The Mississippi Cash Receipts Control Log is an essential tool used by businesses and organizations to maintain accurate and comprehensive records of all cash transactions. It serves as a control measure to ensure the proper handling and tracking of cash received. The primary purpose of the Mississippi Cash Receipts Control Log is to provide a systematic approach to monitor the inflow of cash. It assists in identifying any discrepancies or irregularities in cash receipts, enabling organizations to detect and prevent potential theft or fraud. The log contains a detailed and organized record of each cash transaction, including the date, time, source, amount, and purpose of the received cash. These fields help businesses track the origin of cash, whether it is from sales, donations, or other sources. Additionally, it allows for easy reconciliation with the corresponding bank deposits. By keeping a precise log of cash receipts, businesses can also ensure compliance with accounting standards, tax regulations, and auditing requirements. It helps in identifying any overages or shortages in cash and enables management to take appropriate corrective measures promptly. There are no known different types of Mississippi Cash Receipts Control Logs, as it primarily refers to a standard control log utilized by businesses and organizations throughout the state. However, each organization might customize the log to fit their specific needs and requirements. Using keywords relevant to the Mississippi Cash Receipts Control Log, some essential terms to include are "cash receipts," "control measure," "accurate records," "tracking cash," "discrepancies," "theft prevention," "fraud detection," "date and time," "source of cash," "bank deposits," "compliance," "accounting standards," "tax regulations," "auditing requirements," "overages," "shortages," and "customization."

