Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits

Description

How to fill out Affidavit Of Both Domestic Partners To Employer In Order To Receive Benefits?

Locating the appropriate legal documents template can be challenging.

Clearly, there are numerous designs available online, but how can you find the legal document you require.

Make use of the US Legal Forms website. The service provides a wide array of templates, including the Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, which you can utilize for both business and personal needs.

You can preview the form by clicking the Preview button and review the document outline to confirm it is the right fit for you.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to get the Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits.

- Use your account to browse the legal documents you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have picked the correct document for your region/area.

Form popularity

FAQ

If you live together but are not married, you will typically file as single on your taxes. However, you may still qualify for certain deductions or credits related to your domestic partnership. Utilizing a Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can further validate your relationship, allowing you to navigate potential tax benefits and employer-provided advantages more smoothly.

The filing status for domestic partners can vary based on state laws. While federal tax law treats domestic partners as single, Mississippi allows you to define your status through local documents, such as the Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. This affidavit can clarify your relationship for both tax purposes and any benefits you wish to receive from your employer.

Domestic partners generally do not file as single for federal tax purposes. Instead, both partners may need to review their specific state regulations to determine their filing status. In Mississippi, you may find it beneficial to provide a Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, which supports your partnership while filing taxes and establishes your eligibility for certain benefits.

Domestic partner relationship status refers to a legally recognized partnership between two individuals who live together and share a domestic life, similar to marriage. In many jurisdictions, including Mississippi, this status allows partners to receive benefits and rights typically granted to married couples. The Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits is essential for clarifying this status with your employer and ensuring access to associated perks.

To claim your domestic partner on your taxes, first, ensure that both of you meet the necessary criteria for a domestic partnership. Then, file your taxes using the correct forms, taking into account any applicable state regulations. In Mississippi, submitting a Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits can help further clarify your relationship status to the IRS, allowing you to access certain tax benefits associated with domestic partnerships.

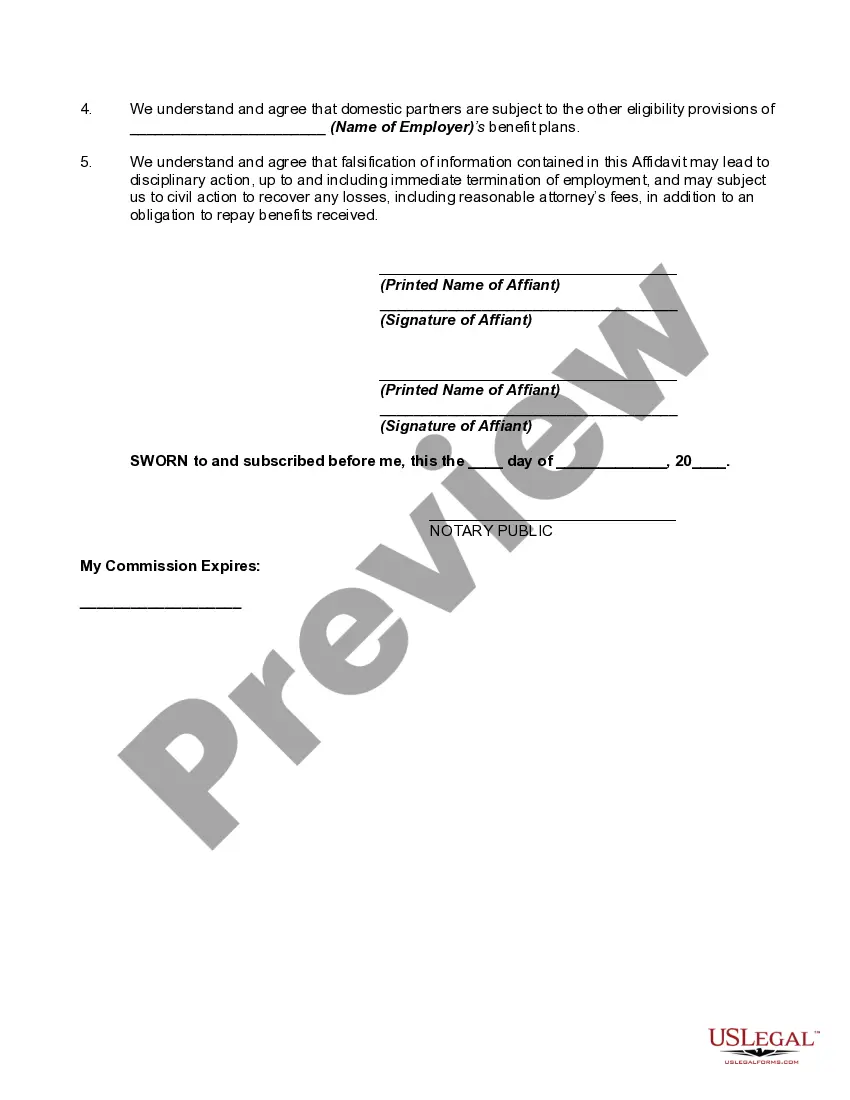

A domestic partner affidavit is a legal document that verifies the relationship between two individuals who live together and share a domestic life. In Mississippi, the Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits allows partners to access certain employee benefits typically reserved for spouses. This affidavit acts as a formal declaration for employers, ensuring that domestic partners can receive equitable treatment under employee benefit programs. If you need assistance creating this affidavit, uslegalforms provides tailored solutions to help you meet your legal documentation needs seamlessly.

An affidavit confirming that you meet the criteria of a domestic partnership is a legal document that states your relationship status. This document, often referred to as a Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits, outlines the essential elements of your partnership, such as shared living arrangements and mutual financial responsibilities. Employers or insurance providers may require this affidavit to grant benefits to partners, providing necessary validation of your relationship.

Mississippi does not officially recognize domestic partnerships or civil unions. However, some employers may still accept the Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits for health insurance purposes. Since this topic is complex, it's vital to research and understand how your situation aligns with your employer's policies. Consulting resources like uslegalforms can offer clarity on your options.

Domestic partnerships are recognized in several states across the U.S., but the laws can vary significantly. Some states provide full rights akin to marriage, while others may have limited recognition. It's important to check the laws in your state and refer to a Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits if you reside in Mississippi. Understanding the recognition in your area can help you navigate health insurance options effectively.

To prove your domestic partnership for health insurance, you will usually need to submit specific documentation, such as a Mississippi Affidavit of Both Domestic Partners to Employer in Order to Receive Benefits. This affidavit must affirm that you meet the criteria for a domestic partnership. Additionally, you might need to provide other evidence of your relationship, like joint bank statements or lease agreements, to support your claim.