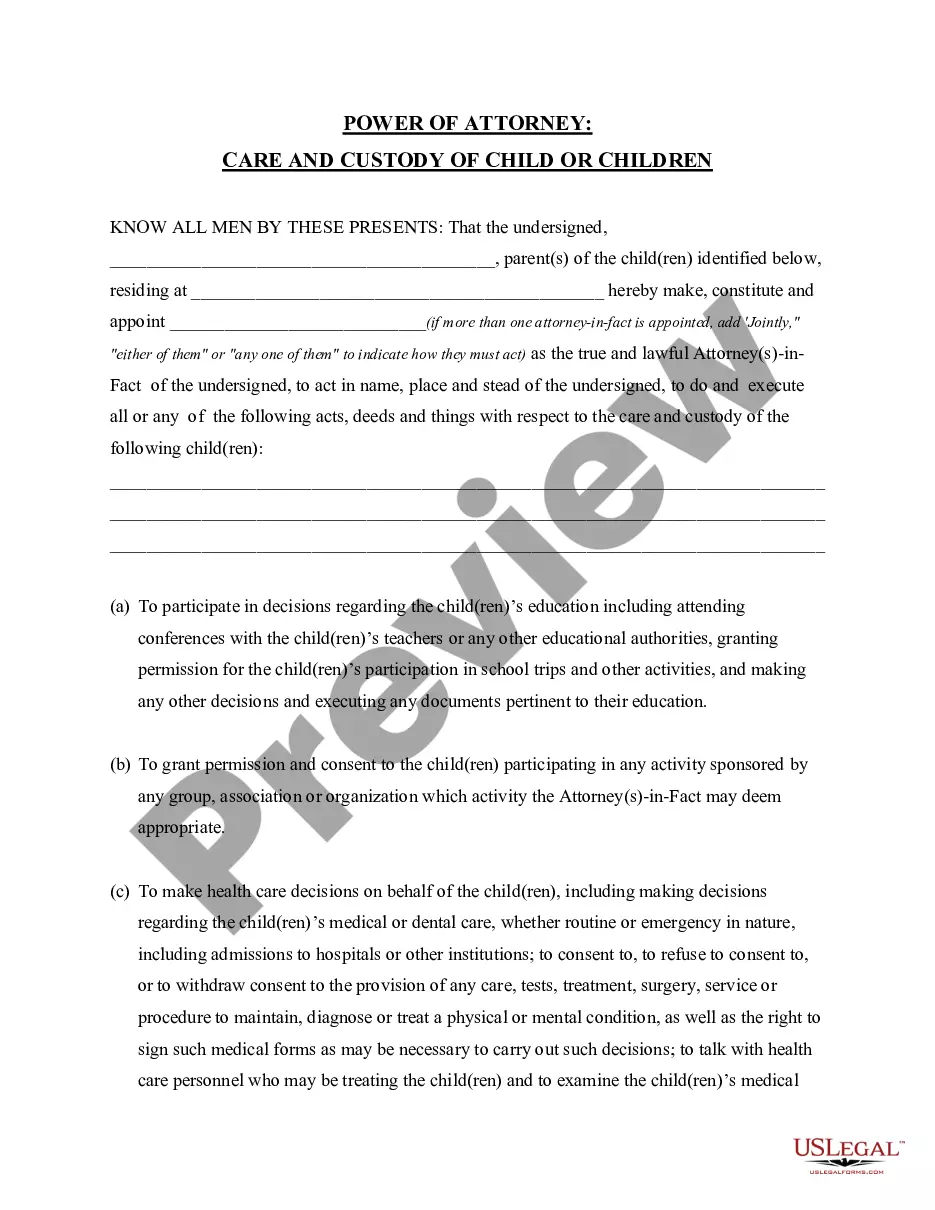

The Mississippi Business Credit Application serves as a crucial document for companies seeking financial assistance or credit from various lenders in the state. This application allows businesses to provide detailed information about their financial status, credit history, and overall viability. By evaluating this application, lenders can make informed decisions about extending credit to businesses in Mississippi. The Mississippi Business Credit Application typically consists of several sections, each requesting specific information. The application typically starts by asking for basic company details, such as the business name, address, contact information, and legal structure. This section may also require the business to provide its federal tax identification number or Employer Identification Number (EIN). The application then delves into the financial aspects of the business. It may inquire about the company's annual revenue, profit margins, and expenses. This section might also include questions related to previous bankruptcies, outstanding debts, or any ongoing legal disputes. Furthermore, the Mississippi Business Credit Application will likely request information regarding the credit history of the company. Lenders often request details about existing credit lines, loans, or credit cards that the business currently holds. This helps lenders determine the company's ability to manage credit and repay debts promptly. Additionally, the application may require businesses to provide bank statements or financial statements, including balance sheets and profit and loss statements. These documents offer a comprehensive overview of the business's financial stability and performance. It is important to note that there may be various types of Mississippi Business Credit Applications available, depending on the specific lender or type of credit being sought. Some common variations include: 1. Small Business Credit Application: Designed for small businesses, this type of application focuses on the financials and creditworthiness of small enterprises. 2. Startup Business Credit Application: Tailored specifically for newly established businesses, this application may place emphasis on the business plan, projected cash flows, and personal credit history of the business owners. 3. Commercial Real Estate Credit Application: Geared towards businesses seeking credit for commercial real estate ventures, this application may require additional details about the property, its value, and potential rental income. In conclusion, the Mississippi Business Credit Application is a comprehensive document that allows businesses to provide crucial information to lenders to secure credit or financial assistance. By completing this application accurately and thoroughly, businesses can enhance their chances of obtaining credit and meeting their financial objectives.

Mississippi Business Credit Application

Description

How to fill out Mississippi Business Credit Application?

