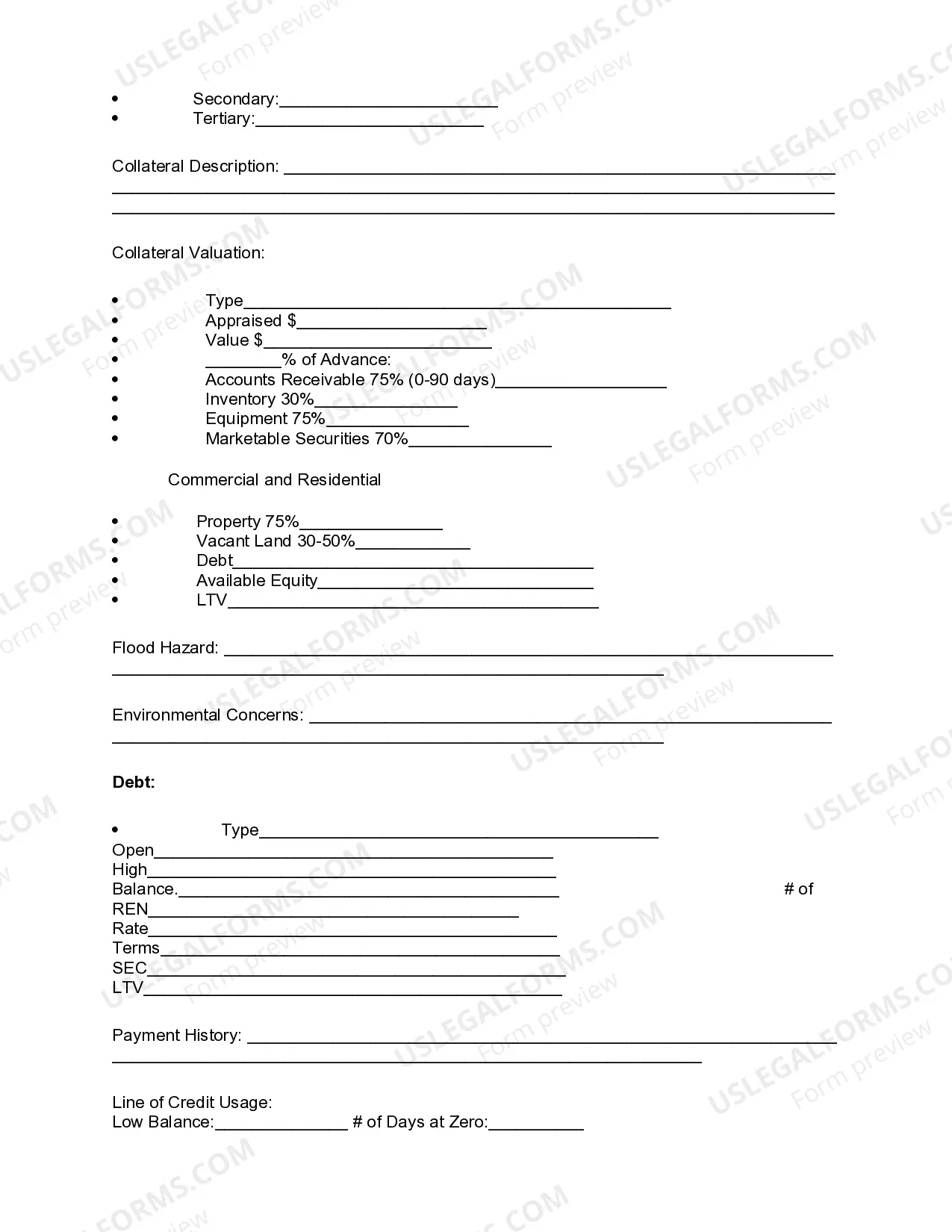

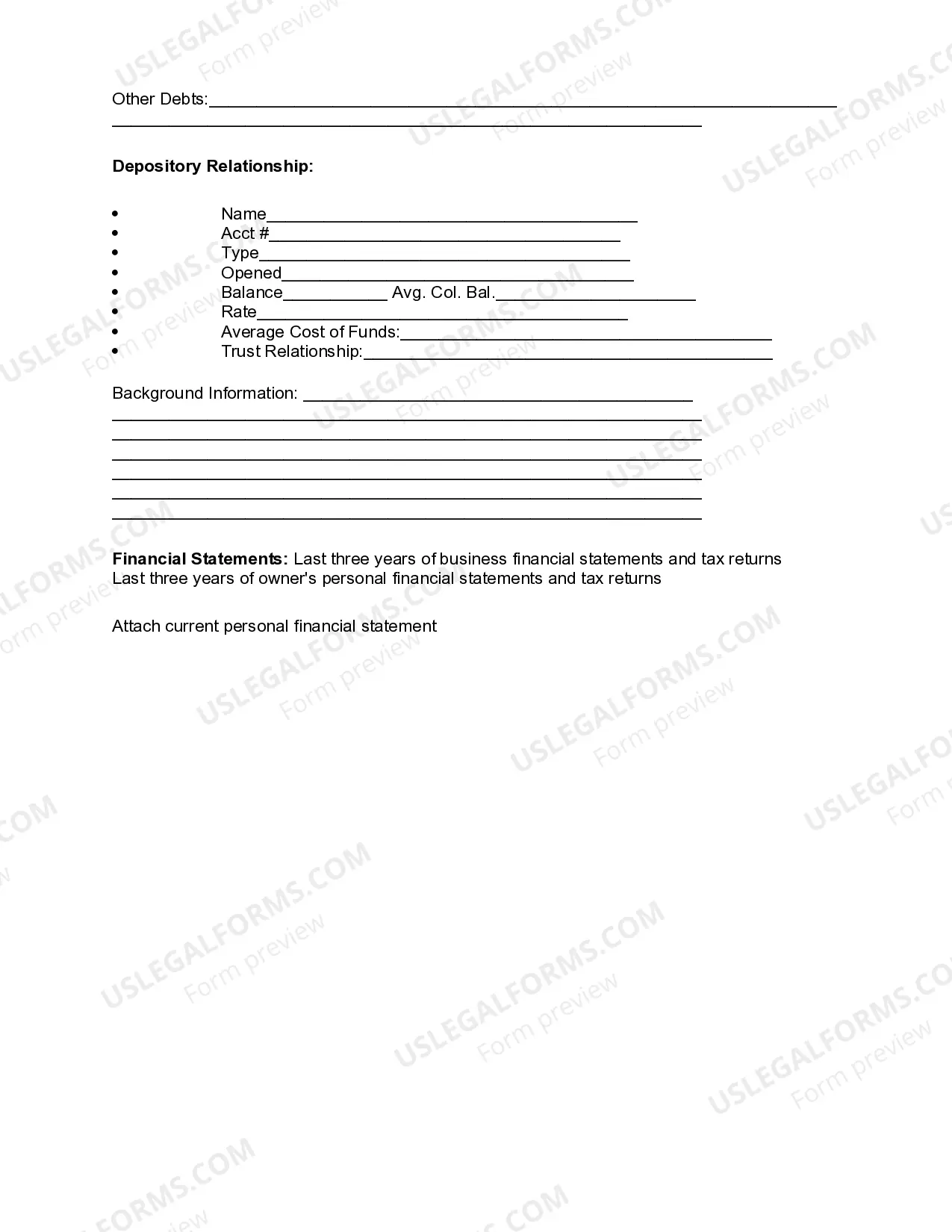

Mississippi Review of Loan Application

Description

How to fill out Review Of Loan Application?

Discovering the right legitimate papers design can be quite a struggle. Obviously, there are a lot of web templates available on the net, but how would you find the legitimate develop you will need? Take advantage of the US Legal Forms web site. The assistance gives a large number of web templates, for example the Mississippi Review of Loan Application, which can be used for enterprise and personal demands. Every one of the kinds are checked out by experts and meet federal and state needs.

In case you are currently registered, log in to your bank account and then click the Down load option to have the Mississippi Review of Loan Application. Utilize your bank account to check from the legitimate kinds you possess ordered in the past. Visit the My Forms tab of your respective bank account and acquire another backup in the papers you will need.

In case you are a brand new user of US Legal Forms, listed below are easy guidelines for you to comply with:

- First, ensure you have selected the proper develop for your personal area/state. It is possible to check out the form utilizing the Review option and look at the form explanation to make sure this is the best for you.

- In the event the develop fails to meet your needs, make use of the Seach discipline to obtain the proper develop.

- Once you are certain the form is suitable, click on the Get now option to have the develop.

- Pick the costs prepare you want and enter in the essential info. Build your bank account and pay for your order using your PayPal bank account or Visa or Mastercard.

- Opt for the data file formatting and down load the legitimate papers design to your device.

- Complete, change and print out and signal the obtained Mississippi Review of Loan Application.

US Legal Forms will be the biggest local library of legitimate kinds that you can find numerous papers web templates. Take advantage of the company to down load skillfully-manufactured documents that comply with state needs.

Form popularity

