Mississippi Employment Verification Letter for Independent Contractor serves as a vital document in the state of Mississippi to confirm the employment status and income details of an independent contractor. This letter acts as proof of income and employment for various purposes such as loan applications, housing rentals, visa processing, and more. The Mississippi Employment Verification Letter for Independent Contractor typically includes the following key information: 1. Contact Information: The letter starts with the contact details of the employer, including their name, address, phone number, and email address. It also mentions the contractor's details like name and address. 2. Date: The date on which the letter is issued is mentioned to establish the currency of the information. 3. Nature of Contract: The letter outlines the type of contractual relationship between the employer and the independent contractor. It specifies that the individual is not an employee but rather a self-employed contractor. 4. Duration of Contract: The letter includes the start and end dates of the contract period, if applicable. It indicates the length of time the contractor has been working for the employer. 5. Compensation Details: This section provides a breakdown of the contractor's compensation, including the payment structure (e.g., hourly rate, fixed amount per project), frequency (weekly, monthly, etc.), and any additional benefits or allowances provided. 6. Verification and Confirmation: The letter confirms the authenticity of the information provided by the contractor and verifies that they have been engaged by the employer for the specified period. It may also state that the information provided is true to the best of the employer's knowledge. Different types of Mississippi Employment Verification Letters for Independent Contractors may include variations based on specific requirements, such as: 1. Self-Employed Verification Letter: This letter is issued specifically to confirm the self-employed status of the contractor and their income details. 2. Project-based Verification Letter: If the independent contractor is working on a project basis, this type of letter may detail the specific project, its duration, and the compensation related to that project. 3. Periodic Income Verification Letter: In cases where income verification is required periodically, such as for government assistance programs, a letter detailing the contractor's monthly or annual earnings may be provided. In conclusion, the Mississippi Employment Verification Letter for Independent Contractor is a comprehensive document that confirms the contractor's employment and income details. Its purpose is to establish the contractor's credibility and financial position for various official and personal requirements.

Independent Contractor Verification Letter Sample

Description

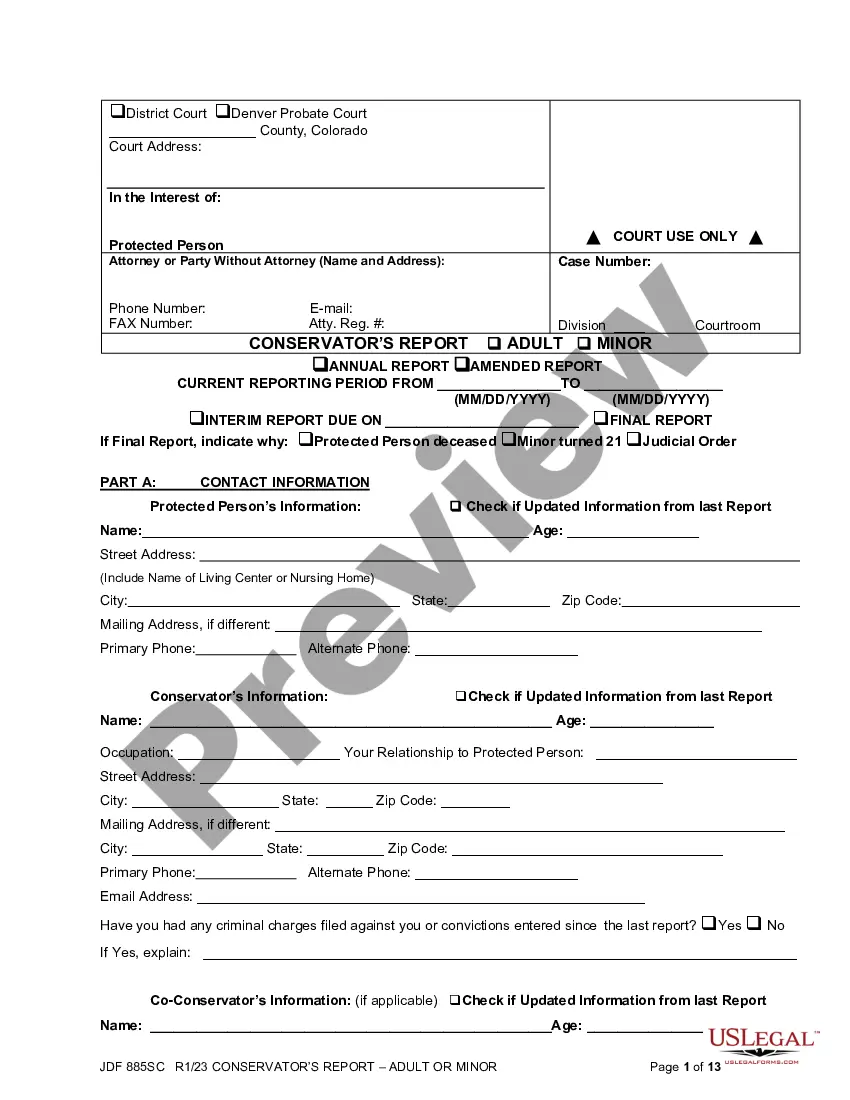

How to fill out Mississippi Employment Verification Letter For Independent Contractor?

