An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Verification of an Account for Services and Supplies to a Public Entity

Description

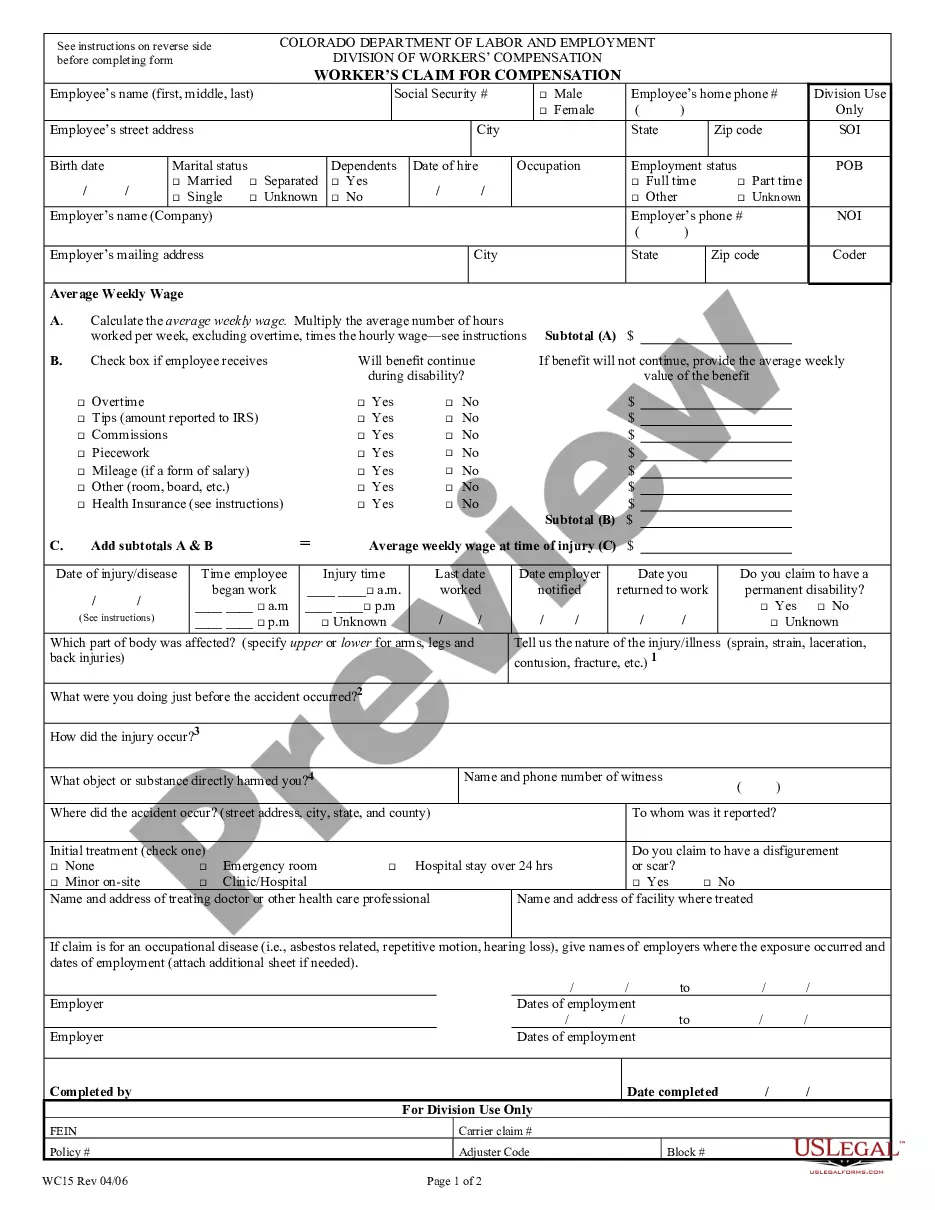

How to fill out Verification Of An Account For Services And Supplies To A Public Entity?

