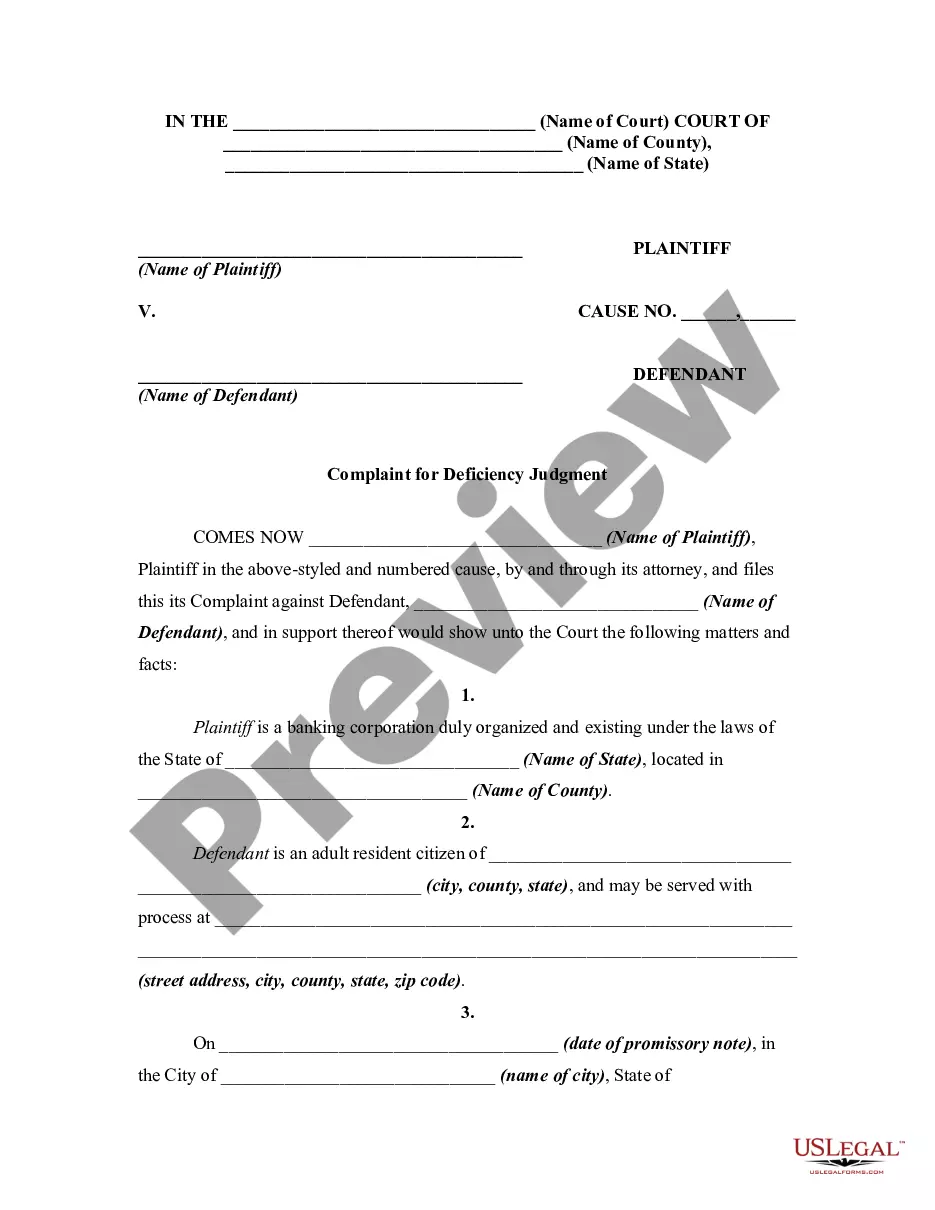

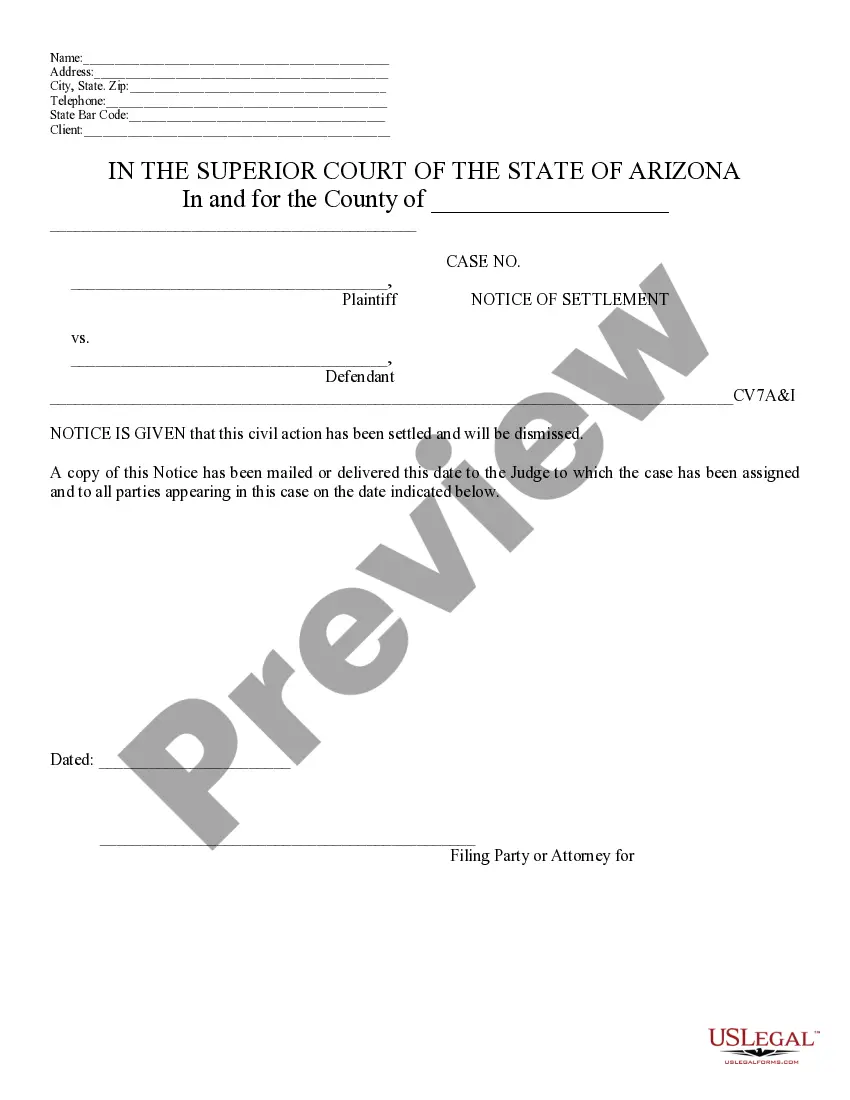

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Receipt and Acceptance of Residential Mortgage Loan Commitment

Description

How to fill out Receipt And Acceptance Of Residential Mortgage Loan Commitment?

Are you inside a situation in which you need documents for sometimes company or personal functions virtually every working day? There are a variety of lawful papers templates available on the Internet, but discovering types you can rely isn`t straightforward. US Legal Forms gives thousands of develop templates, much like the Mississippi Receipt and Acceptance of Residential Mortgage Loan Commitment, that happen to be published to fulfill federal and state demands.

Should you be presently familiar with US Legal Forms web site and have an account, just log in. Afterward, you are able to acquire the Mississippi Receipt and Acceptance of Residential Mortgage Loan Commitment template.

If you do not provide an account and need to begin using US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is for the right city/area.

- Take advantage of the Preview switch to check the shape.

- See the information to actually have selected the proper develop.

- In case the develop isn`t what you`re looking for, take advantage of the Lookup area to find the develop that meets your requirements and demands.

- When you obtain the right develop, simply click Purchase now.

- Pick the rates program you need, complete the specified info to create your account, and purchase the transaction making use of your PayPal or bank card.

- Pick a handy paper structure and acquire your duplicate.

Locate all of the papers templates you might have bought in the My Forms menu. You can get a further duplicate of Mississippi Receipt and Acceptance of Residential Mortgage Loan Commitment at any time, if necessary. Just select the required develop to acquire or printing the papers template.

