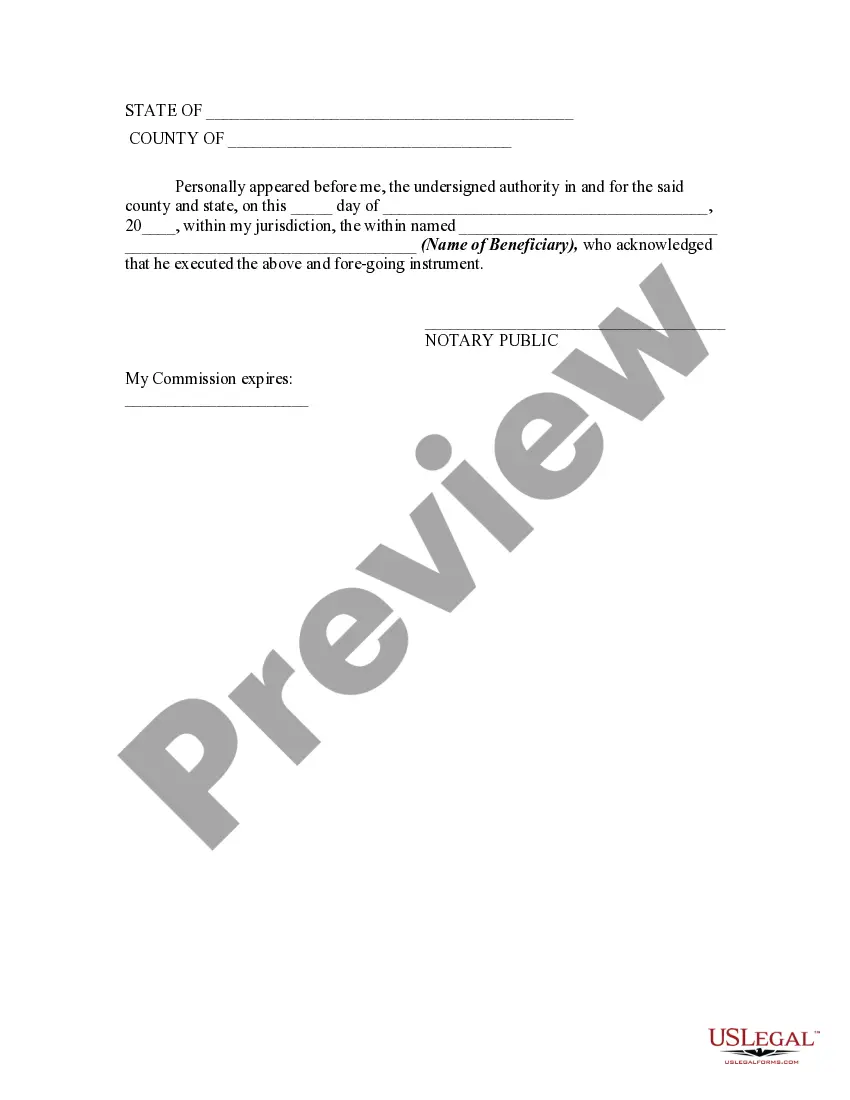

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document that allows a beneficiary of a trust in the state of Mississippi to assign or transfer their interest in the trust to another individual or entity. This assignment can be partial or complete, depending on the beneficiary's intentions and requirements. In Mississippi, there are various types of assignments that beneficiaries can make regarding their interest in a trust. These assignments may include: 1. Partial Assignment: This type of assignment involves transferring only a portion of the beneficiary's interest in the trust to another party. The beneficiary might choose to assign a specific percentage or specific assets from the trust to the assignee, while retaining the remaining interest. 2. Complete Assignment: A complete assignment involves the beneficiary transferring their entire interest in the trust to another individual or entity. The assignee then becomes a new beneficiary of the trust and will have the rights and responsibilities associated with that role. 3. Revocable Assignment: This type of assignment allows the beneficiary to revoke or cancel the assignment at a later date if they change their mind about transferring their interest in the trust. The beneficiary maintains control and can reclaim their interest in the trust if desired. 4. Irrevocable Assignment: An irrevocable assignment is a permanent transfer of the beneficiary's interest in the trust. Once the assignment is made, the beneficiary relinquishes all rights and control over their interest, and it becomes the property of the assignee. 5. Specific Asset Assignment: This type of assignment involves the transfer of a specific asset or property held within the trust rather than the overall interest in the trust. The beneficiary may choose to assign a particular real estate property, financial investment, or any other asset to the assignee. When preparing a Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it is important to include relevant details such as the names and addresses of the original beneficiary and the assignee, the effective date of the assignment, a clear and concise description of the interest being assigned, and any conditions or terms associated with the assignment. It is crucial to consult with a legal professional for guidance and assistance when drafting or executing a Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, as the specific requirements and regulations may vary.Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document that allows a beneficiary of a trust in the state of Mississippi to assign or transfer their interest in the trust to another individual or entity. This assignment can be partial or complete, depending on the beneficiary's intentions and requirements. In Mississippi, there are various types of assignments that beneficiaries can make regarding their interest in a trust. These assignments may include: 1. Partial Assignment: This type of assignment involves transferring only a portion of the beneficiary's interest in the trust to another party. The beneficiary might choose to assign a specific percentage or specific assets from the trust to the assignee, while retaining the remaining interest. 2. Complete Assignment: A complete assignment involves the beneficiary transferring their entire interest in the trust to another individual or entity. The assignee then becomes a new beneficiary of the trust and will have the rights and responsibilities associated with that role. 3. Revocable Assignment: This type of assignment allows the beneficiary to revoke or cancel the assignment at a later date if they change their mind about transferring their interest in the trust. The beneficiary maintains control and can reclaim their interest in the trust if desired. 4. Irrevocable Assignment: An irrevocable assignment is a permanent transfer of the beneficiary's interest in the trust. Once the assignment is made, the beneficiary relinquishes all rights and control over their interest, and it becomes the property of the assignee. 5. Specific Asset Assignment: This type of assignment involves the transfer of a specific asset or property held within the trust rather than the overall interest in the trust. The beneficiary may choose to assign a particular real estate property, financial investment, or any other asset to the assignee. When preparing a Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it is important to include relevant details such as the names and addresses of the original beneficiary and the assignee, the effective date of the assignment, a clear and concise description of the interest being assigned, and any conditions or terms associated with the assignment. It is crucial to consult with a legal professional for guidance and assistance when drafting or executing a Mississippi Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, as the specific requirements and regulations may vary.