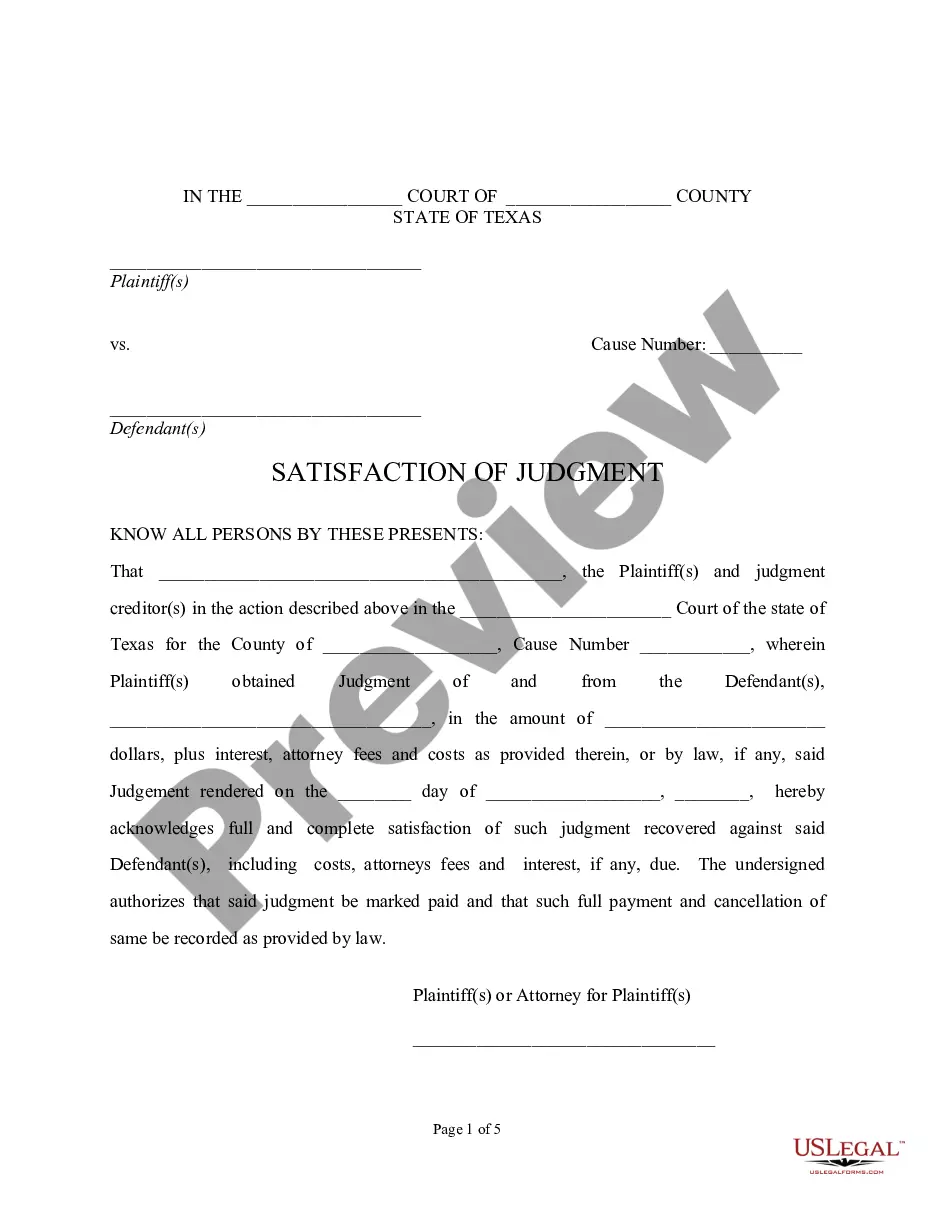

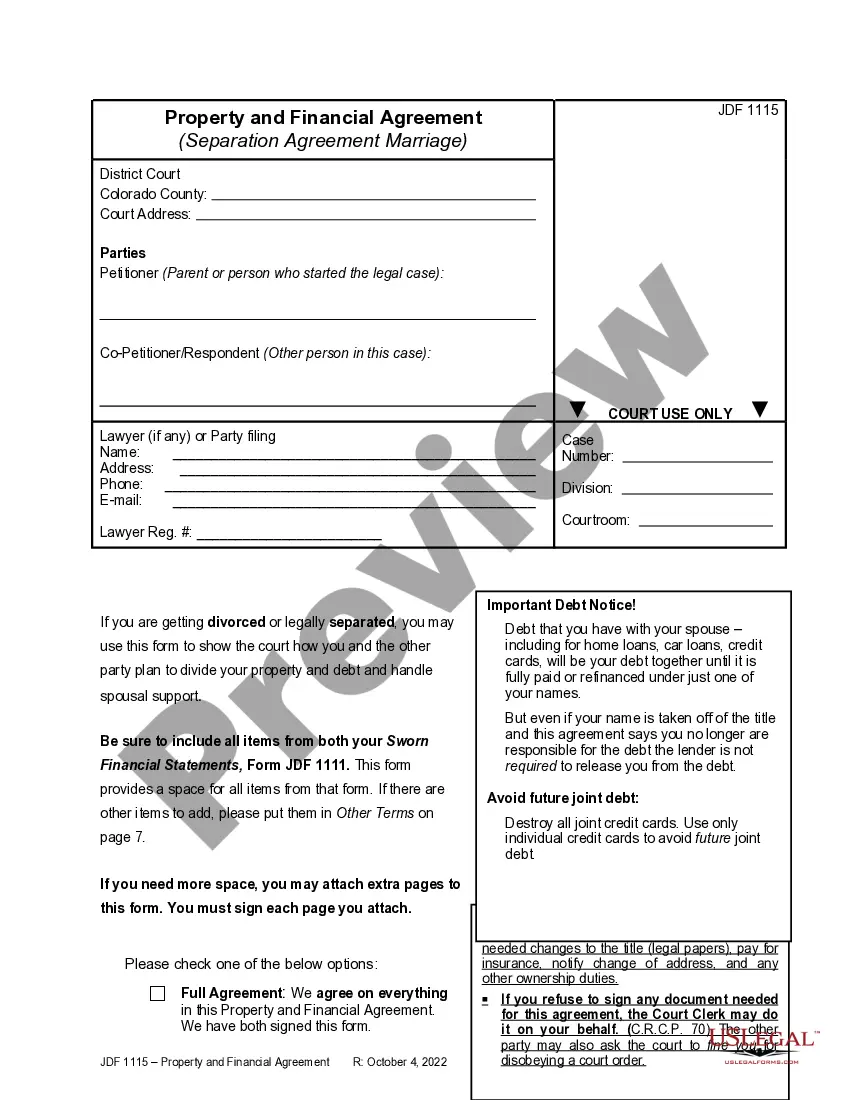

The Mississippi Bill of Transfer to a Trust is a legal document that allows individuals to transfer their property or assets into a trust. A trust is a legal entity that holds and manages assets on behalf of a beneficiary, providing numerous benefits such as asset protection, estate planning, and tax efficiency. The Bill of Transfer to a Trust serves as evidence of the transfer and outlines the details of the trust arrangement. It specifies the property being transferred, the name of the trust, and the names of the settler (the person creating the trust) and the trustee (the person or entity responsible for managing the trust's assets). In Mississippi, there are several types of Bill of Transfer to a Trust that individuals can utilize based on their specific needs and goals. These include: 1. Revocable Living Trust: This type of trust allows individuals to maintain control over their assets during their lifetime while designating beneficiaries who will receive the assets upon their death. The settler can modify or revoke the trust at any time. 2. Irrevocable Living Trust: Unlike a revocable living trust, once assets are transferred to an irrevocable trust, they cannot be taken back or modified by the settler without beneficiary consent. This type of trust offers enhanced asset protection and estate tax reduction benefits. 3. Special Needs Trust: This trust is designed to provide financial support and assistance for individuals with disabilities without jeopardizing their eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). 