Are you inside a place where you will need files for both organization or specific reasons almost every day? There are a lot of legal file templates available on the net, but discovering kinds you can depend on is not easy. US Legal Forms offers 1000s of type templates, like the Mississippi Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act, that happen to be published in order to meet state and federal requirements.

When you are presently informed about US Legal Forms site and possess your account, merely log in. Following that, you are able to down load the Mississippi Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act web template.

Unless you come with an profile and need to begin to use US Legal Forms, abide by these steps:

- Discover the type you want and ensure it is for that appropriate city/region.

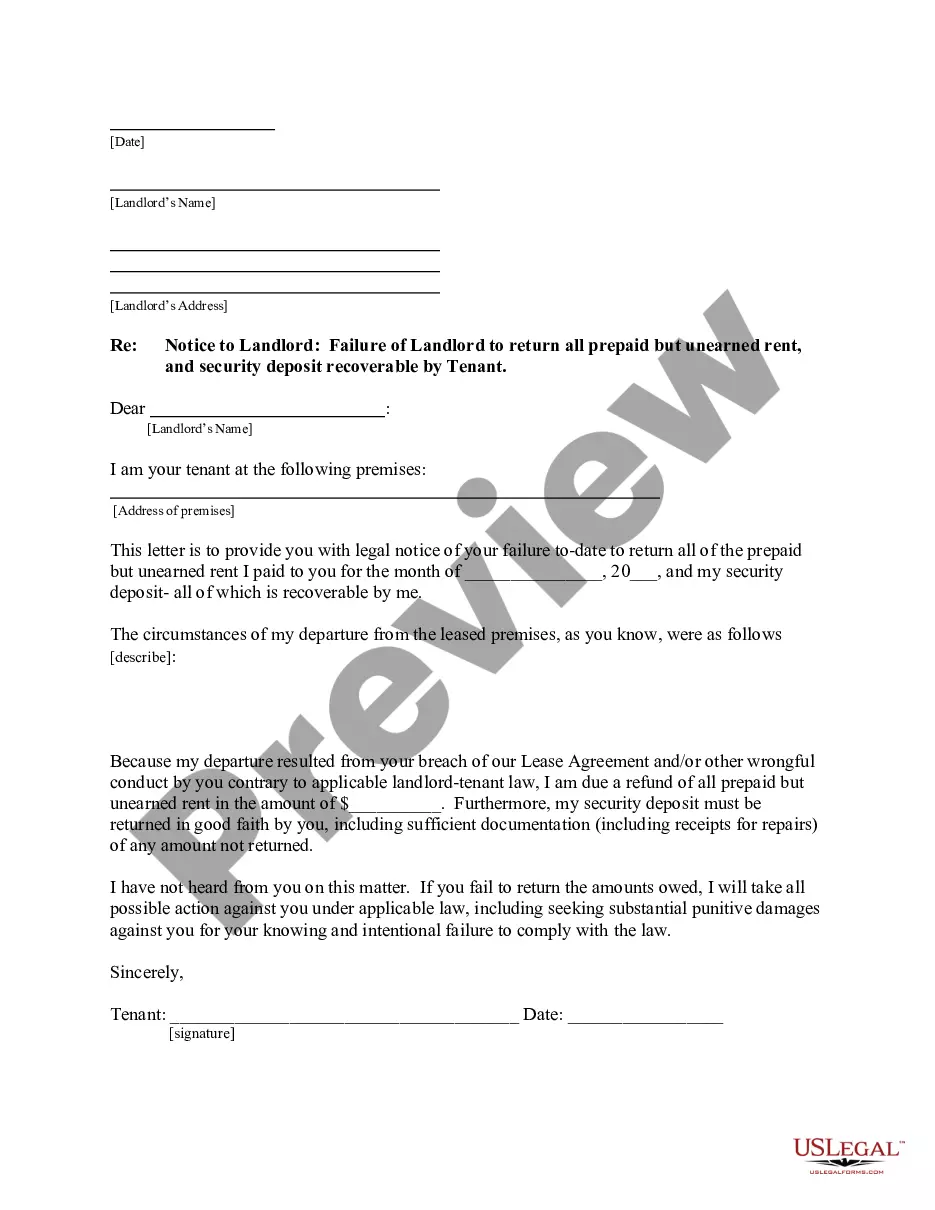

- Take advantage of the Review switch to analyze the form.

- See the outline to actually have chosen the correct type.

- In the event the type is not what you are looking for, take advantage of the Search field to discover the type that meets your requirements and requirements.

- Whenever you obtain the appropriate type, click on Buy now.

- Opt for the costs prepare you would like, fill out the desired info to create your bank account, and purchase your order using your PayPal or bank card.

- Choose a convenient file file format and down load your copy.

Find each of the file templates you have bought in the My Forms food list. You may get a further copy of Mississippi Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act whenever, if necessary. Just go through the necessary type to down load or print the file web template.

Use US Legal Forms, probably the most comprehensive variety of legal varieties, to save time as well as stay away from blunders. The service offers professionally produced legal file templates which you can use for a selection of reasons. Generate your account on US Legal Forms and start making your lifestyle a little easier.