One principal advantage of insurance trusts is that they permit a greater flexibility in investment and distribution than may be effected under settlement options generally included in the policies themselves. Another advantage is that such trusts, like other gifts of insurance policies, may afford substantial estate tax savings.

Mississippi Irrevocable Trust Funded by Life Insurance

Description

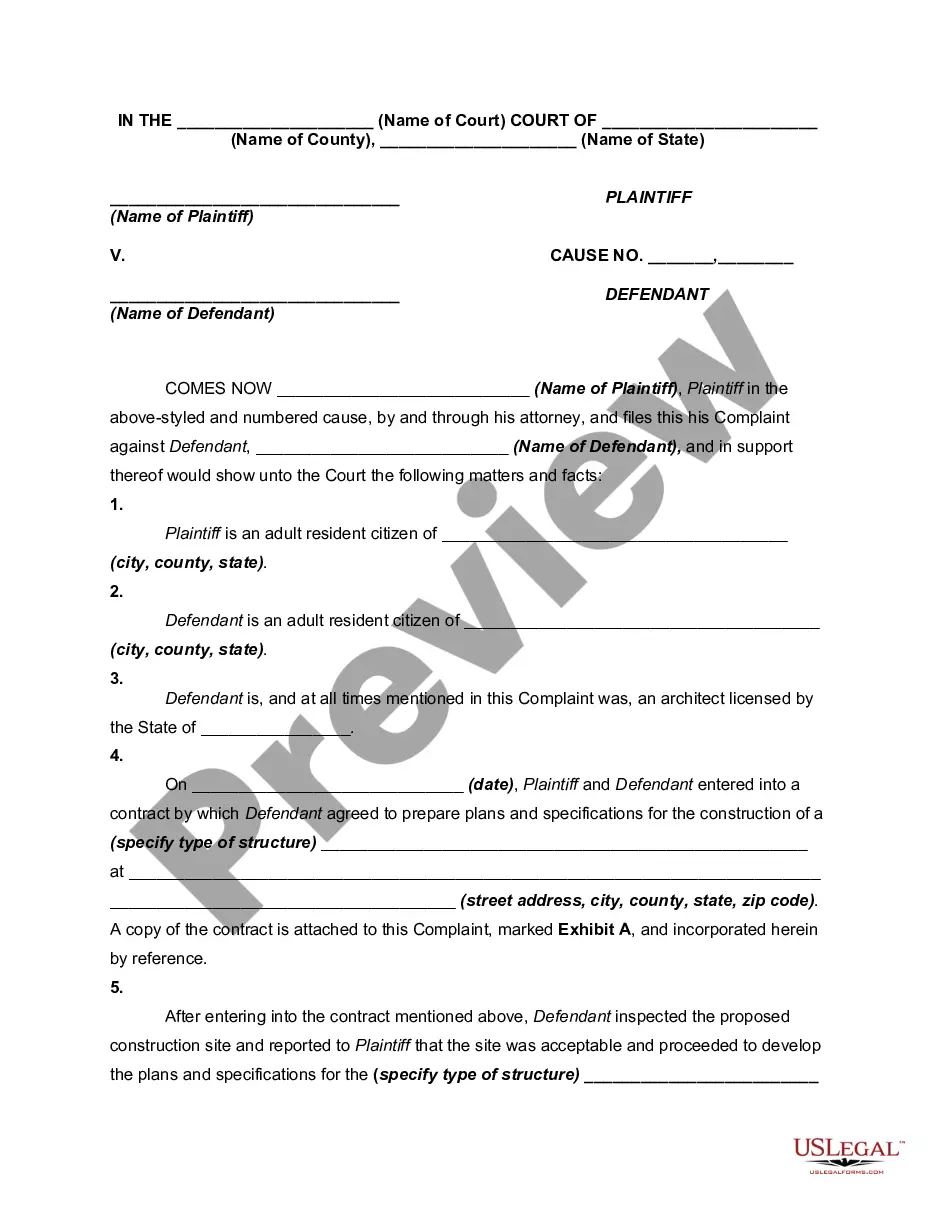

How to fill out Irrevocable Trust Funded By Life Insurance?

