Mississippi Release of Lien for Property

Description

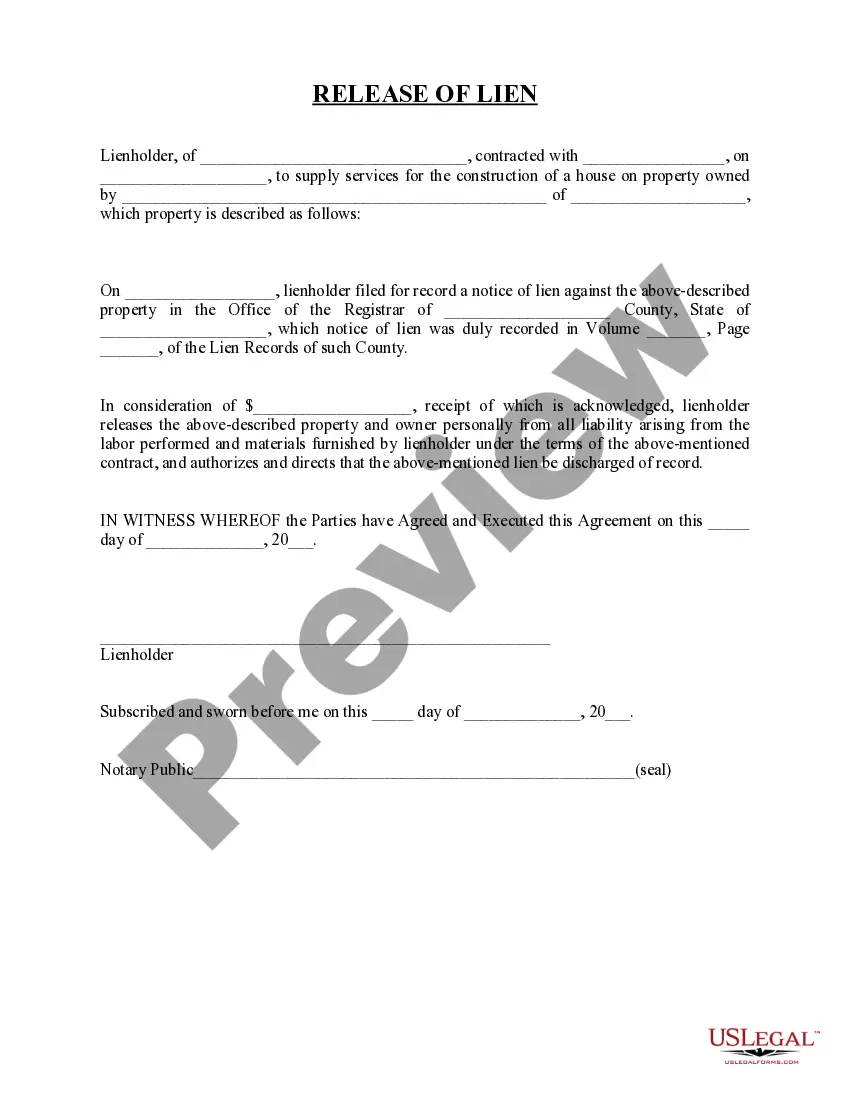

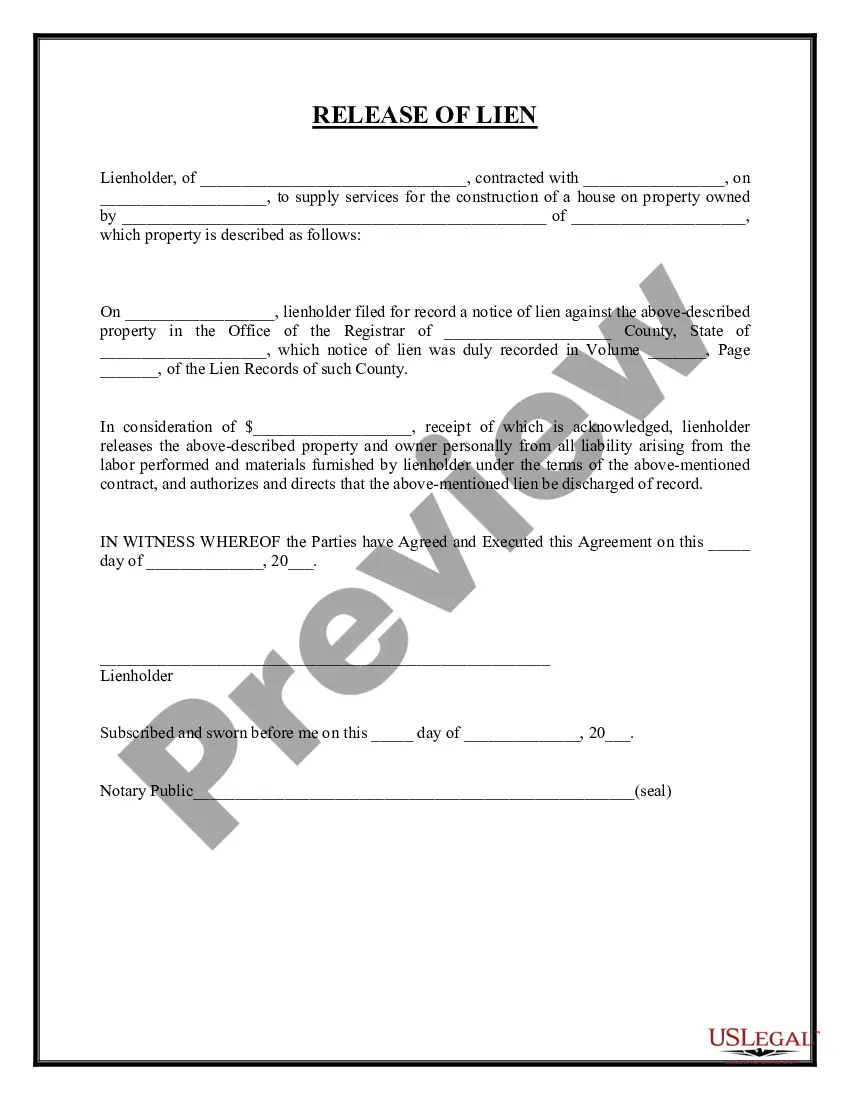

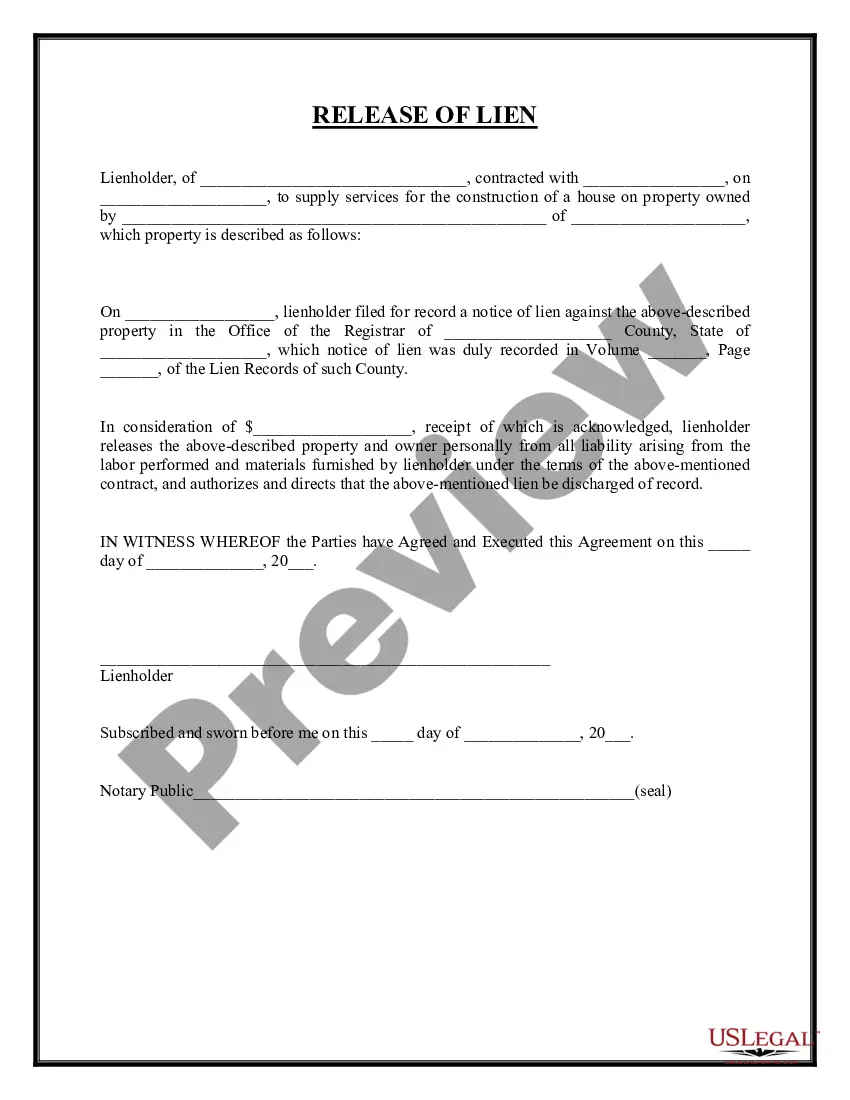

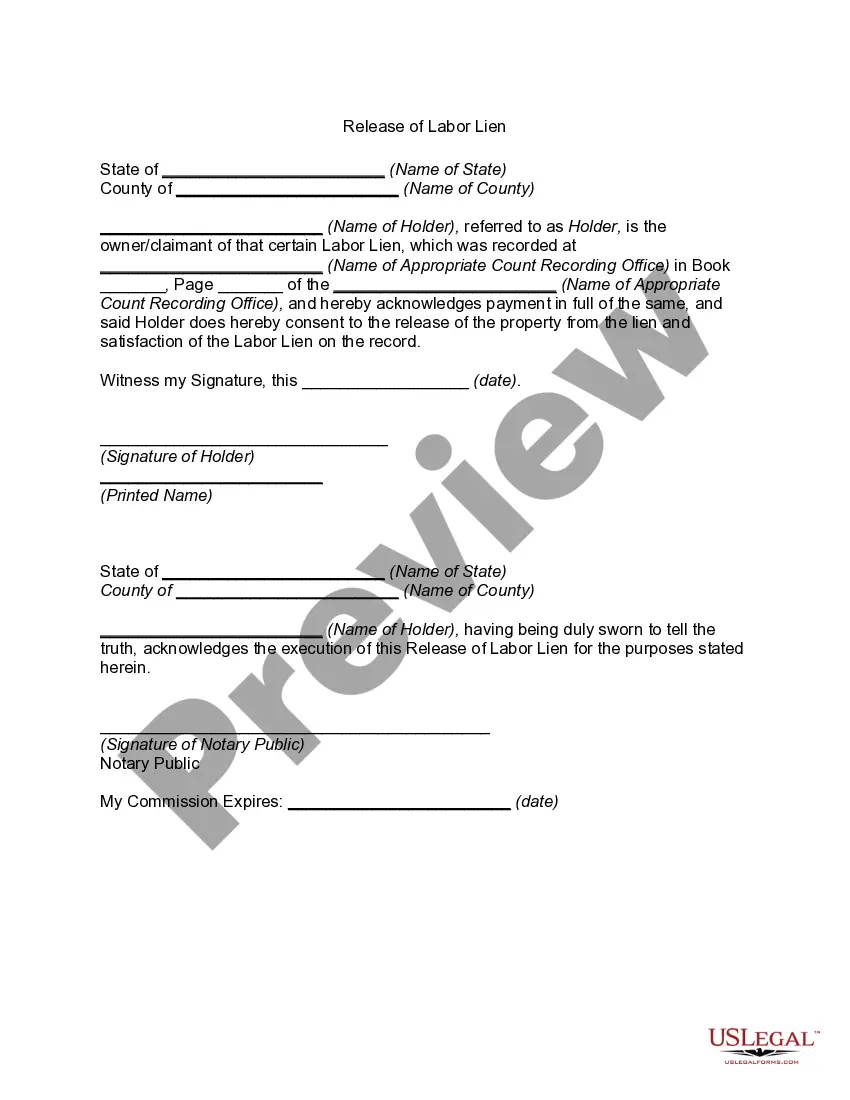

How to fill out Release Of Lien For Property?

Are you within a position where you need documents for either company or specific reasons virtually every day? There are tons of legitimate papers themes accessible on the Internet, but locating ones you can rely on is not simple. US Legal Forms delivers a large number of form themes, just like the Mississippi Release of Lien for Property, that are created to meet state and federal requirements.

When you are already familiar with US Legal Forms site and possess a free account, merely log in. Afterward, you may down load the Mississippi Release of Lien for Property web template.

Should you not come with an bank account and need to begin to use US Legal Forms, follow these steps:

- Get the form you want and ensure it is for that appropriate area/region.

- Utilize the Preview key to analyze the form.

- See the information to actually have selected the right form.

- In case the form is not what you`re looking for, use the Lookup discipline to get the form that meets your needs and requirements.

- Once you obtain the appropriate form, just click Buy now.

