It is not uncommon for employers to make loans to their new executives. The purpose of such a loan may be to assist the executive in the purchase of a home or other relocation expenses. Frequently, the loan is forgivable over a period of time provided the executive remains employed. The loan also may be forgivable if the executive's employment terminates for specified reasons (e.g., death, disability or termination by the employer without cause).

Mississippi Promissory Note - Forgivable Loan

Description

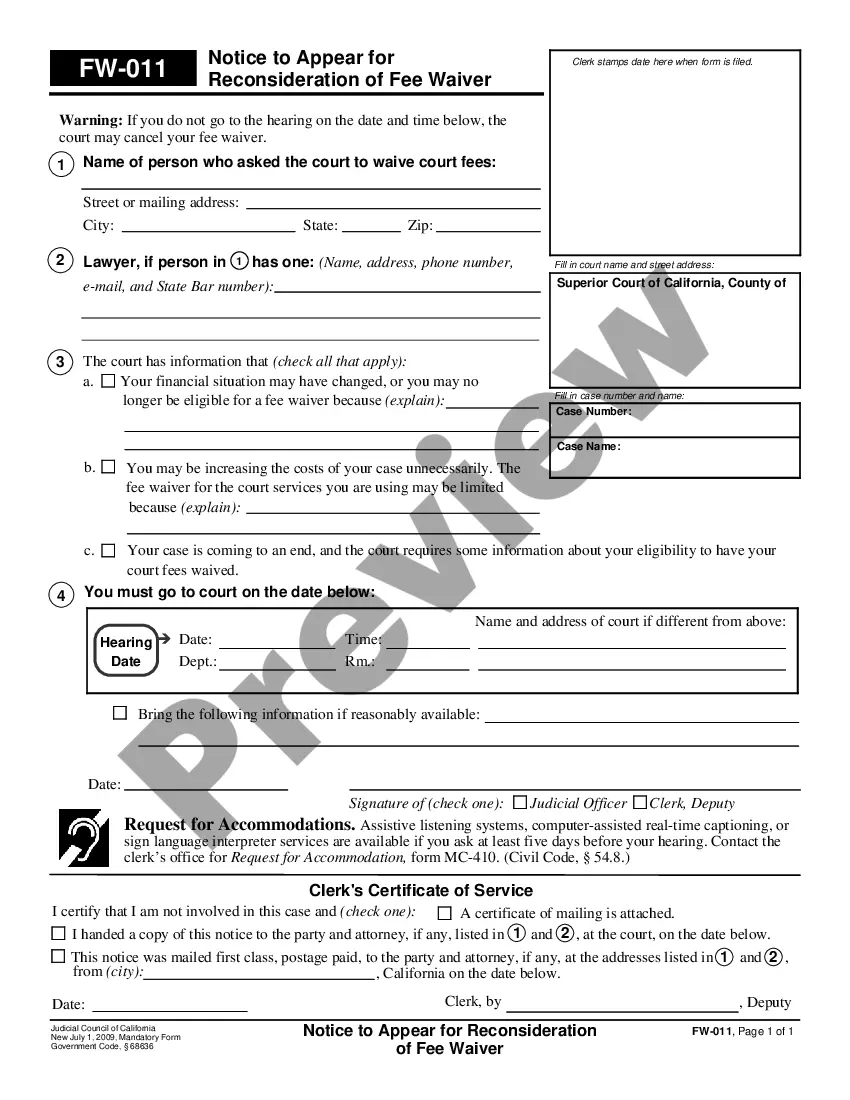

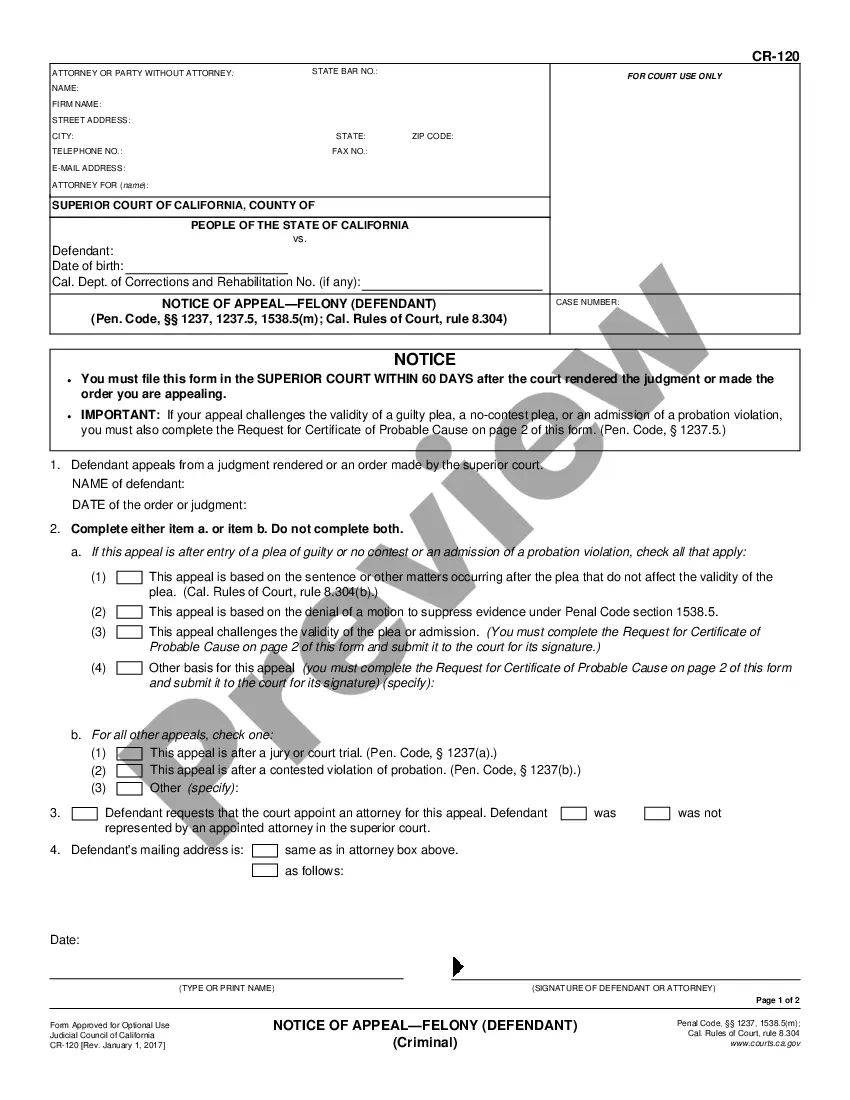

How to fill out Promissory Note - Forgivable Loan?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can obtain or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Mississippi Promissory Note - Forgivable Loan within moments.

If you already have a subscription, Log In and download the Mississippi Promissory Note - Forgivable Loan from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Make edits. Fill out, modify, and print and sign the downloaded Mississippi Promissory Note - Forgivable Loan. Every template you added to your account has no expiration date and belongs to you permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Mississippi Promissory Note - Forgivable Loan with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form’s content.

- Read the form description to make sure you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking on the Download now button.

- Next, choose the pricing plan you desire and provide your information to create an account.

Form popularity

FAQ

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.

A promissory note is a written agreement between one party (you, the borrower) to pay back a loan given by another party (often a bank or other financial institution).

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

The lender holds the promissory note while the loan is being repaid. Then the note is marked as paid. It's returned to the borrower when the loan is satisfied.

Promissory notes are legally binding contracts. That means when you don't pay back your loan, you could lose your collateral. If there's no collateral to secure the loan, the lender on the promissory note can take the borrower to court seeking repayment.

A forgivable loan, also called a soft second, is a form of loan in which its entirety, or a portion of it, can be forgiven or deferred for a period of time by the lender when certain conditions are met.

How to get PPP loan forgivenessUse it for eligible expenses.Keep your employee headcount upDon't reduce an employee's wages by more than 25%Document everything.Talk with your lender.Apply for loan forgiveness.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Work full time for a government organization at any level (state, federal, local) or a tax-exempt nonprofit. Make 120 monthly on-time payments (they don't have to be consecutive; payments made during forbearance or in deferment don't count).

Whatever the scope of the promissory note, the basic tenet is that once it is signed by the involved parties, it becomes a legal instrument that can be enforced via legal remedy if one of the parties does not uphold their end of the bargain.