FAQ

A loan review analyst examines credit data and financial statements to assess the risk of individual loans. As a loan review analyst, you may work with commercial, real estate, business, or agriculture loans.

Your income and employment history are good indicators of your ability to repay outstanding debt. Income amount, stability, and type of income may all be considered. The ratio of your current and any new debt as compared to your before-tax income, known as debt-to-income ratio (DTI), may be evaluated.

By understanding the different types of loans available, reviewing the loan terms and conditions, and working with a financial advisor, you can ensure that you're getting the best loan for your needs. Remember to review your credit report and prepare the necessary documents before applying for a loan.

Collecting Documentation And Underwriting: A Few Days To A Few Weeks. Once the details of your loan and application have been prepared, an underwriter will look over every aspect of your file and verify that you qualify for the loan and that the lender isn't taking on too much risk by lending to you.

A loan review provides an assessment of the overall quality of a loan portfolio. Specifically, a loan review: ? Assesses individual loans, including repayment risks.

Getting approved for a personal loan generally takes anywhere from one day to one week. As we mentioned above, how long it takes for a personal loan to go through depends on several factors, like your credit score. However, one of the primary factors that will affect your approval time is where you get your loan from.

Typically, a loan review is conducted on commercial loan files, either internally by bank or credit union staff, or by hired third-party auditors. These investigators check for completeness of loan documentation and/or evaluate loan performance.

Assessing Client's Financial needs and goals. Author has 89 answers and 18.2K answer views Apr 13. When a loan application is under review or pending approval from a lender, it means that the lender is evaluating the borrower's creditworthiness and financial situation to determine whether they are eligible for a loan.