Mississippi Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

You might spend numerous hours online attempting to locate the official document template that meets the federal and state requirements you have. US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can download or print the Mississippi Promissory Note in Relation to a Sale and Purchase of a Mobile Home from the service.

If you already possess a US Legal Forms account, you can Log In and click the Download button. After that, you can complete, modify, print, or sign the Mississippi Promissory Note in Relation to a Sale and Purchase of a Mobile Home. Each legal document template you purchase is yours permanently. To receive another copy of the purchased form, visit the My documents tab and click the corresponding button.

Select the file format of the document and download it to your system. Make alterations to the document if necessary. You can complete, modify, and sign and print the Mississippi Promissory Note in Relation to a Sale and Purchase of a Mobile Home. Download and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/city of choice. Review the form description to confirm you have the right form.

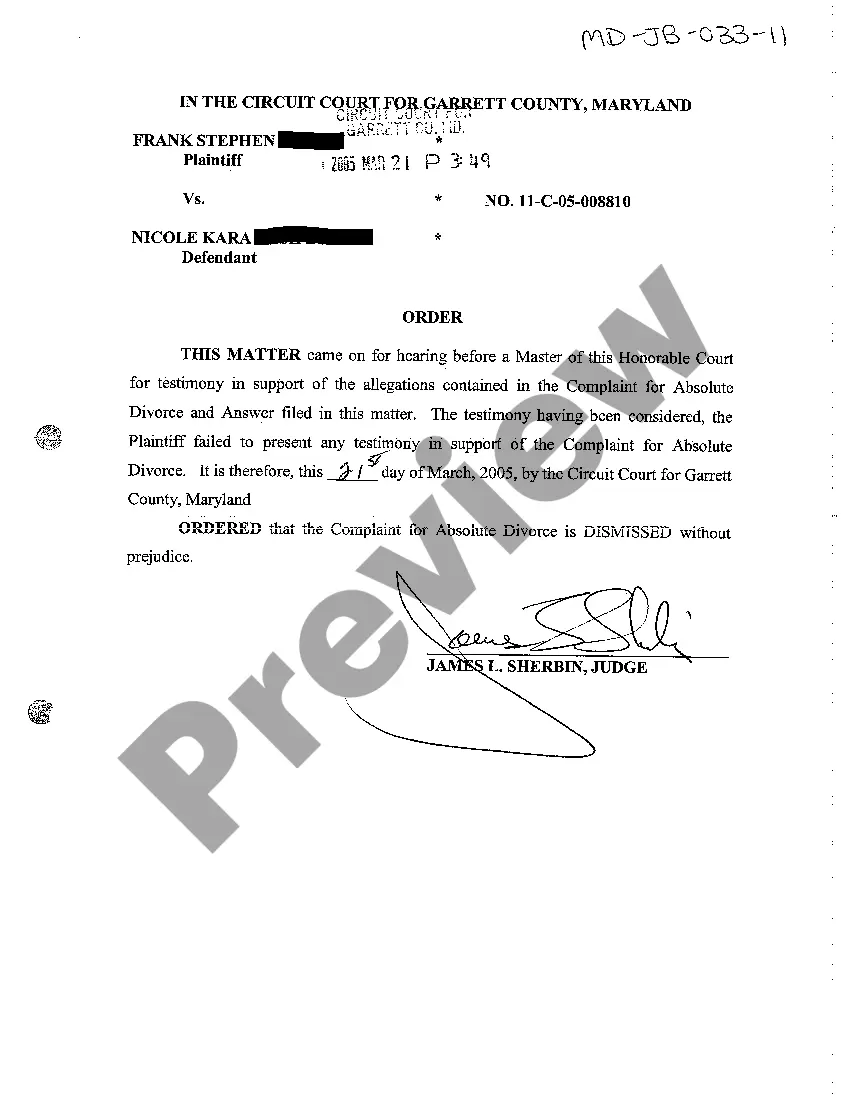

- If available, use the Preview button to view the document template simultaneously.

- If you wish to discover another version of the form, use the Search field to find the template that meets your needs and requirements.

- Once you have identified the template you want, click Acquire now to proceed.

- Select the pricing plan you desire, enter your credentials, and register for a free account on US Legal Forms.

- Complete the purchase. You can use your Visa or Mastercard or PayPal account to pay for the legal form.

Form popularity

FAQ

You can absolutely write your own promissory note. It is important to ensure that the document includes all relevant details such as the principal amount, interest rate, payment terms, and signatures. If you're unsure how to proceed, utilizing platforms like USLegalForms can provide valuable templates and guidance to help you craft an effective promissory note.

To obtain a copy of your promissory note for your mortgage, you should contact your mortgage lender or servicer. They typically keep records of all mortgage documents, including the promissory note. If you need assistance in this process, consider using resources available on USLegalForms, which can guide you through documentation and retrieval.

A Mississippi Promissory Note itself does not create a lien; however, it can be associated with a lien through a separate document. By creating a mortgage or deed of trust, the lender secures the note against the property. This lien gives the lender the right to claim ownership of the property if the borrower fails to meet obligations. In this way, the promissory note and lien work together to protect the lender's interests.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Unlike a promissory note, a loan agreement imposes obligations on both parties, which is why both the borrower and lender must sign the agreement. A loan agreement should state what purpose the loan is used for, and whether the borrower must provide compensation if the lender suffers loss.

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.