Use US Legal Forms, by far the most comprehensive collection of lawful types, to save lots of efforts and steer clear of blunders. The support gives expertly made lawful papers templates which you can use for an array of functions. Create an account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

Does A Loan Commitment Letter Mean I'm Approved? After you're preapproved, you'll receive a conditional mortgage commitment letter. That does not mean you're approved for the loan. With this conditional approval, you'll still have steps to take in the mortgage application process.

Once you're approved and getting ready to set a move-in date, you'll need to go through the settlement process of the purchase transaction and mortgage loan. It's important to note that just because your mortgage company created the commitment letter, doesn't mean you shouldn't be able to still back out.

A mortgage commitment letter is a formal document issued by the lender to confirm the approval of a loan. It is given to the borrower after successfully completing the pre?approval process and undergoing a thorough review by the underwriting team.

Once your mortgage commitment letter has been submitted, you've entered the final stage of the mortgage process. The letter is not a final approval, but more so a pledge to the borrower that the mortgage lender will grant the loan if all conditions are met. If there are no loose ends, you should be approved.

This includes: home purchase loans, refinances, lender approved assumptions, property improvement loans, equity lines of credit, and reverse mortgages.

IN GENERAL. § 81-18-35 - Journal of mortgage transactions for Mississippi residential loans that licensee originates and/or funds; journal of serviced loans for Mississippi residential loans that licensee owns and/or services [Repealed effective July 1, 2016]