Indemnification is the act of making another "whole" by paying any loss another might suffer. This usually arises from a clause in a contract where a party agrees to pay for any monetary damages which arise or have arisen.

Mississippi Indemnification of Purchaser of Personal Property from Estate

Description

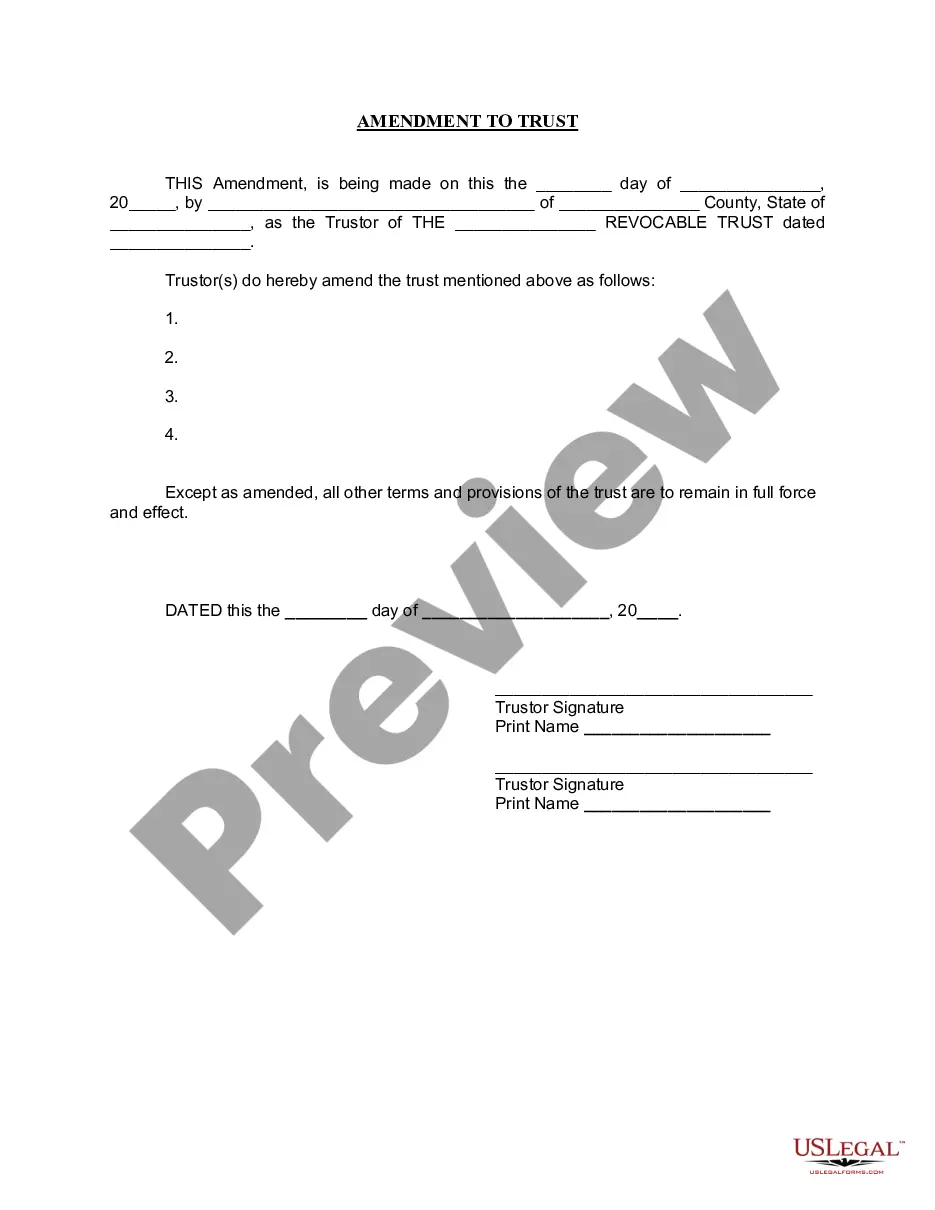

How to fill out Indemnification Of Purchaser Of Personal Property From Estate?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest forms such as the Mississippi Indemnification of Purchaser of Personal Property from Estate within minutes.

Review the form summary to ensure you have chosen the correct document.

If the form does not fit your requirements, use the Search area at the top of the screen to find one that does.

- If you have a subscription, Log In and download the Mississippi Indemnification of Purchaser of Personal Property from Estate from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

The statute of limitations on property disputes in Mississippi typically ranges around six years. This timeframe applies to claims regarding property rights, including those stemming from estate transactions. Understanding the statute of limitations is vital when dealing with property and respecting laws like the Mississippi Indemnification of Purchaser of Personal Property from Estate.

In Mississippi, an estate must have a value exceeding $75,000 to undergo the probate process. This threshold includes real estate and personal property. Awareness of this limit is essential for heirs and buyers, especially when navigating estate laws, including the Mississippi Indemnification of Purchaser of Personal Property from Estate.

In Mississippi, the order of inheritance determines who receives property from an estate when there is no will. Typically, spouses and children are first in line, followed by parents and siblings. Understanding this order is important, as it impacts how the Mississippi Indemnification of Purchaser of Personal Property from Estate applies in transactions involving inherited property.

Mississippi estate laws govern how property is managed and distributed after a person passes away. These laws cover wills, probate processes, and inheritance rights. Familiarizing yourself with these laws is crucial for anyone dealing with estates to ensure compliance and protection under regulations like the Mississippi Indemnification of Purchaser of Personal Property from Estate.

Yes, siblings can force the sale of inherited property in Mississippi, but it often requires legal action. If one or more family members wish to keep the property while others want to sell, disputes may arise. In such cases, pursuing a legal resolution may necessitate understanding the Mississippi Indemnification of Purchaser of Personal Property from Estate to safeguard your interests.

Several factors can trigger probate in Mississippi, including the presence of a will, ownership of property solely in the deceased's name, and the nature of the estate's assets. If you are dealing with the Mississippi indemnification of purchaser of personal property from estate, it's essential to identify triggers promptly to ensure that the probate process proceeds smoothly and legally.

Yes, Mississippi recognizes the right of survivorship. This means that if one owner of a joint property passes away, the surviving owner automatically inherits the deceased owner's share. It's important to consider these aspects when discussing the Mississippi indemnification of purchaser of personal property from estate, as joint ownership can impact asset distribution.

The probate process in Mississippi can vary, typically taking several months to over a year, depending on the estate's complexity. Factors like the size of the estate, potential disputes among heirs, and court schedules can also affect the timeline. Understanding the Mississippi indemnification of purchaser of personal property from estate is vital as it relates to the efficient settlement of assets during this time.

In Mississippi, not all wills need to be probated, but many do. A will that distributes personal property or real estate typically requires probate to validate its contents. Thus, if you are navigating the Mississippi indemnification of purchaser of personal property from estate, it is wise to consult with a legal expert to determine whether probate applies to your situation.

Not all estates in Mississippi are required to go through probate. For instance, if an estate consists solely of joint property or assets with named beneficiaries, probate may not be necessary. However, when dealing with the Mississippi indemnification of purchaser of personal property from estate, it is crucial to understand which assets require probate to ensure proper distribution.