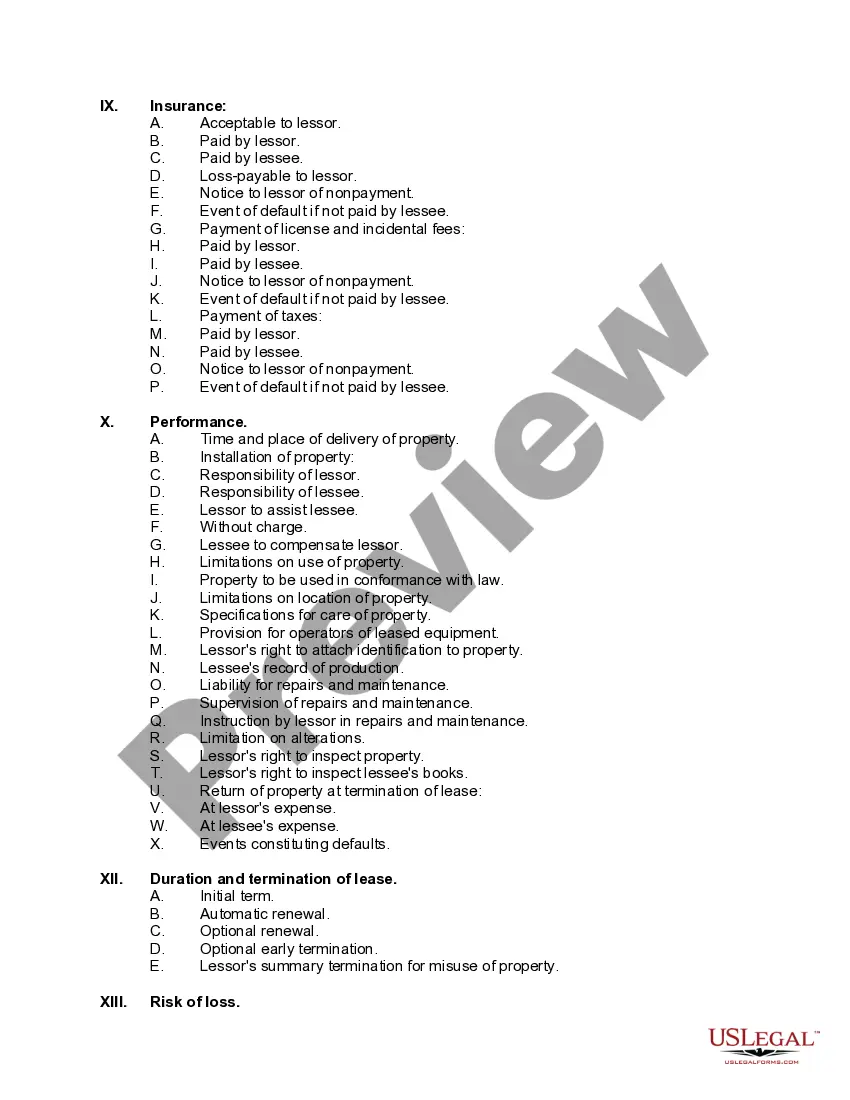

Mississippi Equipment Lease Checklist

Description

How to fill out Equipment Lease Checklist?

Locating the correct legal document template can be a significant challenge.

Of course, there are numerous templates accessible online, but how can you find the legal form that you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Mississippi Equipment Lease Checklist, which can be utilized for both business and personal purposes.

You can review the form using the Preview button and examine the form summary to ensure it is suitable for you.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to acquire the Mississippi Equipment Lease Checklist.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents tab in your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are straightforward steps you should follow.

- First, ensure that you have selected the correct form for your city/state.

Form popularity

FAQ

You can technically write a lease to yourself, but it is generally considered unnecessary. However, if you want to clarify terms for subleasing or documenting the rental of a property owned by you, ensure you follow relevant laws. The Mississippi Equipment Lease Checklist will assist you in structuring the lease correctly. USLegalForms provides thorough templates to guide you in establishing a clear agreement.

Writing your own lease is legal in most states, including Mississippi. However, it is crucial to ensure that your lease complies with local laws and includes all necessary provisions. Utilizing the Mississippi Equipment Lease Checklist can help you cover essential aspects of the lease. If you feel uncertain, consider using USLegalForms for ready-to-use templates that can simplify the process and ensure compliance.

Filling out a commercial lease agreement involves detailing key information about the property, rental terms, and rights of both parties. Start by breaking down the lease into clearly defined sections, following the guidance of the Mississippi Equipment Lease Checklist. This checklist helps you understand what to include, such as the lease duration, payment structure, and maintenance responsibilities. By adhering to these guidelines, you can create a robust rental agreement.

A handwritten lease agreement can be legally binding, provided it meets specific requirements of contract law. For a lease to be enforceable, it must clearly outline the terms and conditions agreed upon by both parties. The Mississippi Equipment Lease Checklist can guide you in drafting a comprehensive lease that aligns with legal standards. Always ensure both parties sign the document and keep a copy for reference.

Yes, you can create your own lease agreement template. However, to ensure that it complies with state laws and covers all necessary terms, refer to the Mississippi Equipment Lease Checklist. This checklist provides essential elements to include, making your template effective and legally sound. To streamline the process, consider using platforms like USLegalForms, which offer customizable templates tailored to your needs.

Recording leased equipment requires you to evaluate the lease type to determine if it is capital or operating. As outlined in the Mississippi Equipment Lease Checklist, for capital leases, record the equipment as an asset and the lease obligation as a liability. Maintaining meticulous records of these transactions can support your financial integrity and compliance efforts.

Finding lease documents can be streamlined by using online platforms like USLegalForms. These types of resources often offer templates and checklists tailored to your needs, including the Mississippi Equipment Lease Checklist. By searching through these platforms, you can gain access to accurate and compliant lease documents efficiently.

Accounting for leased assets involves understanding the lease's classification, either capital or operating. As per the Mississippi Equipment Lease Checklist, you account for capital leases by recording the asset and liability on your balance sheet. For operating leases, you'll generally record lease payments as an expense without adding the asset to your balance sheet.

The journal entry for a lease involves debiting the leased equipment account and crediting the lease liability account. This process is expressly detailed in the Mississippi Equipment Lease Checklist, which serves as a vital tool for understanding accounting entries for different leases. Maintaining accurate records ensures compliance and clarity in your financial reporting.

To record leased equipment in accounting, you should follow the guidelines outlined in the Mississippi Equipment Lease Checklist. Start by determining the type of lease—capital or operating. For a capital lease, you would recognize the asset and corresponding liability on your balance sheet at the present value of the lease payments.