- Select the costs program you would like, fill out the desired information and facts to create your bank account, and pay money for an order making use of your PayPal or bank card.

- Decide on a convenient document file format and down load your duplicate.

Find all the papers themes you might have bought in the My Forms food list. You can aquire a additional duplicate of Mississippi Release of Lien for Property at any time, if needed. Just go through the needed form to down load or print out the papers web template.

Use US Legal Forms, one of the most comprehensive assortment of legitimate forms, to conserve time as well as steer clear of mistakes. The service delivers expertly produced legitimate papers themes which you can use for a selection of reasons. Create a free account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

A lien effectively makes the property collateral for the debt. All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. In Mississippi, the county treasurer can hold a tax sale to collect overdue property taxes.

When homeowners don't pay their property taxes, the overdue amount becomes a lien on the property. A lien effectively makes the property collateral for the debt.

How to File a Mississippi Mechanics Lien Prepare the lien document, taking care to include all the necessary information set forth above ? including the required statements. Sign the document. Deliver the lien must the office of the clerk of the chancery court of the county where the property is located.

In Mississippi, mechanic's liens rights are afforded to contractors, subcontractors and materialmen furnishing material for the improvement of real estate; as well as registered architects or professional engineers furnishing plans, drawings, designs, or other architectural or engineering services on or with respect to ...

If the owner of the property does not pay the taxes within 2 years from the purchase date the purchaser can acquire the property.

An additional penalty for late payment is charged 60 days after due date or when a warrant for collection is issued. The amount of this penalty is 10 percent of tax due. Total penalties generally will not exceed 20 percent for any calendar quarter.

A person must occupy the property for 10 years to be able to claim ownership by adverse possession. In addition, the person must pay taxes on the property for at least 2 years. In addition, Mississippi has a special type of public land title called 16th Section land that's held in trust for public education.

When are property taxes due? Taxes are due on or before February 1 for property assessed the preceding year. If February 1 falls on a weekend or legal holiday, taxes may be paid the following Monday without penalties or interest.