4. Charitable Remainder Trust: Individuals who wish to make a charitable donation while retaining an income stream during their lifetime may choose to establish a charitable remainder trust. This trust allows assets to be transferred to a charitable organization, with the settler or other beneficiaries receiving income from the trust for a specified period. 5. Testamentary Trust: Unlike the aforementioned trusts, a testamentary trust is established through a will and takes effect after the settler's death. This allows for the distribution of assets according to the settler's specific instructions, such as providing for minor children or individuals with special needs. It is important to consult with an experienced attorney or estate planning professional to ensure the proper drafting and execution of a Mississippi Bill of Transfer to a Trust. The specific type of trust chosen should align with the individual's goals, financial circumstances, and legal requirements.

Mississippi Bill of Transfer to a Trust

Description

How to fill out Mississippi Bill Of Transfer To A Trust?

You are able to commit time on-line searching for the legitimate file web template that meets the state and federal demands you want. US Legal Forms supplies a large number of legitimate types which can be examined by professionals. It is simple to down load or produce the Mississippi Bill of Transfer to a Trust from our support.

If you already have a US Legal Forms profile, you can log in and click the Obtain switch. After that, you can comprehensive, change, produce, or signal the Mississippi Bill of Transfer to a Trust. Each legitimate file web template you acquire is your own forever. To acquire another copy for any purchased develop, visit the My Forms tab and click the corresponding switch.

