The courts have inherent power to restrain the sale of mortgaged premises in foreclosure proceedings, but are reluctant to exercise such power except where it is shown that particular circumstances, extrinsic to the instrument, would render its enforcement in this manner inequitable and work irreparable injury, and that complainant has no adequate remedy at law. Furthermore, a party must show a probable right of recovery in order to obtain a temporary injunction of a foreclosure action.

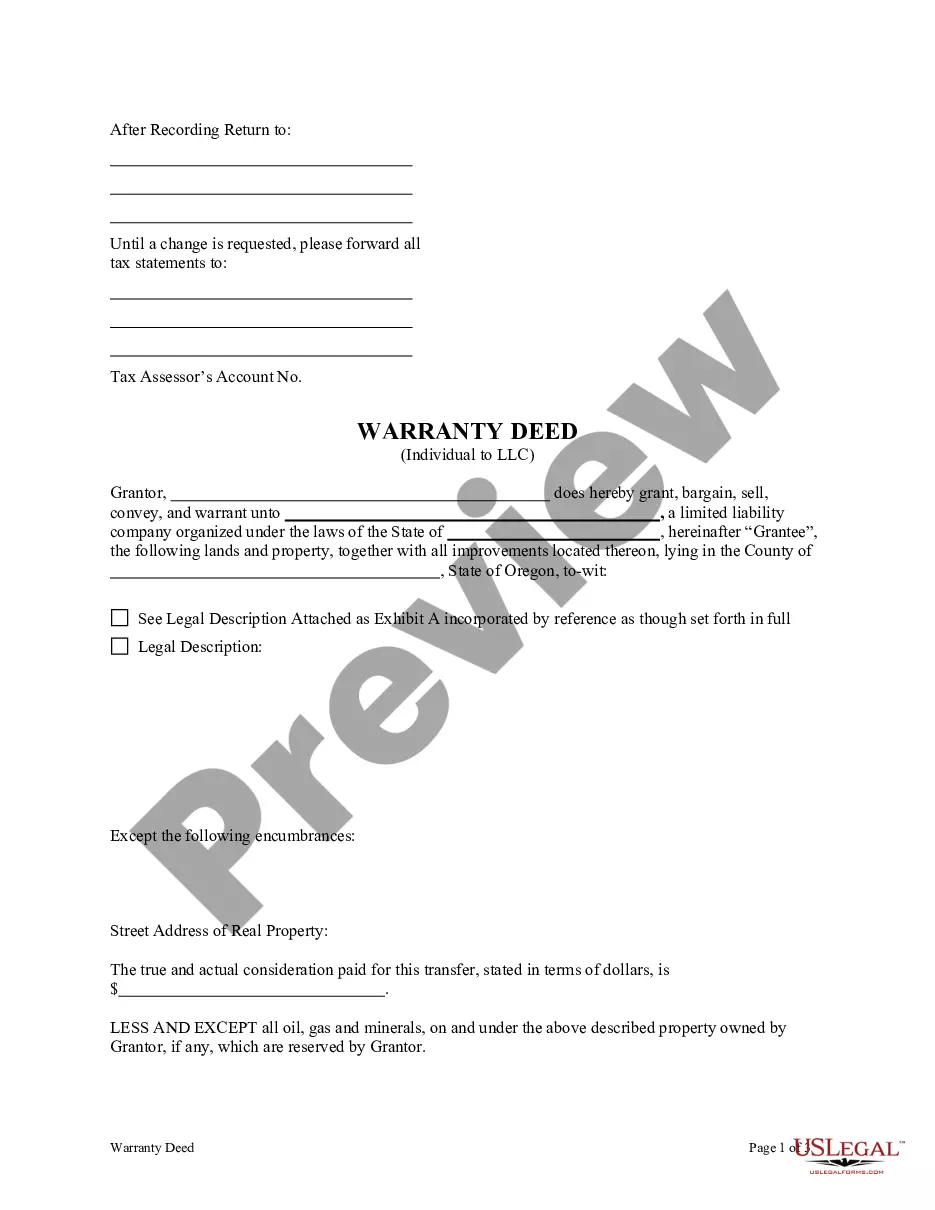

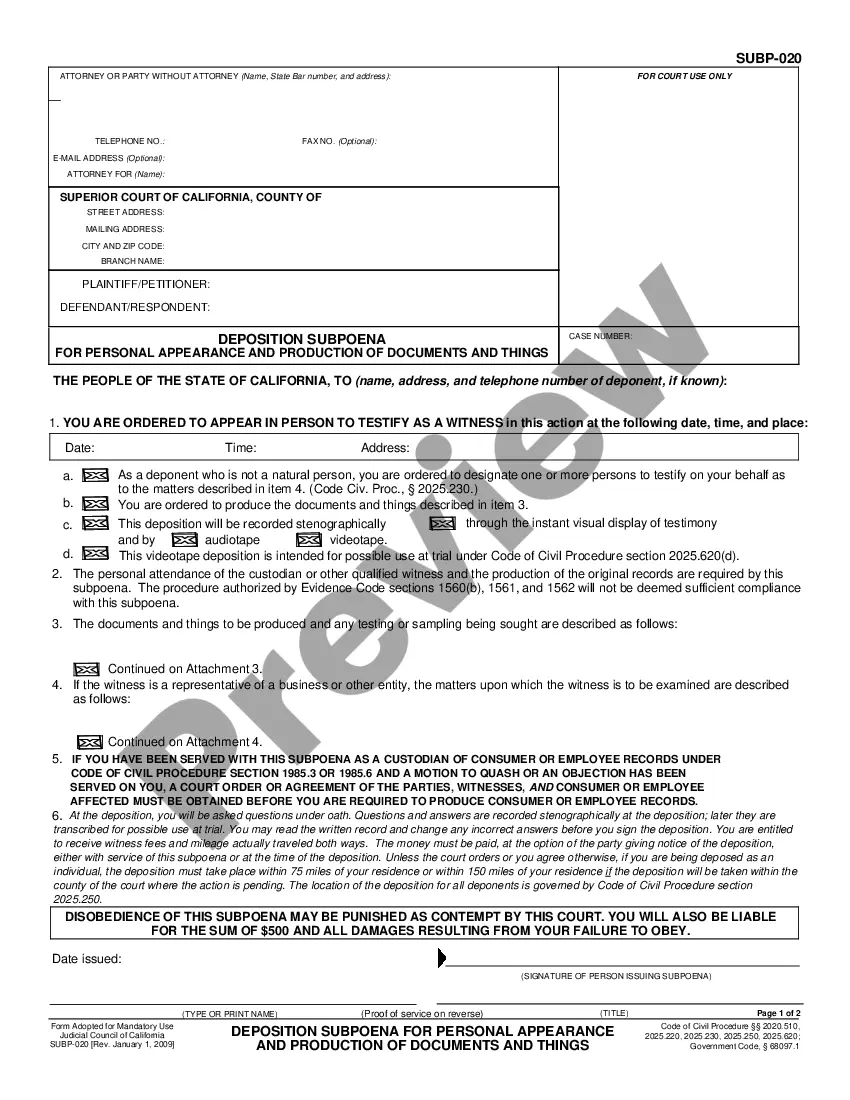

Mississippi Petition to Enjoin Foreclosure Sale and Seeking Ascertainment of Amount Owed on Note and Deed of Trust

Description

How to fill out Petition To Enjoin Foreclosure Sale And Seeking Ascertainment Of Amount Owed On Note And Deed Of Trust?

US Legal Forms - among the largest libraries of legitimate forms in the United States - delivers a wide array of legitimate file web templates you may download or print out. While using website, you may get a huge number of forms for organization and specific reasons, sorted by types, says, or search phrases.You will find the latest variations of forms such as the Mississippi Petition to Enjoin Foreclosure Sale and Seeking Ascertainment of Amount Owed on Note and Deed of Trust within minutes.

If you already possess a registration, log in and download Mississippi Petition to Enjoin Foreclosure Sale and Seeking Ascertainment of Amount Owed on Note and Deed of Trust from your US Legal Forms catalogue. The Obtain button will appear on each and every type you see. You have accessibility to all in the past delivered electronically forms within the My Forms tab of your own accounts.

If you would like use US Legal Forms for the first time, here are simple recommendations to obtain started out:

- Be sure you have selected the proper type to your town/area. Click the Review button to review the form`s information. Browse the type outline to ensure that you have selected the appropriate type.

- In case the type doesn`t fit your requirements, utilize the Research field towards the top of the monitor to find the the one that does.

- Should you be happy with the form, affirm your option by simply clicking the Get now button. Then, pick the rates plan you favor and supply your qualifications to sign up on an accounts.

- Approach the purchase. Utilize your credit card or PayPal accounts to complete the purchase.

- Select the formatting and download the form on your product.

