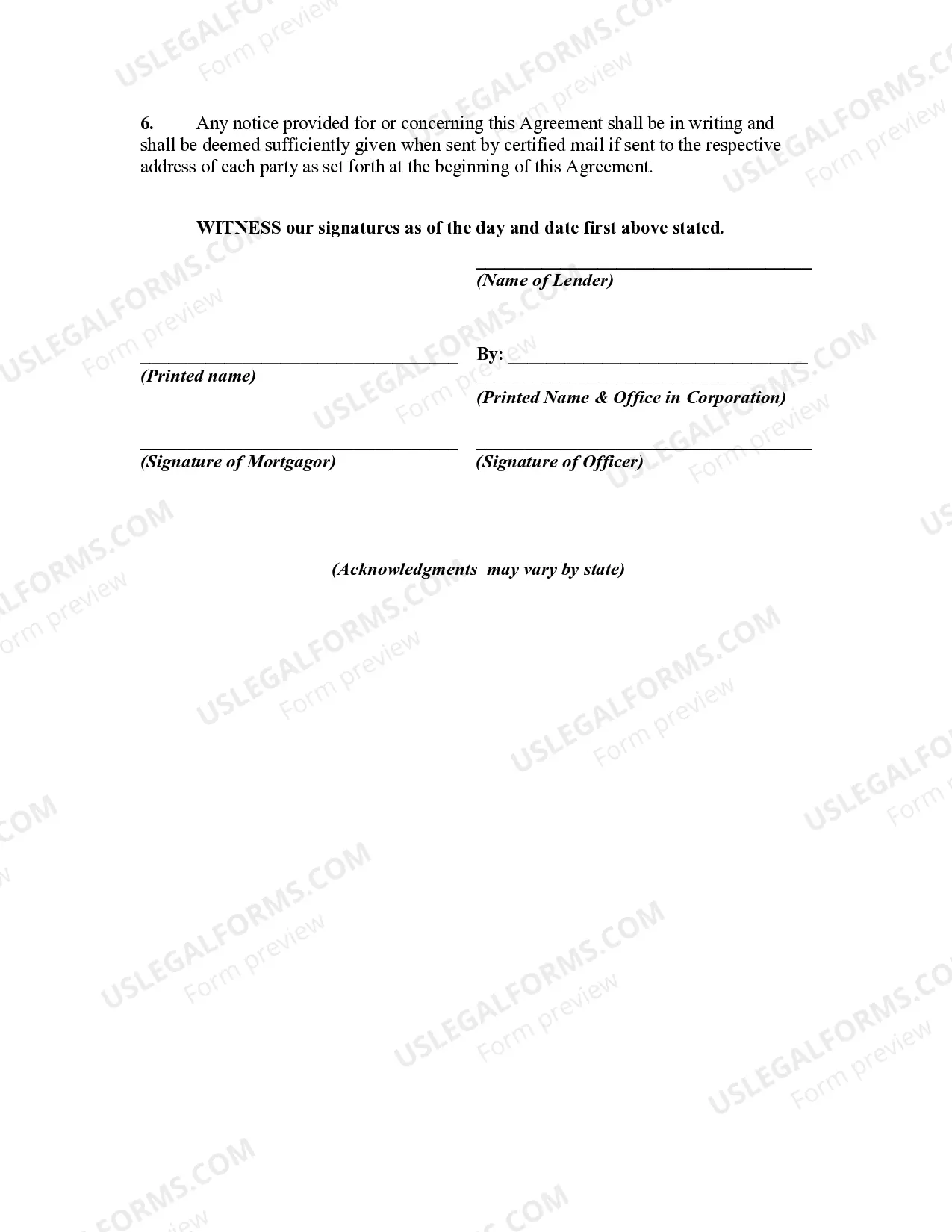

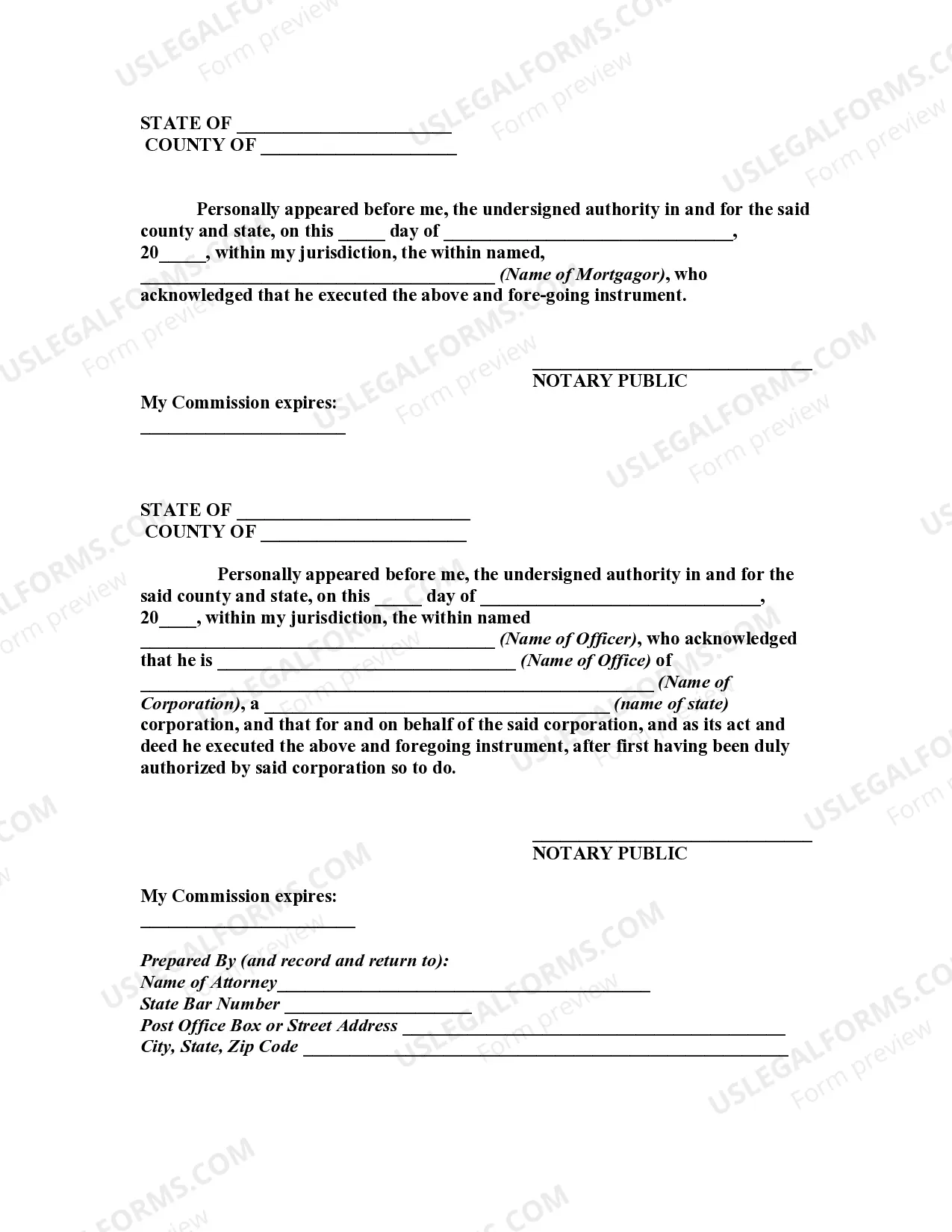

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate

Description

How to fill out Mortgage Loan Extension Agreement As To Maturity Date And Increase In Interest Rate?

If you need to total, obtain, or print out lawful document web templates, use US Legal Forms, the greatest variety of lawful forms, that can be found on the Internet. Make use of the site`s easy and practical search to find the paperwork you will need. Numerous web templates for enterprise and individual reasons are sorted by groups and states, or keywords and phrases. Use US Legal Forms to find the Mississippi Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate in a couple of clicks.

In case you are presently a US Legal Forms customer, log in to the accounts and click on the Acquire key to get the Mississippi Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate. Also you can accessibility forms you previously acquired inside the My Forms tab of the accounts.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for your right city/land.

- Step 2. Take advantage of the Preview option to check out the form`s articles. Do not forget about to read through the explanation.

- Step 3. In case you are not happy with the kind, take advantage of the Search field at the top of the display screen to locate other variations of your lawful kind web template.

- Step 4. After you have located the shape you will need, click the Buy now key. Opt for the pricing program you choose and add your accreditations to register for an accounts.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Pick the format of your lawful kind and obtain it in your product.

- Step 7. Full, change and print out or sign the Mississippi Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate.

Every lawful document web template you acquire is your own for a long time. You may have acces to each kind you acquired in your acccount. Click the My Forms portion and choose a kind to print out or obtain again.

Be competitive and obtain, and print out the Mississippi Mortgage Loan Extension Agreement as to Maturity Date and Increase in Interest Rate with US Legal Forms. There are many expert and state-certain forms you may use to your enterprise or individual requires.