If you use the US Legal Forms internet site the very first time, keep to the easy recommendations listed below:

- First, make certain you have chosen the best file web template to the area/area of your liking. Read the develop description to make sure you have picked the correct develop. If accessible, take advantage of the Review switch to look throughout the file web template also.

- If you would like discover another model from the develop, take advantage of the Look for discipline to find the web template that fits your needs and demands.

- After you have located the web template you would like, click Purchase now to carry on.

- Select the pricing program you would like, type in your accreditations, and register for a merchant account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal profile to purchase the legitimate develop.

- Select the file format from the file and down load it to the system.

- Make modifications to the file if required. You are able to comprehensive, change and signal and produce Mississippi Bill of Transfer to a Trust.

Obtain and produce a large number of file web templates while using US Legal Forms site, which provides the most important selection of legitimate types. Use expert and condition-particular web templates to tackle your small business or personal requirements.

Form popularity

FAQ

You cannot transfer debt into a trust directly; instead, utilize a Mississippi Bill of Transfer to a Trust to maintain control over your assets. Begin by consulting with a legal advisor who understands the intricacies of trust management. They can guide you in the process of structuring your trust to protect your assets while managing your debts effectively. This strategic approach ensures that your financial interests are aligned with your trust objectives.

Certain assets cannot be placed in a trust, such as retirement accounts or certain types of life insurance policies. Additionally, personal property that is not formally titled may not be suitable for a trust. Understanding the implications of the Mississippi Bill of Transfer to a Trust is crucial when deciding which assets to include. Consulting with a professional can ensure your assets are properly managed according to your wishes.

You cannot directly transfer your debt to a trust. However, a Mississippi Bill of Transfer to a Trust can help manage your assets and liabilities more effectively. It is essential to consult a legal expert to understand how your debts interact with the trust. Trusts are typically designed to hold assets, not debts, so ensure you structure your finances appropriately.

While trusts offer various benefits, there are some downsides to consider. Transferring your house into a trust can involve legal fees and paperwork, which may complicate the process. Moreover, you might have limited access to the property for personal use if you establish an irrevocable trust. It's essential to weigh the advantages and disadvantages, especially when considering the Mississippi Bill of Transfer to a Trust.

Some assets may not be suitable for inclusion in a trust, such as retirement accounts and certain insurance policies. These typically have designated beneficiaries who receive them directly, bypassing the trust. Additionally, some may choose to keep personal items out of a trust for simplicity. Always review your assets carefully to determine the best approach, including any involvement with the Mississippi Bill of Transfer to a Trust.

The Mississippi Trust Act outlines the regulations governing trusts in the state. It provides a framework for establishing and managing trusts, including the rights and responsibilities of trustees and beneficiaries. This body of law ensures that individuals can create effective estate plans, including utilizing the Mississippi Bill of Transfer to a Trust, thereby protecting assets like homes and investments.

Deciding between gifting a house and placing it in a trust depends on your goals. Gifting removes the property from your estate, which may help for tax purposes, but it can also lead to losing control over it. On the other hand, placing your home in a trust allows you to retain some control while facilitating a smoother transfer upon your death, often guided by the Mississippi Bill of Transfer to a Trust. Consider your estate planning needs carefully.

The bill of transfer for a trust is a legal document that facilitates the movement of assets into a trust. This document outlines the specific assets being transferred and the terms under which they are held. By understanding the Mississippi Bill of Transfer to a Trust, you can ensure that your assets are managed and distributed according to your wishes.

Transferring assets into a trust requires you to formally document the ownership change, typically through a deed, title, or other legal means. Clear records are crucial, so every asset is correctly titled in the name of the trust. Utilizing guidelines from the Mississippi Bill of Transfer to a Trust ensures you fulfill all legal requirements effortlessly.

Generally, transferring assets from one trust to another is not considered a taxable event. However, certain situations may create tax implications depending on the specific assets involved. Consulting with a tax professional and considering the guidelines of the Mississippi Bill of Transfer to a Trust can help you navigate these complexities.

Interesting Questions

More info

This is to make it easier to transfer property in case an heir is found by the deceased. Transfer for transfer trust is a method through which the assets are divided into smaller groups by the beneficiaries. The beneficiaries of the transfer trust can be chosen by the third party in order to limit conflicts of interest. Transfer trust and transfer by appointment is also available, so the third party is not forced to choose people who are able to do the deed. The trustees can also be restricted from taking title. Another common use for transfer trust is to split the amount of the inheritance among other people. For example, the parents can transfer 35,000 to their two daughters. The children want 60,000, so they put the money in a trust for inheritance purposes. If the parents agree, the trust then makes the 30,000 to one daughter and 20,000 to the other daughter after the third daughter pays the remaining amount of the inheritance.