- Make alterations. Load, revise and print out and indication the delivered electronically Mississippi Petition to Enjoin Foreclosure Sale and Seeking Ascertainment of Amount Owed on Note and Deed of Trust.

Every design you included in your bank account lacks an expiration date which is the one you have eternally. So, if you want to download or print out an additional duplicate, just proceed to the My Forms area and click around the type you need.

Get access to the Mississippi Petition to Enjoin Foreclosure Sale and Seeking Ascertainment of Amount Owed on Note and Deed of Trust with US Legal Forms, the most extensive catalogue of legitimate file web templates. Use a huge number of skilled and express-distinct web templates that satisfy your organization or specific demands and requirements.

Form popularity

FAQ

On the contrary, Mississippi laws do not give the right of redemption after the foreclosure. The borrower may have the right to stop the non-judicial foreclosure when you ?reinstate? the loan, as long as the total overdue amount (including interest and fees) will be paid off.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

No Redemption Period After a Nonjudicial Foreclosure in Mississippi. Some states have a law that gives a foreclosed homeowner time after the foreclosure sale to redeem the property. In Mississippi, however, you don't get a post-sale redemption period after a foreclosure.

Similar to a short sale, a deed in lieu of foreclosure likely will not damage your credit as severely as a foreclosure or a bankruptcy. As noted above, the burden of selling your home shifts to someone else, so it may be more appealing than a short sale.

Yes, a deed in lieu of foreclosure harms your credit, but less so than a foreclosure would. If you obtain a deed in lieu, your mortgage will be listed on your credit reports as closed with a zero balance, but not paid in full. This is a negative entry that will remain on your credit report for up to seven years.

A homeowner has many options to stop a foreclosure in Mississippi, which are follows: Deed in lieu of foreclosure: The borrower transfers the property to lender, who then waives the mortgage debt and doesn't pursue foreclosure. Forbearance: The lender agrees to reduce or suspend payments for a period of time.

Mississippi is a state where mortgage holders may foreclose on mortgages or deeds of trusts that are in default by either judicial or non-judicial foreclosure processes. If the deed of trust or the mortgage contains no power of sale clause, the lender must seek an order to foreclose from the civil courts.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.