If you want to complete, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s simple and convenient search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing option you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Mississippi Irrevocable Trust Funded by Life Insurance with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the Mississippi Irrevocable Trust Funded by Life Insurance.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document design.

Form popularity

FAQ

Yes, if your trust generates any income, you must file a tax return for your Mississippi Irrevocable Trust Funded by Life Insurance. This return should detail all income received and expenses incurred by the trust. Filing accurately is crucial to avoid penalties and allow for proper management of trust assets. It is wise to partner with a tax advisor to ensure compliance and efficiency.

Yes, a Mississippi Irrevocable Trust Funded by Life Insurance must file a tax return if it generates income. The trust is treated as a separate taxable entity. Therefore, it is essential to maintain accurate records and timely file any necessary documentation. Consulting with a tax professional can clarify your obligations.

An irrevocable life insurance trust (ILIT) can be a wise choice for many individuals looking to protect their assets and manage estate taxes. By establishing a Mississippi Irrevocable Trust Funded by Life Insurance, you remove the death benefit from your taxable estate, potentially lowering your tax liabilities. Additionally, ILITs offer control over how the insurance proceeds are distributed, providing peace of mind. As with any financial decision, it’s beneficial to analyze your specific circumstances with a qualified professional before proceeding.

To leave life insurance to a Mississippi Irrevocable Trust Funded by Life Insurance, you first need to designate the trust as the beneficiary on your life insurance policy. This process involves filling out the beneficiary designation form provided by your insurance company. It’s essential to ensure that the trust is properly established before making this change, as any errors can lead to complications after your passing. Consulting with a legal expert can help ensure that everything is set up correctly.

One of the biggest mistakes parents often make when establishing a Mississippi Irrevocable Trust Funded by Life Insurance is failing to communicate their intentions with their beneficiaries. This lack of clarity can lead to confusion, misunderstandings, and potential conflicts among family members later on. It’s vital to have open discussions about the purpose and benefits of the trust. Additionally, many overlook the importance of reviewing and updating the trust regularly to reflect changes in their financial situation or family dynamics.

You can indeed place life insurance in an irrevocable trust, which is a common strategy for effective estate planning. A Mississippi irrevocable trust funded by life insurance allows you to remove the policy from your taxable estate while ensuring that your beneficiaries receive the proceeds. This arrangement provides security for your loved ones and can help manage potential estate taxes. Consider accessing resources like uslegalforms to assist you in setting up this trust correctly.

Yes, an irrevocable life insurance trust may need to file a tax return if it has taxable income. Although the life insurance proceeds themselves are not taxable, any income generated by the trust’s assets could be subject to tax. Therefore, it is essential to stay informed about your tax obligations. Utilizing platforms like uslegalforms can help you navigate these complexities effectively.

Life insurance proceeds received by an irrevocable trust are generally not subject to income tax. When you establish a Mississippi irrevocable trust funded by life insurance, the death benefit remains untaxed, allowing the full amount to be distributed to the beneficiaries. This feature enhances the value of your estate planning strategy. To ensure compliance and maximize benefits, consider consulting with a professional.

Putting life insurance in an irrevocable trust can help shelter the death benefit from estate taxes, ensuring more of your wealth goes to your beneficiaries. Furthermore, it allows for a structured distribution of assets, which can be especially beneficial if you have minor children or dependents. By utilizing a Mississippi Irrevocable Trust Funded by Life Insurance, you can achieve peace of mind regarding your legacy.

While irrevocable life insurance trusts provide significant benefits, they do come with some disadvantages. Once the trust is established, you cannot change its terms or regain control of the assets. Additionally, there may be costs and complexities involved in setting it up and maintaining it, so it's crucial to weigh these factors carefully in managing your Mississippi Irrevocable Trust Funded by Life Insurance.