Mississippi Cash Receipts Control Log

Description

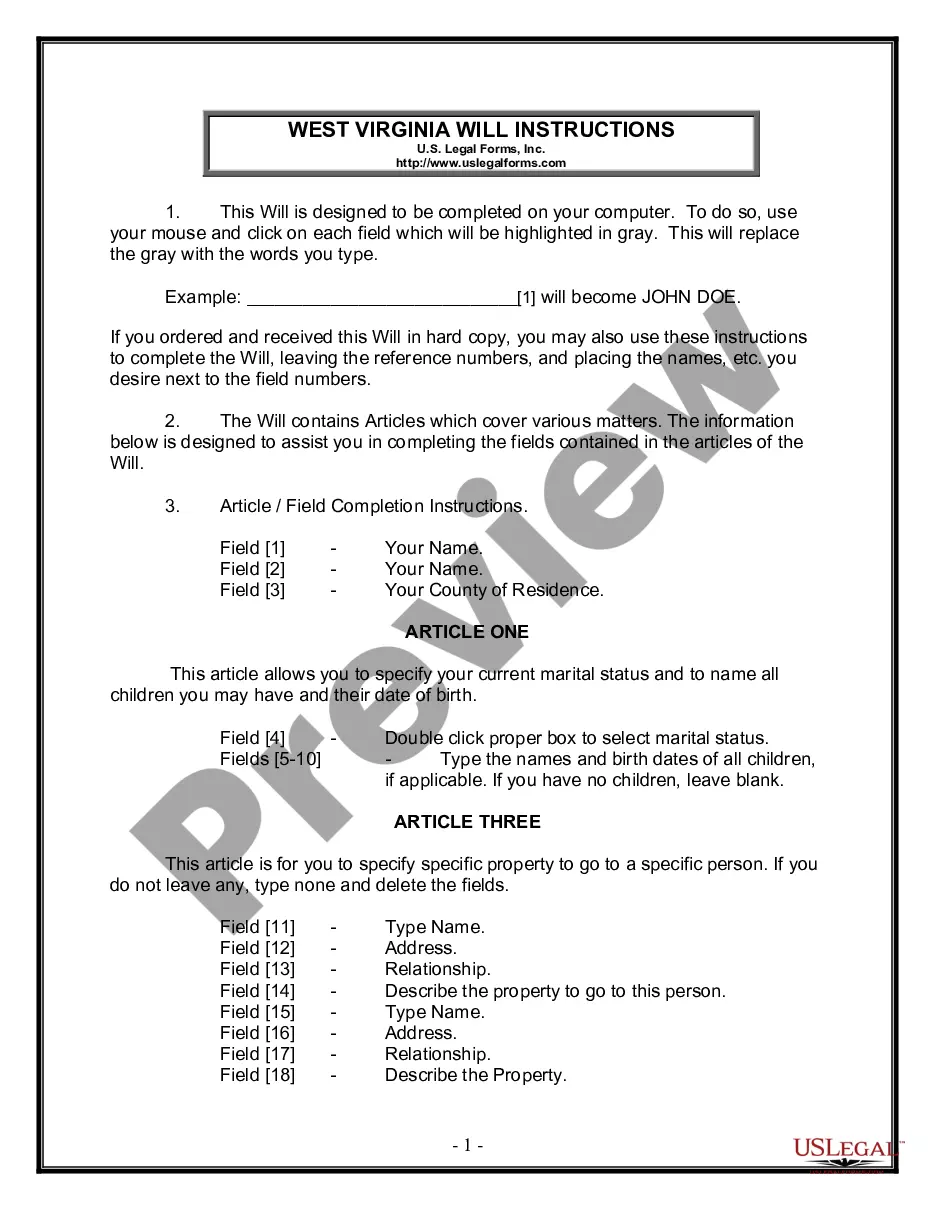

How to fill out Mississippi Cash Receipts Control Log?

US Legal Forms - among the largest libraries of legitimate kinds in the USA - delivers an array of legitimate file web templates you may download or print out. While using internet site, you can find a large number of kinds for enterprise and personal purposes, sorted by categories, claims, or search phrases.You will discover the latest variations of kinds just like the Mississippi Cash Receipts Control Log in seconds.

If you currently have a membership, log in and download Mississippi Cash Receipts Control Log from the US Legal Forms local library. The Download switch can look on each form you see. You get access to all formerly acquired kinds inside the My Forms tab of your respective account.

If you want to use US Legal Forms initially, allow me to share easy recommendations to help you get began:

- Be sure to have chosen the proper form to your city/region. Click on the Preview switch to analyze the form`s articles. Read the form explanation to ensure that you have selected the correct form.

- When the form does not satisfy your specifications, use the Research discipline at the top of the display to obtain the one which does.

- When you are happy with the shape, validate your option by clicking on the Get now switch. Then, opt for the rates plan you like and offer your credentials to register on an account.

- Process the purchase. Make use of credit card or PayPal account to accomplish the purchase.

- Pick the format and download the shape on your system.

- Make changes. Load, edit and print out and indicator the acquired Mississippi Cash Receipts Control Log.

Every single web template you put into your bank account lacks an expiry date and is also your own property permanently. So, if you wish to download or print out an additional duplicate, just check out the My Forms section and click on on the form you need.

Obtain access to the Mississippi Cash Receipts Control Log with US Legal Forms, one of the most considerable local library of legitimate file web templates. Use a large number of professional and state-certain web templates that fulfill your organization or personal requirements and specifications.

Form popularity

FAQ

The procedure for check receipts processing is outlined below.Record Checks and Cash. When the daily mail delivery arrives, record all received checks and cash on the mailroom check receipts list.Forward Payments.Apply Cash to Invoices.Record Other Cash (Optional)Deposit Cash.Match to Bank Receipt.

Record Checks and Cash For each check received, state on the form the name of the paying party, the check number and the amount paid. If the receipt was in cash, then state the name of the paying party, check the cash? box, and the amount paid.

Objective. The objective of cash receipt controls is to ensure that all monies (checks, currency, coin, and credit cards) are properly accounted for and timely deposited.

The most effective way to protect cash at both receipt and disbursement is to have both written protocol on cash handling and separation of duties. Separation of duties means to separate one big job into several smaller jobs, with a different individual performing each.

Your cash receipts journal should have a chronological record of your cash transactions. Using your sales receipts, record each cash transaction in your cash receipts journal. Do not record the sales tax you collected in the cash receipts journal. You must record this in the sales journal instead.

Record any cash payments as a debit in your cash receipts journal like usual. Then, debit the customer's accounts receivable account for any purchase made on credit. In your sales journal, record the total credit entry.

Internal control mechanisms the auditor should check for include documents that establish accountability for the reception of cash and completion of bank deposits, an accurate daily cash summary and deposit slip, requiring daily journal entries that post the amount received to customer accounts and appropriate

Best practices:Record cash receipts when received.Keep funds secured.Document transfers.Give receipts to each customer.Don't share passwords.Give each cashier a separate cash drawer.Supervisors verify cash deposits.Supervisors approve all voided refunded transactions.

In the cash receipts process, the 1) Payment Receipts, 2) Bank Deposit, and 3) Recording roles should be segregated to ensure funds are not intercepted between receipt and deposit of cash and checks payments. When possible, someone other than the Treasurer should receive and document all cash and check receipts.