Form popularity

FAQ

As a homeowner, it's possible to change your maturity date by coming to a new agreement with your lender. An extension on your maturity date could give you the time you need to repay the loan in full. Plus, extending your maturity date may also help you lower your monthly payments.

State interest rate laws vary depending on where you live and the type of credit or loan involved. These laws are designed to help consumers by restricting the amount of interest a creditor can charge. The legal maximum in Mississippi is 8%, with some exceptions for property loans and borrowing for business purposes.

Just like a traditional fixed-rate mortgage, if the Fed raises its rates during your fixed period, yours won't change. But once you're in the adjustable period, you can expect it to go up within the year. On the other hand, if they lower their rate, you can expect yours to go down too.

Loan modifications are a long-term financial relief option for homeowners who can't make their mortgage payments. If approved by your lender, this option can help you avoid foreclosure by lowering your interest rate or changing the structure of your overall loan.

In general, the longer your loan term, the more interest you will pay. Loans with shorter terms usually have lower interest costs but higher monthly payments than loans with longer terms.

The modification can reduce your monthly payment to an amount you can afford. Modifications may involve extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing or reducing your principal balance.

Different to a tracker mortgage, the lender sets the variable interest rate you pay and has several choices when there's a change to the base rate. As with a variable-rate mortgage, a tracker mortgage interest rate can change over time meaning your repayments can go up or down.

Paying more interest over time. If you have agreed to a lower monthly payment without significantly reducing your interest rate, you may end up paying more money in total because you are paying interest for a longer time than you otherwise would have.