Mississippi Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

Are you presently at the location where you need documents for either business or personal reasons almost every time.

There are numerous legal document templates available online, but locating ones you can rely on isn't simple.

US Legal Forms provides thousands of form templates, similar to the Mississippi Revocable Trust for Lottery Winnings, designed to meet state and federal requirements.

Once you find the appropriate form, click on Get now.

Choose the pricing plan you desire, fill in the necessary details to create your account, and pay for your order using PayPal or a credit card.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Mississippi Revocable Trust for Lottery Winnings template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it matches the correct city/state.

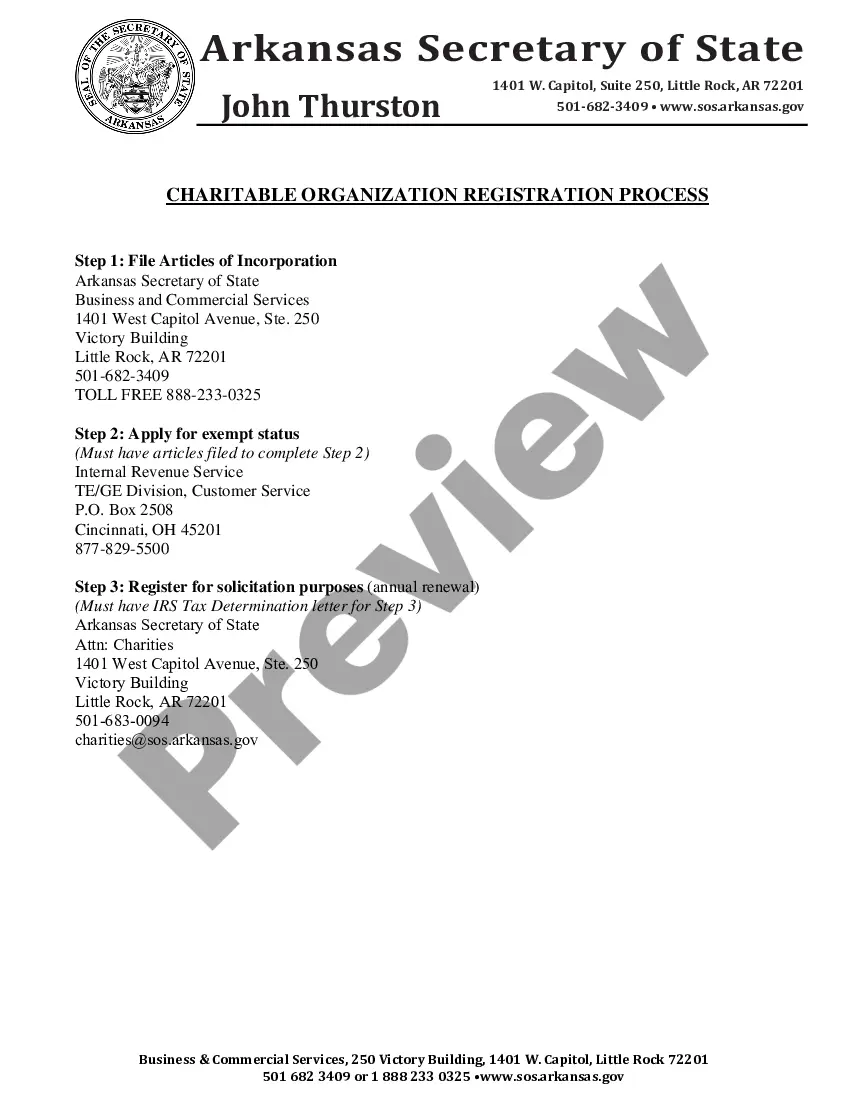

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form isn't what you're searching for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

Handling large lottery winnings can be challenging without the right approach. Start by creating a financial plan and consider setting up a Mississippi Revocable Trust for Lottery Winnings. This trust not only helps manage your assets but also offers tax advantages and security. Working with a financial advisor can provide additional guidance to ensure your winnings work for you over time.

Mississippi allows lottery winners to remain anonymous, but there are specific steps to follow. By thoroughly understanding your options, you can use a Mississippi Revocable Trust for Lottery Winnings as a shield to protect your identity. This tool helps maintain your privacy while you enjoy your prize without unwanted attention. Always consult with an attorney to ensure you handle your winnings correctly.

Many people are unaware that there are exclusions and exemptions in gift tax laws that can be beneficial. One common approach is using a Mississippi Revocable Trust for Lottery Winnings, which offers flexibility in how you handle distributions. Additionally, annual gift exclusions allow you to give a certain amount to individuals without tax consequences. It's important to stay informed about these options and seek advice from a tax professional to ensure you're using them effectively.

If you want to share your lottery winnings without incurring gift taxes, consider forming a Mississippi Revocable Trust for Lottery Winnings. This trust allows you to distribute funds to family or friends without triggering immediate tax liabilities. Plus, using a trust can provide greater security and control over how and when your loved ones receive their gifts. Make sure to consult with a tax professional to maximize your sharing strategy.

Winning the lottery is exciting, but it can come with significant tax implications. One effective strategy to reduce your tax burden is to set up a Mississippi Revocable Trust for Lottery Winnings. By placing your winnings in this trust, you may have more control over distributions, potentially minimizing your tax obligations. Additionally, working with a financial advisor can help you understand the best ways to utilize your trust for greater tax efficiency.

Yes, many individuals have won the lottery in Mississippi. These winners come from various backgrounds and have claimed substantial prizes over the years. For these winners, setting up a Mississippi Revocable Trust for Lottery Winnings can be a wise choice, providing a secure way to manage their newfound wealth.

No, you do not have to go public if you win the lottery in Mississippi. Utilizing a Mississippi Revocable Trust for Lottery Winnings allows you to keep your identity private while still claiming your prize. This not only provides privacy but also helps you manage your winnings effectively with the right legal guidance.

Yes, you can maintain a level of anonymity if you win the lottery in Mississippi. By establishing a Mississippi Revocable Trust for Lottery Winnings, you can claim your prize without revealing your personal details to the public. This approach not only enhances your privacy but also offers additional financial planning benefits.

Claiming lottery winnings anonymously varies by state regulations. In Mississippi, if you choose to set up a Mississippi Revocable Trust for Lottery Winnings, you can significantly enhance your privacy. This means that the trust can claim the winnings on your behalf, keeping your name out of public records to a certain extent.

Several states require lottery winners to disclose their identities publicly. These states include California, Texas, and Illinois, among others. However, Mississippi offers some opportunities for anonymity, particularly through a Mississippi Revocable Trust for Lottery Winnings. Creating such a trust can help protect your identity while allowing you to enjoy your winnings.