A Mississippi Simple Promissory Note for Personal Loan is a legal document that outlines the terms and conditions of a loan between two individuals. This note serves as an agreement between the lender (the person providing the loan) and the borrower (the person receiving the loan) and establishes the loan amount, repayment terms, interest rate, and any other terms or conditions agreed upon by both parties. In Mississippi, there are various types of Simple Promissory Notes for Personal Loans that borrowers and lenders can utilize based on their specific needs. These types include: 1. Fixed Interest Rate Promissory Note: This type of promissory note establishes a set interest rate that remains constant throughout the loan term. Borrowers and lenders might agree upon a fixed rate to ensure stability and predictability in repayment. 2. Adjustable Interest Rate Promissory Note: Unlike the fixed interest rate promissory note, this type allows the interest rate to fluctuate based on a predetermined index or market conditions. The interest rate adjustment is typically made at specified intervals, providing flexibility to borrowers and lenders. 3. Secured Promissory Note: In a secured promissory note, the borrower pledges collateral (such as real estate, vehicle, or other valuable assets) to secure the loan. This provides lenders with an added level of security, reducing their risk if the borrower defaults on the loan. 4. Unsecured Promissory Note: Contrary to a secured promissory note, this type does not require any collateral. Lenders may consider factors such as creditworthiness, income, and repayment history when deciding to approve an unsecured personal loan. 5. Installment Promissory Note: This type of promissory note allows borrowers to repay the loan amount and interest in equal installments over a specified period. Installment loans commonly have monthly, quarterly, or annual repayment plans. 6. Demand Promissory Note: As the name suggests, a demand promissory note is payable upon the lender's request. This type does not have a specific repayment schedule but grants the lender the authority to request payment from the borrower at any time. It is crucial for both parties involved in a loan agreement to carefully draft and review the promissory note to ensure that all terms and conditions are accurately reflected and agreed upon. Seeking legal advice or utilizing standardized promissory note templates specific to Mississippi can help ensure the note is legally binding and protects the rights and obligations of both the borrower and the lender.

Mississippi Simple Promissory Note for Personal Loan

Description

How to fill out Mississippi Simple Promissory Note For Personal Loan?

You can invest time on-line searching for the lawful papers design that suits the federal and state specifications you will need. US Legal Forms gives a large number of lawful forms that are evaluated by experts. You can actually download or print out the Mississippi Simple Promissory Note for Personal Loan from my support.

If you already possess a US Legal Forms profile, you are able to log in and then click the Down load option. Following that, you are able to full, modify, print out, or indication the Mississippi Simple Promissory Note for Personal Loan. Each lawful papers design you purchase is your own property forever. To acquire an additional version for any purchased develop, visit the My Forms tab and then click the related option.

If you are using the US Legal Forms site the very first time, follow the simple recommendations listed below:

- Initially, make certain you have selected the proper papers design for that area/town of your choosing. See the develop description to ensure you have chosen the proper develop. If readily available, utilize the Review option to appear from the papers design at the same time.

- If you wish to locate an additional variation from the develop, utilize the Research field to get the design that suits you and specifications.

- Once you have discovered the design you want, just click Buy now to move forward.

- Find the rates plan you want, type your qualifications, and register for your account on US Legal Forms.

- Complete the financial transaction. You can utilize your Visa or Mastercard or PayPal profile to pay for the lawful develop.

- Find the structure from the papers and download it for your system.

- Make adjustments for your papers if required. You can full, modify and indication and print out Mississippi Simple Promissory Note for Personal Loan.

Down load and print out a large number of papers themes utilizing the US Legal Forms site, that provides the largest variety of lawful forms. Use specialist and state-certain themes to take on your company or person needs.

Form popularity

FAQ

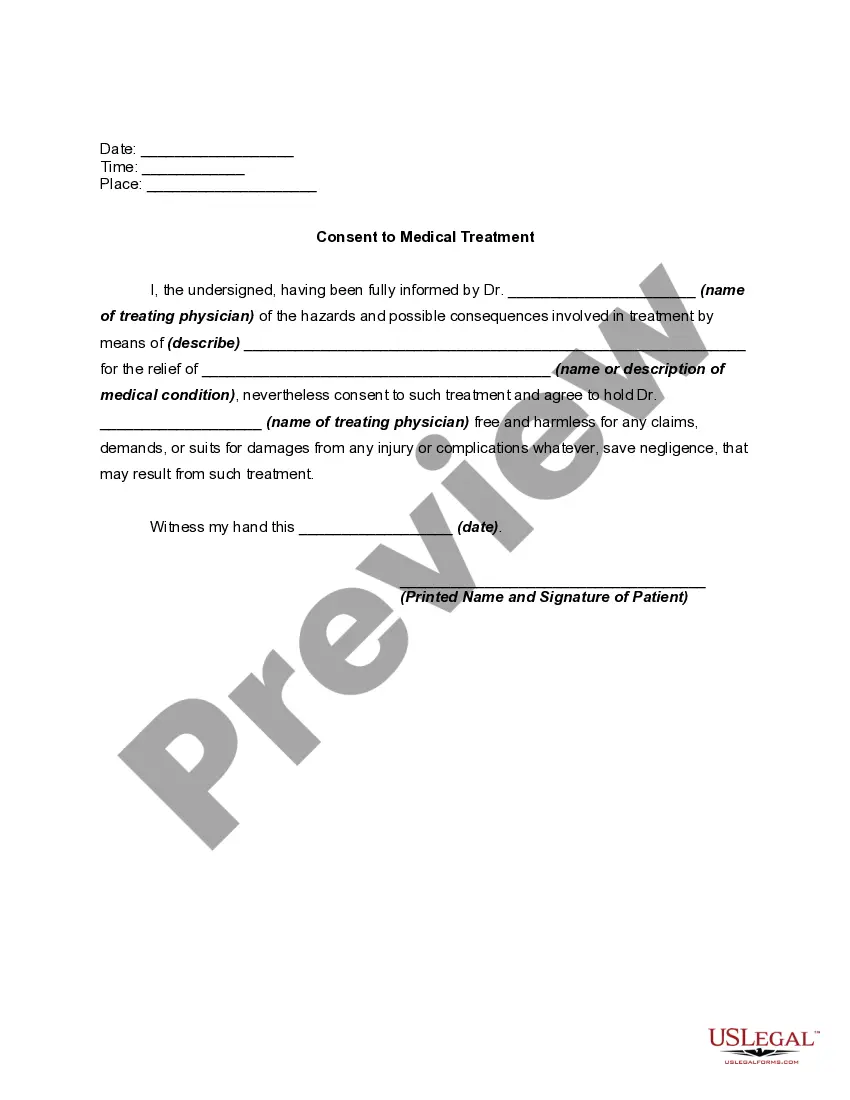

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Promissory notes do not bind the lender. As alluded to above, although both documents bind the borrower, only loan agreements also "bind" the lender. That's because the lender also signs a loan agreement, but does not sign a promissory note.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

More info

Borrower hereby agrees to furnish to BORROWER and LENDER credit reports on all current financial transactions, including but not limited to mortgages on real property owned by BORROWER, on which BORROWER has paid BORROWER and LENDER in full on the dates listed in the LOAN. LENDER reserves the right to require BORROWER or any other person that is required to be notified by BORROWER to sign any document in connection with the Borrower's borrowing under this LOAN, but such signature alone shall not be legally binding on BORROWER.