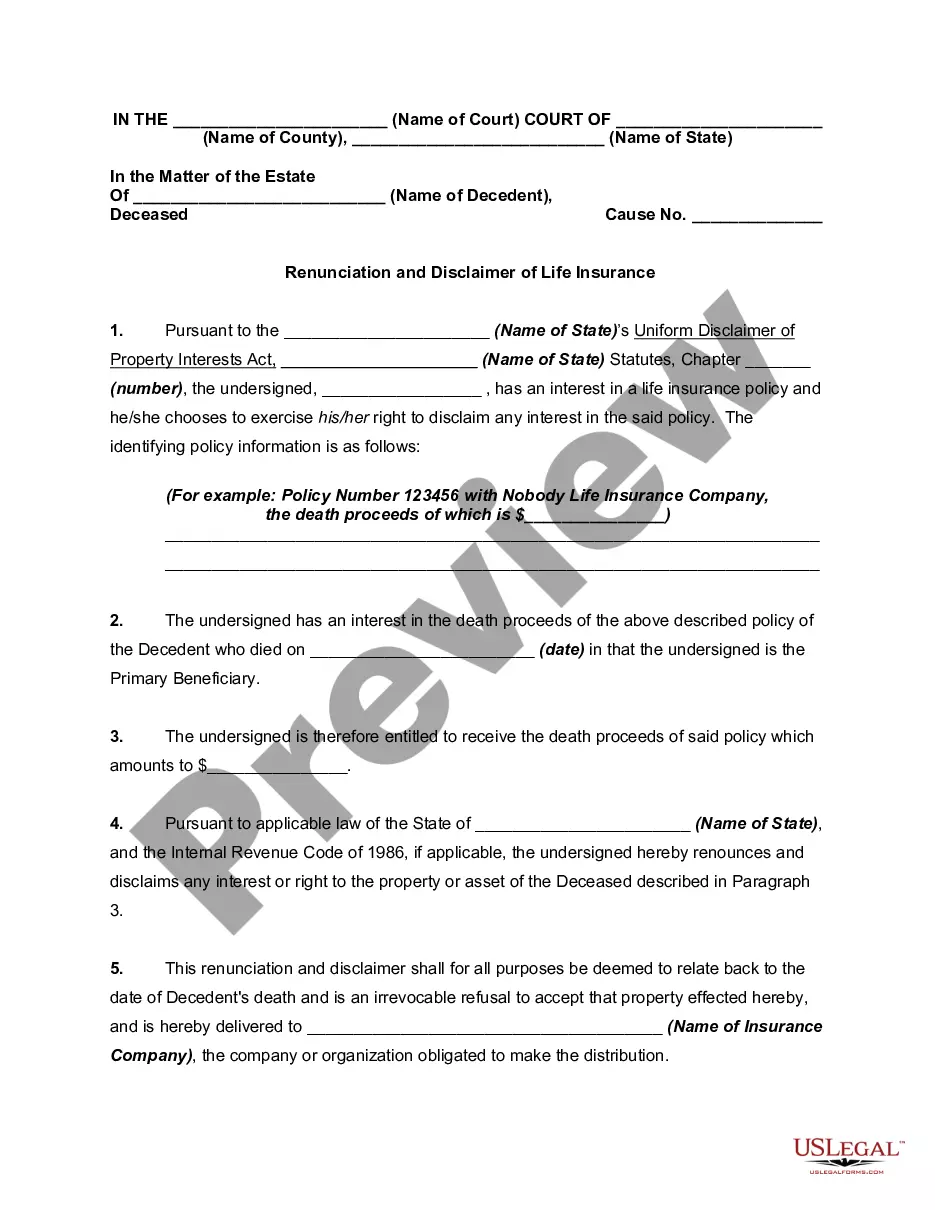

Are you presently in a position where you require documents for possibly enterprise or specific functions virtually every day time? There are a variety of legal record themes available online, but discovering kinds you can rely on is not simple. US Legal Forms provides a huge number of kind themes, just like the Mississippi Renunciation and Disclaimer of Interest in Life Insurance Proceeds, that happen to be written in order to meet federal and state requirements.

When you are previously knowledgeable about US Legal Forms internet site and possess a merchant account, just log in. Afterward, you are able to acquire the Mississippi Renunciation and Disclaimer of Interest in Life Insurance Proceeds web template.

If you do not offer an profile and would like to start using US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is for that appropriate area/county.

- Take advantage of the Review key to analyze the form.

- Browse the explanation to ensure that you have selected the correct kind.

- In case the kind is not what you are seeking, take advantage of the Look for field to obtain the kind that meets your requirements and requirements.

- When you discover the appropriate kind, click Get now.

- Pick the costs plan you would like, submit the specified information and facts to generate your account, and pay for the transaction making use of your PayPal or bank card.

- Choose a handy data file formatting and acquire your backup.

Get all of the record themes you possess purchased in the My Forms food list. You can obtain a extra backup of Mississippi Renunciation and Disclaimer of Interest in Life Insurance Proceeds anytime, if needed. Just select the needed kind to acquire or produce the record web template.

Use US Legal Forms, by far the most considerable selection of legal types, to save efforts and avoid mistakes. The service provides skillfully produced legal record themes which can be used for a variety of functions. Make a merchant account on US Legal Forms and begin producing your daily life a little easier.