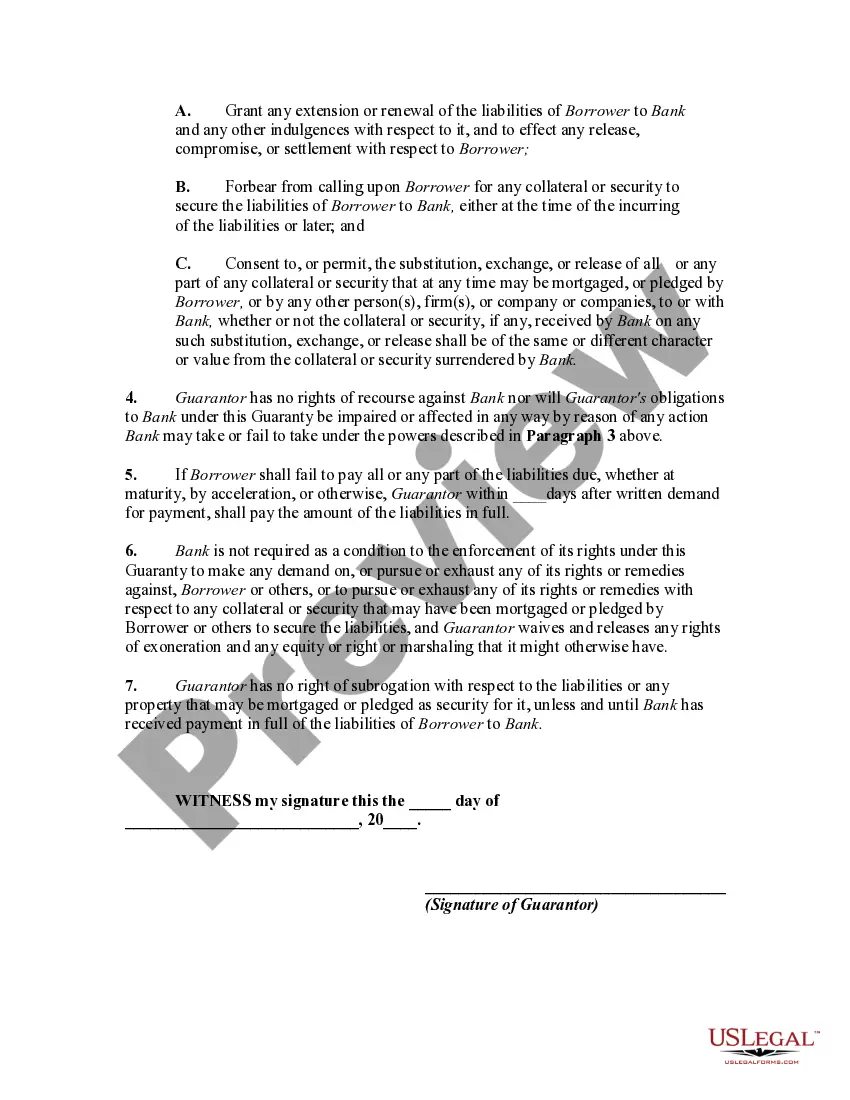

A Mississippi Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit is a legal document that provides additional security to a lender when granting a line of credit to a borrower. This guaranty ensures that the borrower's obligations will be fulfilled in instances where they default on the line of credit. In specific, an absolute guaranty is an unconditional promise of payment made by a guarantor who is willing to take full responsibility for the borrower's debts. This type of guaranty provides the lender with a Form of security that is not contingent on any other factors. It ensures that the guarantor will make the necessary payments on behalf of the borrower, up to the full amount of the line of credit extended. The extension of a line of credit is a financial arrangement between a lender and a borrower. It allows the borrower to access funds up to an agreed-upon limit, similar to a credit card or a personal loan. This flexibility offers the borrower the ability to withdraw funds as needed and only pay interest on the amount utilized. Furthermore, there are various types of Mississippi Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit. These types may differ based on the parties involved, the terms and conditions specified, or the specific purpose of the line of credit. Some common variations include: 1. Personal Guaranty: In this type, an individual guarantees payment on behalf of the borrower. This guaranty generally applies to personal lines of credit, such as credit cards or personal loans, where the guarantor is not a legal entity but an individual. 2. Corporate Guaranty: In the case where a borrower is a corporation or a business entity, a corporate guaranty may be required. This means that the company itself is guaranteeing the payment and is responsible for any default or non-payment. 3. Limited Guaranty: A limited guaranty sets specific boundaries or limitations on the guarantor's responsibility. It may specify a capped liability, cover a certain time period, or restrict the guarantor's obligation to certain events or defaults. 4. Continuing Guaranty: This type of guaranty remains effective until it is voluntarily terminated or revoked by the guarantor. It covers all obligations arising throughout the tenure of the line of credit, including multiple advances or renewals. 5. Cross-Guaranty: In situations where multiple borrowers and lines of credit are involved, a cross-guaranty may be utilized. This means that each borrower guarantees the debts of the others, ensuring that all parties are collectively responsible for the line of credit. Each type of guaranty serves to protect the lender by providing an additional layer of security. It minimizes the risk of default and ensures that the lender will be repaid, even if the borrower fails to meet their obligations. The specific type of guaranty utilized in a Mississippi Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit will depend on the parties involved and the desired terms and conditions.A Mississippi Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit is a legal document that provides additional security to a lender when granting a line of credit to a borrower. This guaranty ensures that the borrower's obligations will be fulfilled in instances where they default on the line of credit. In specific, an absolute guaranty is an unconditional promise of payment made by a guarantor who is willing to take full responsibility for the borrower's debts. This type of guaranty provides the lender with a Form of security that is not contingent on any other factors. It ensures that the guarantor will make the necessary payments on behalf of the borrower, up to the full amount of the line of credit extended. The extension of a line of credit is a financial arrangement between a lender and a borrower. It allows the borrower to access funds up to an agreed-upon limit, similar to a credit card or a personal loan. This flexibility offers the borrower the ability to withdraw funds as needed and only pay interest on the amount utilized. Furthermore, there are various types of Mississippi Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit. These types may differ based on the parties involved, the terms and conditions specified, or the specific purpose of the line of credit. Some common variations include: 1. Personal Guaranty: In this type, an individual guarantees payment on behalf of the borrower. This guaranty generally applies to personal lines of credit, such as credit cards or personal loans, where the guarantor is not a legal entity but an individual. 2. Corporate Guaranty: In the case where a borrower is a corporation or a business entity, a corporate guaranty may be required. This means that the company itself is guaranteeing the payment and is responsible for any default or non-payment. 3. Limited Guaranty: A limited guaranty sets specific boundaries or limitations on the guarantor's responsibility. It may specify a capped liability, cover a certain time period, or restrict the guarantor's obligation to certain events or defaults. 4. Continuing Guaranty: This type of guaranty remains effective until it is voluntarily terminated or revoked by the guarantor. It covers all obligations arising throughout the tenure of the line of credit, including multiple advances or renewals. 5. Cross-Guaranty: In situations where multiple borrowers and lines of credit are involved, a cross-guaranty may be utilized. This means that each borrower guarantees the debts of the others, ensuring that all parties are collectively responsible for the line of credit. Each type of guaranty serves to protect the lender by providing an additional layer of security. It minimizes the risk of default and ensures that the lender will be repaid, even if the borrower fails to meet their obligations. The specific type of guaranty utilized in a Mississippi Absolute Guaranty of Payment in Consideration of Extension of a Line of Credit will depend on the parties involved and the desired terms and conditions.