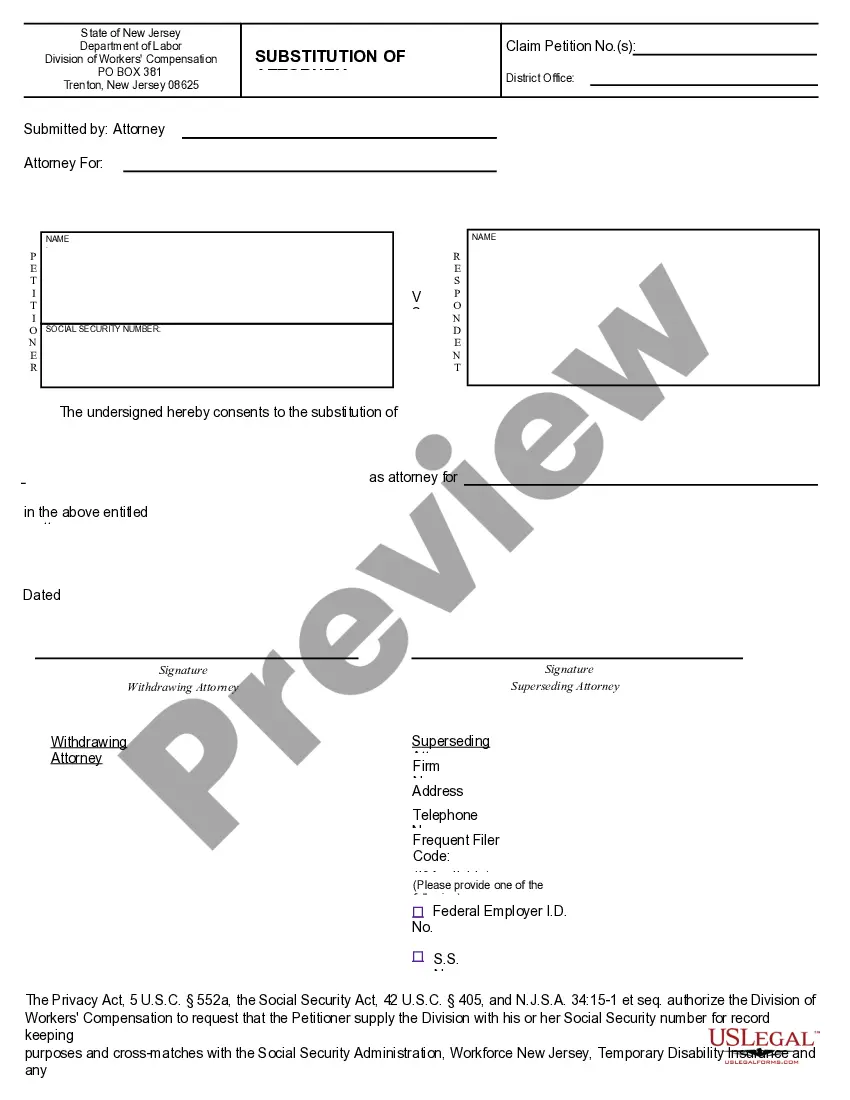

Finding the right legitimate record design might be a have difficulties. Obviously, there are a lot of templates accessible on the Internet, but how do you find the legitimate develop you require? Use the US Legal Forms site. The service gives 1000s of templates, such as the Mississippi Verification of an Account for Services and Supplies to a Public Entity, which can be used for organization and personal demands. Every one of the kinds are checked out by specialists and meet up with state and federal specifications.

If you are presently registered, log in to the bank account and click on the Acquire key to find the Mississippi Verification of an Account for Services and Supplies to a Public Entity. Use your bank account to search through the legitimate kinds you might have ordered earlier. Visit the My Forms tab of your bank account and acquire an additional duplicate of the record you require.

If you are a new customer of US Legal Forms, listed here are simple instructions for you to adhere to:

- First, make sure you have selected the correct develop to your area/county. It is possible to check out the form making use of the Review key and study the form outline to make sure this is the right one for you.

- If the develop does not meet up with your requirements, make use of the Seach area to get the correct develop.

- When you are certain that the form is acceptable, go through the Get now key to find the develop.

- Choose the prices plan you want and type in the necessary information. Make your bank account and pay money for your order making use of your PayPal bank account or Visa or Mastercard.

- Opt for the file format and obtain the legitimate record design to the device.

- Full, change and print and indicator the acquired Mississippi Verification of an Account for Services and Supplies to a Public Entity.

US Legal Forms is the biggest collection of legitimate kinds for which you can see different record templates. Use the company to obtain skillfully-created files that adhere to state specifications.

Form popularity

FAQ

Some customers are exempt from paying sales tax under Mississippi law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

An enterprise information security policy is a set of rules that people with access to the organization's data, assets, networks, and other IT resources must follow to minimize cyber risk exposure.

The State of Mississippi Enterprise Security Policy establishes the minimum requirements for preserving the confidentiality, integrity, and availability of State data and information technology (IT) resources from unauthorized use, access, disclosure, modification, or destruction.

Once you determine that your small business needs a Mississippi state tax ID, the most convenient channel to apply is online. You can complete the online application in a matter of minutes, then wait a few days to a few weeks for the application to fully process.

Key Pillars of a Cybersecurity System: Security Controls & Layers. Security controls are specific techniques, policies, and tools that are implemented to safeguard the organization's infrastructure and digital assets.

Apply online at the DOR's Taxpayer Access Point portal to receive a Withholding Account Number immediately after completing the registration. Find an existing Withholding Account Number: on Form 89-105, Employer's Withholding Tax Return. by contacting the DOR.

What is an Information Security Policy? Information security (infosec) refers to policies, processes, and tools designed and deployed to protect sensitive business information and data assets from unauthorised access. There are three core aspects of information security: confidentiality, integrity, and availability.

An Enterprise Information Security Policy (or EISP) is a management-level document, often written by the company's CIO, detailing the company's philosophy on security. It also helps to set the direction, scope, and tone for all of an organization's security efforts.