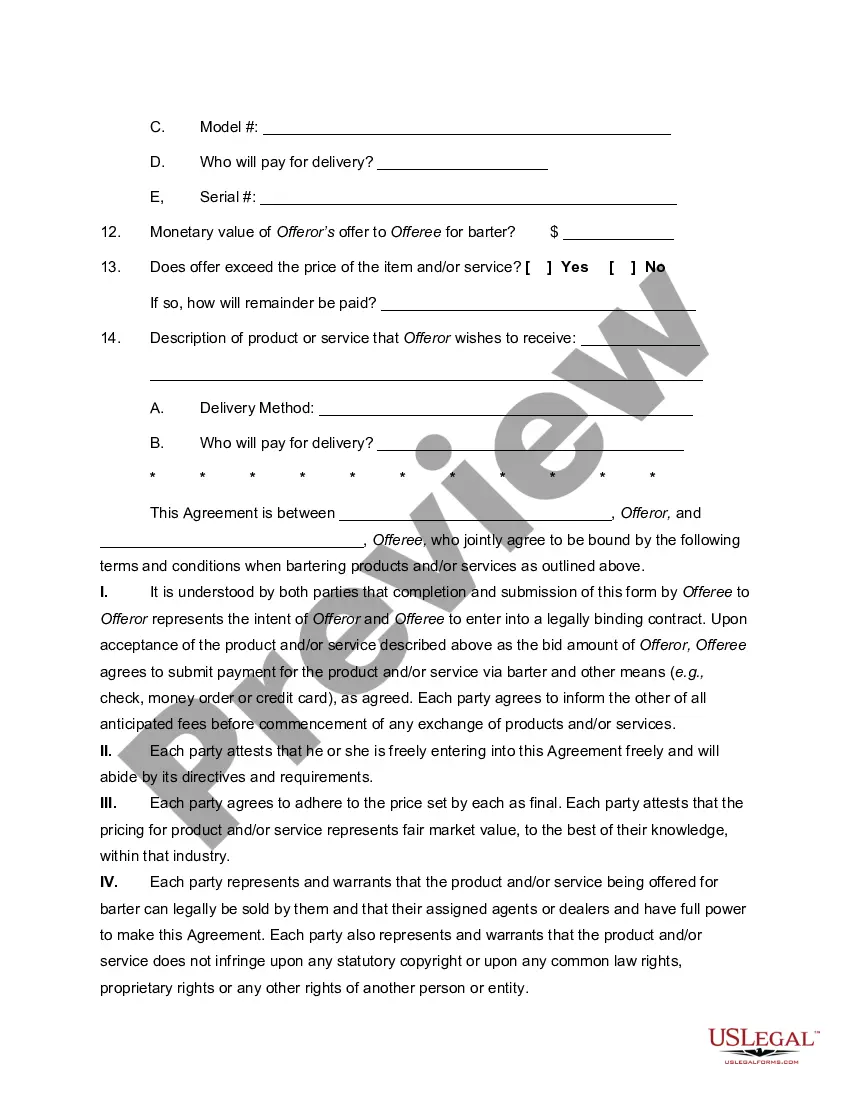

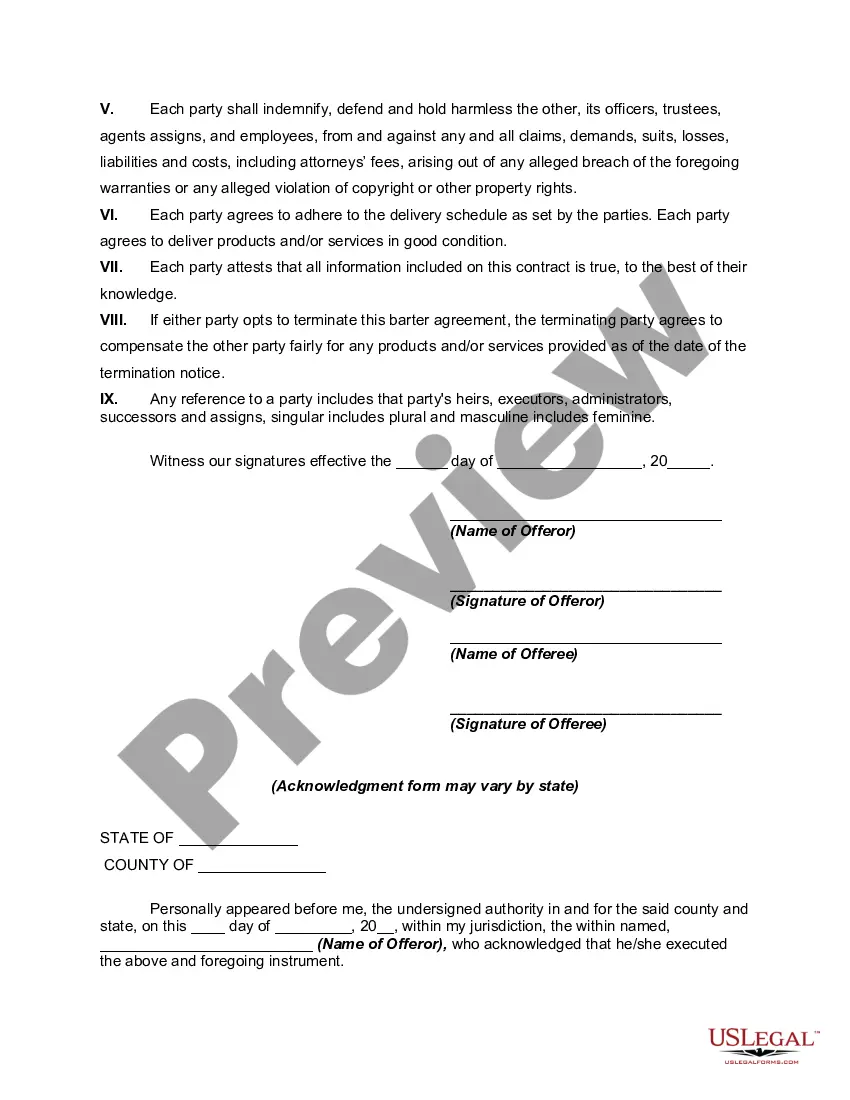

Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Bartering Contract or Exchange Agreement is a legally binding agreement that outlines the terms and conditions of a barter or exchange transaction in the state of Mississippi. Bartering refers to the act of exchanging goods or services without the involvement of money. A bartering contract helps ensure a fair and equitable trade by clearly stating the obligations and expectations of both parties involved. The Mississippi Bartering Contract or Exchange Agreement typically includes essential details such as the names and addresses of the parties involved, a description of the goods or services being exchanged, their estimated value, and the agreed-upon terms of the exchange. It also outlines any additional terms, restrictions, or conditions specific to the transaction. It is important to note that while a bartering contract may not involve monetary transactions, it is still subject to legal regulations and must comply with applicable laws in Mississippi. This agreement is crucial in protecting the interests of both parties and preventing any potential misunderstandings or disputes. There are several types of Mississippi Bartering Contracts or Exchange Agreements, depending on the nature of the exchange. These may include: 1. Goods for Goods Bartering Contract: This type of agreement involves the exchange of physical goods, such as electronics, furniture, or other tangible items. 2. Goods for Services Bartering Contract: In this type of agreement, one party exchanges goods they possess for services provided by the other party. For example, exchanging a laptop for a month of graphic design services. 3. Services for Services Bartering Contract: This type of agreement occurs when both parties provide services to each other in exchange. 4. Time Bank Bartering Contract: Time banking is a system where individuals earn time credits for services they provide to others. This contract outlines the terms and conditions for such exchanges in a time bank. Regardless of the type, a Mississippi Bartering Contract or Exchange Agreement should clearly state the obligations, responsibilities, and limitations of the parties involved, ensuring a fair and equitable transaction. It is recommended to consult with a legal professional experienced in contract law to draft or review such agreements to ensure legal compliance and protection for all parties involved.