Choosing the right legitimate record format might be a have difficulties. Needless to say, there are plenty of themes available on the net, but how would you obtain the legitimate type you want? Take advantage of the US Legal Forms web site. The support gives a huge number of themes, for example the Mississippi Business Credit Application, that you can use for enterprise and private requires. All the forms are checked by pros and satisfy federal and state specifications.

Should you be currently signed up, log in to your profile and click the Down load button to obtain the Mississippi Business Credit Application. Make use of your profile to search through the legitimate forms you have ordered earlier. Visit the My Forms tab of the profile and get yet another backup from the record you want.

Should you be a brand new customer of US Legal Forms, here are basic directions that you should follow:

- Very first, be sure you have selected the proper type for your personal area/region. It is possible to check out the shape while using Preview button and read the shape explanation to make certain this is basically the best for you.

- In case the type fails to satisfy your preferences, utilize the Seach field to obtain the correct type.

- When you are sure that the shape would work, click on the Purchase now button to obtain the type.

- Choose the rates prepare you desire and type in the required information. Create your profile and pay money for the transaction with your PayPal profile or bank card.

- Choose the data file format and acquire the legitimate record format to your system.

- Full, revise and printing and sign the received Mississippi Business Credit Application.

US Legal Forms is definitely the biggest catalogue of legitimate forms for which you can discover various record themes. Take advantage of the company to acquire professionally-created paperwork that follow state specifications.

Form popularity

FAQ

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

How to start a business in Mississippi in 8 steps 1) Think about the type of business you want to start. ... 2) Set up your legal structure. ... 3) Name and register your business. ... 4) Apply for business licenses and permits. ... 5) Choose a location. ... 6) Open a bank account and prepare for future taxes. ... 7) Purchase business insurance.

Mississippi LLC Formation Filing Fee: $50 To bring your Mississippi LLC into existence, you must pay $50 (plus a $4 credit card fee) to file your LLC Certificate of Formation. You must fill out your application online, via the Mississippi Business Services portal.

Initial Mississippi LLC Fees State FeeState Filing TimeExpedited Filing Time$533 Weeks1 Business DayState Fee$53State Filing Time3 WeeksExpedited Filing Time1 Business Day

How to start a business in Mississippi in 8 steps 1) Think about the type of business you want to start. ... 2) Set up your legal structure. ... 3) Name and register your business. ... 4) Apply for business licenses and permits. ... 5) Choose a location. ... 6) Open a bank account and prepare for future taxes. ... 7) Purchase business insurance.

Businesses operated from the home of an individual must obtain a Home Occupation Permit from the Zoning Division. A Home Occupation Permit offers services to the public but has numerous restrictions: No retail trade and no stock on the premises. No increase in traffic to and from the dwelling.