If you wish to total, down load, or print legal file templates, use US Legal Forms, the greatest collection of legal forms, which can be found on the Internet. Take advantage of the site`s simple and convenient lookup to get the paperwork you need. Numerous templates for enterprise and person reasons are categorized by classes and states, or key phrases. Use US Legal Forms to get the Mississippi Employment Verification Letter for Independent Contractor in a couple of mouse clicks.

Should you be currently a US Legal Forms buyer, log in for your profile and click on the Download key to get the Mississippi Employment Verification Letter for Independent Contractor. Also you can entry forms you formerly acquired from the My Forms tab of the profile.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape to the proper area/region.

- Step 2. Take advantage of the Preview solution to examine the form`s information. Never forget to learn the information.

- Step 3. Should you be unsatisfied together with the kind, utilize the Research industry at the top of the screen to find other versions from the legal kind format.

- Step 4. When you have discovered the shape you need, select the Purchase now key. Opt for the prices plan you favor and put your accreditations to sign up on an profile.

- Step 5. Method the deal. You may use your Мisa or Ьastercard or PayPal profile to accomplish the deal.

- Step 6. Choose the file format from the legal kind and down load it on your device.

- Step 7. Full, change and print or signal the Mississippi Employment Verification Letter for Independent Contractor.

Each legal file format you purchase is the one you have eternally. You might have acces to every single kind you acquired with your acccount. Click on the My Forms section and choose a kind to print or down load once more.

Be competitive and down load, and print the Mississippi Employment Verification Letter for Independent Contractor with US Legal Forms. There are thousands of professional and condition-specific forms you may use for your personal enterprise or person requires.

Form popularity

FAQ

Independent contractors typically do not need to go through the e-verify system as it is mainly for employers confirming eligibility for employment. However, having a Mississippi Employment Verification Letter for Independent Contractor can assist with certain clients who may require employment verification. It's essential to stay informed about the requirements of your clients or projects. Platforms like uslegalforms can help you ensure that all necessary documents are properly prepared.

As a self-employed individual, verifying your employment can be straightforward with a Mississippi Employment Verification Letter for Independent Contractor. This letter should detail your business name, the nature of your services, and any relevant client contracts. Often, tax documents and business registrations also serve as proof. Consider using uslegalforms for easily crafting your verification letter.

To prove your employment status as an independent contractor, you can provide a Mississippi Employment Verification Letter for Independent Contractor. This letter outlines your work arrangement, including project details, payment terms, and duration. Additionally, you might include past contracts and invoices as supporting documents. Utilizing platforms like uslegalforms can help you generate a professional and compliant verification letter.

Writing a letter of employment as a self-employed individual involves clearly stating your name, business details, and the nature of your services. Include specifics like your contact information and a Mississippi Employment Verification Letter for Independent Contractor to reinforce your self-employment status. This ensures clarity and professionalism in your communication.

Verifying employment for an independent contractor typically requires proof of previous work relationships and completed contracts. You can obtain a Mississippi Employment Verification Letter for Independent Contractor from your clients, which serves as a formal acknowledgment of your services. This letter plays a crucial role in establishing your work history.

Proving self-employment involves presenting various forms of documentation that highlight your business engagement. This includes tax filings, client contracts, and a Mississippi Employment Verification Letter for Independent Contractor, which confirms your work status. Such documents collectively demonstrate your independence in the workforce.

To show proof of employment as a self-employed individual, compile relevant documentation. Common items include bank statements, invoices, and a Mississippi Employment Verification Letter for Independent Contractor that details your working relationship with clients. These documents not only validate your employment but also provide insight into your professional activities.

Requesting an employment verification letter typically involves contacting the individual or agency that can provide it. Clearly communicate your need for a Mississippi Employment Verification Letter for Independent Contractor to ensure they understand its purpose. Providing necessary details like your full name, work dates, and nature of your work can expedite the process.

To prove that you're self-employed, gather documents that showcase your business activities. This may include tax returns, invoices, contracts, and a Mississippi Employment Verification Letter for Independent Contractor. These documents establish your income and confirm your status as an independent contractor.

To verify a 1099 employee, start by gathering the essential information, such as their tax identification number and details from their IRS Form 1099. You can cross-check this information with your records of payments made during their contract. If needed, you can also refer to platforms like uslegalforms, which provide templates and resources to facilitate the verification process effectively. Taking these steps ensures that your verification aligns with legal requirements.

Interesting Questions

More info

Please make sure the following information on each line is correct and complete: Job Title Job Category, Employer, Office, Location Employment Status Sr. Employee If you are unsure about the last two, please refer to the income statement attached to your tax return for the year of filing. You may enter any salary from the past year. There are no limits on the amount of income you may enter. Employment income from: Salary of 0 to 3,500 Salary of 3,500 and more but less than 9,000 Salary under 9,000 You may enter additional income that exceeds 10%. Additional amount entered: If the total amount entered here equals greater than 10%, an additional tax penalty will be imposed on the taxpayer during the year the additional income is received. If you do not exceed the limit, it will not be imposed. You may enter up to 2,000 on this line.