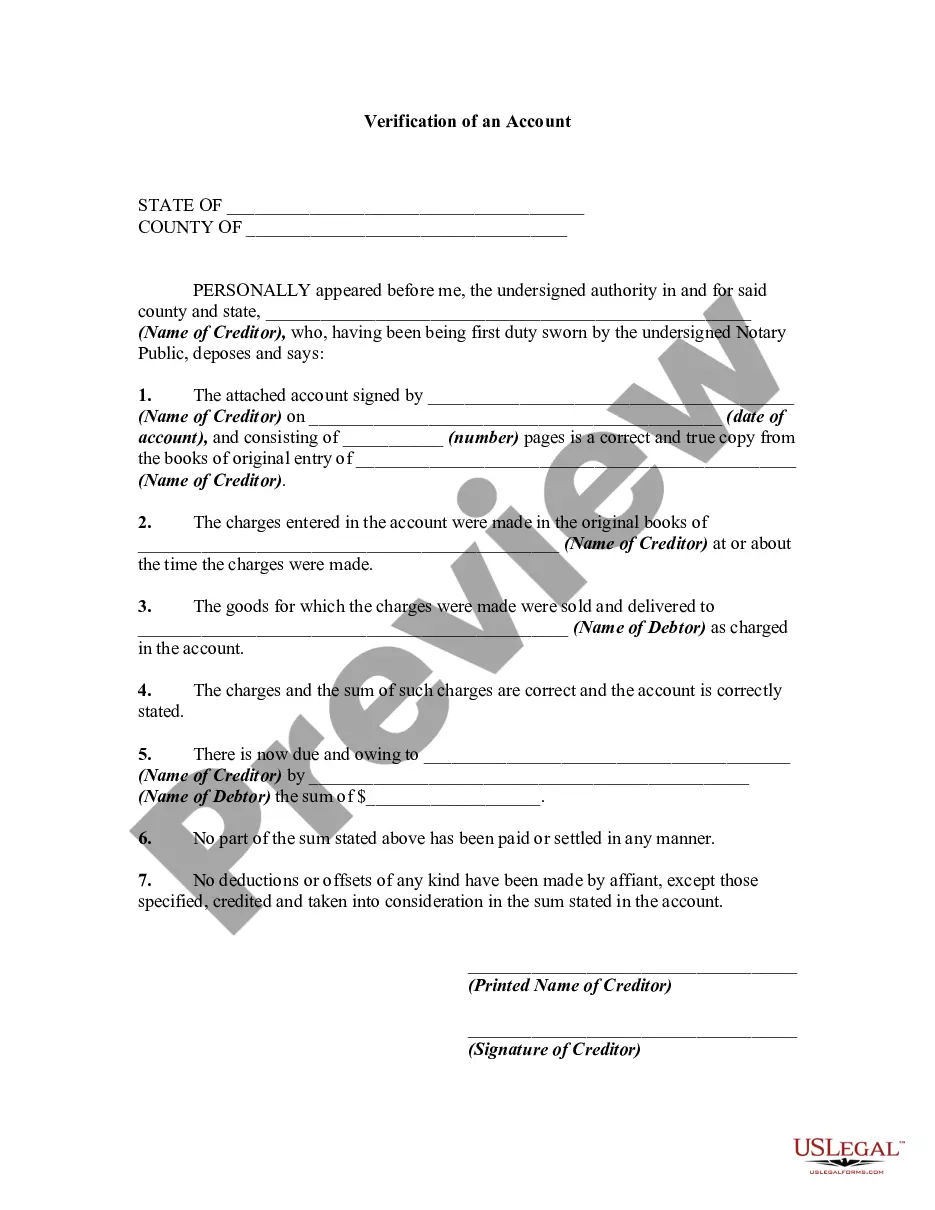

An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Verification of an Account is an essential process used to confirm the accuracy and legitimacy of financial information related to a particular account in Mississippi. This type of verification serves as a way to maintain transparency and prevent potential fraudulent activities. It is especially important when dealing with financial institutions, such as banks or lending agencies, as they require authentic and reliable information for various purposes. The Mississippi Verification of an Account typically involves cross-checking the details provided by the account holder against the records and statements held by the financial institution. This process helps to ensure that the information provided is consistent, up-to-date, and reliable. It can include verifying personal details, such as name, address, contact information, as well as more specific financial information like bank account balances, transaction history, or credit details. There are various types of Mississippi Verification of an Account that may be conducted depending on the nature and purpose of the verification. Some of these may include: 1. Bank Account Verification: This process focuses on verifying the authenticity of bank account information provided by the account holder. The financial institution typically verifies the account holder's identity, account balances, recent transactions, and any other relevant details to ensure the accuracy of the account information. 2. Credit Verification: Credit verification involves confirming the creditworthiness and credit history of an individual or business. The account holder's credit score, outstanding debts, payment history, and any defaults or bankruptcy information may be checked during this process. It helps lenders and financial institutions assess the risk associated with extending credit or offering loans. 3. Employment Verification: Employment verification ensures the accuracy of employment-related information provided by the account holder. This type of verification may include confirming the current employment status, position, income details, and length of employment. It is commonly required when applying for loans or opening financial accounts. 4. Identity Verification: Identity verification is crucial for confirming the identity of the account holder and preventing identity theft or fraud. The process involves validating personal information, such as name, date of birth, social security number, and address, against official records, identification documents, or other trusted databases. Overall, Mississippi Verification of an Account is a crucial process in ensuring the reliability and validity of financial information. It helps protect both individuals and financial institutions from potential risks and fraud. By conducting thorough verification processes, institutions can maintain trust and integrity in their operations, while individuals can have confidence that their financial accounts and information are secure.Mississippi Verification of an Account is an essential process used to confirm the accuracy and legitimacy of financial information related to a particular account in Mississippi. This type of verification serves as a way to maintain transparency and prevent potential fraudulent activities. It is especially important when dealing with financial institutions, such as banks or lending agencies, as they require authentic and reliable information for various purposes. The Mississippi Verification of an Account typically involves cross-checking the details provided by the account holder against the records and statements held by the financial institution. This process helps to ensure that the information provided is consistent, up-to-date, and reliable. It can include verifying personal details, such as name, address, contact information, as well as more specific financial information like bank account balances, transaction history, or credit details. There are various types of Mississippi Verification of an Account that may be conducted depending on the nature and purpose of the verification. Some of these may include: 1. Bank Account Verification: This process focuses on verifying the authenticity of bank account information provided by the account holder. The financial institution typically verifies the account holder's identity, account balances, recent transactions, and any other relevant details to ensure the accuracy of the account information. 2. Credit Verification: Credit verification involves confirming the creditworthiness and credit history of an individual or business. The account holder's credit score, outstanding debts, payment history, and any defaults or bankruptcy information may be checked during this process. It helps lenders and financial institutions assess the risk associated with extending credit or offering loans. 3. Employment Verification: Employment verification ensures the accuracy of employment-related information provided by the account holder. This type of verification may include confirming the current employment status, position, income details, and length of employment. It is commonly required when applying for loans or opening financial accounts. 4. Identity Verification: Identity verification is crucial for confirming the identity of the account holder and preventing identity theft or fraud. The process involves validating personal information, such as name, date of birth, social security number, and address, against official records, identification documents, or other trusted databases. Overall, Mississippi Verification of an Account is a crucial process in ensuring the reliability and validity of financial information. It helps protect both individuals and financial institutions from potential risks and fraud. By conducting thorough verification processes, institutions can maintain trust and integrity in their operations, while individuals can have confidence that their financial accounts and information are secure.