Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement

Description

How to fill out Resolutions Of Shareholders And Directors Approving Liquidating Trust Agreement?

You might allocate time online searching for the legal document template that satisfies the state and federal requirements you will necessitate.

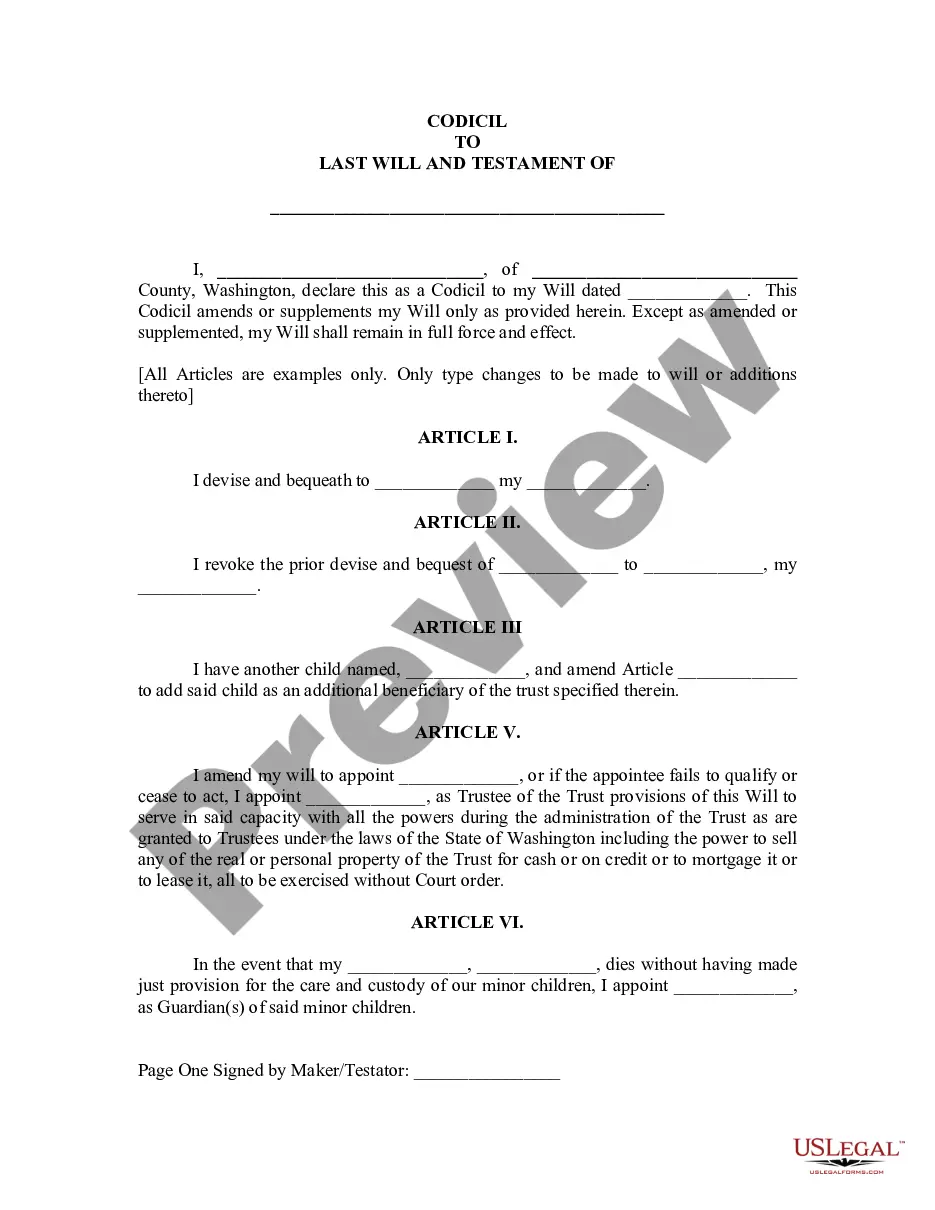

US Legal Forms offers an extensive selection of legal forms that are reviewed by experts.

You can download or print the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement from this service.

If available, use the Preview option to browse the document format as well. If you want to find another version of the form, use the Search field to locate the template that fulfills your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and click the Acquire option.

- After that, you can complete, modify, print, or sign the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

- Every legal document template you obtain is yours indefinitely.

- To obtain another copy of the purchased form, go to the My documents tab and select the appropriate option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the county/city of your choice.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

Filling out a board of directors resolution requires you to write down the name of your company, the date, and a detailed description of the resolution. Ensure all directors are aware of the resolution, and include spaces for signatures to validate it. When addressing the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, clear and complete information fosters transparency and legitimacy.

To fill out a corporate resolution form, start by entering the company’s name and the resolution date. Include the resolution's clear objectives and signatories from the board. When applying for the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, make sure to comply with the legal requirements and accurate documentation principles.

The board resolution format typically includes the company’s name, the date, and the title of the resolution. It details the resolution's intent and any specific actions to be taken. In the context of Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, a clear format helps maintain consistency and legal compliance.

A written resolution of the board of directors is a formal document that outlines decisions made by the board outside of a formal meeting. This format includes necessary information such as the date, title of the resolution, and the specific decision being made. Incorporating elements of the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can ensure compliance and proper governance.

To write a shareholder resolution, begin by clearly stating the purpose of the resolution. It should include the date, the name of the company, and the specific actions shareholders are approving. Ensure you detail any required information regarding the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement to provide context and clarity.

The shareholder resolution process begins with proposing a resolution that spells out the intended action. Shareholders must be informed about the resolution and convene to discuss it, followed by a vote. The Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can streamline this process by providing clear templates and guidelines, facilitating smoother communication and compliance among all parties involved.

The requirements for a shareholder resolution often include reviewing company bylaws, specifying the resolution's intent, and gathering proper votes from the shareholders. Additionally, notice must be provided to all shareholders about the meeting details and discussion points. By following the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, companies can ensure they fulfill all necessary legal requirements, enhancing overall trust among shareholders.

To pass a shareholders resolution, follow these steps: convene a meeting, ensure proper notice to shareholders, discuss the resolution openly, and conduct a vote. It's crucial to track votes meticulously and document the results. Using the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can aid in formalizing this process, providing essential documentation for transparency and accountability.

The percentage of shareholders required to pass a resolution can vary based on state laws and the company’s bylaws. In many cases, a simple majority, or more than 50%, suffices for general resolutions. However, for significant decisions like the Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, a higher threshold may be necessary, emphasizing the importance of understanding your specific circumstances.

To pass a resolution, a company must hold a meeting where shareholders can discuss and vote on the proposed action. The company typically provides all shareholders with adequate notice of the meeting, explaining the resolution's details. The Mississippi Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement simplifies this process by offering structured guidelines to ensure all legal requirements are met.