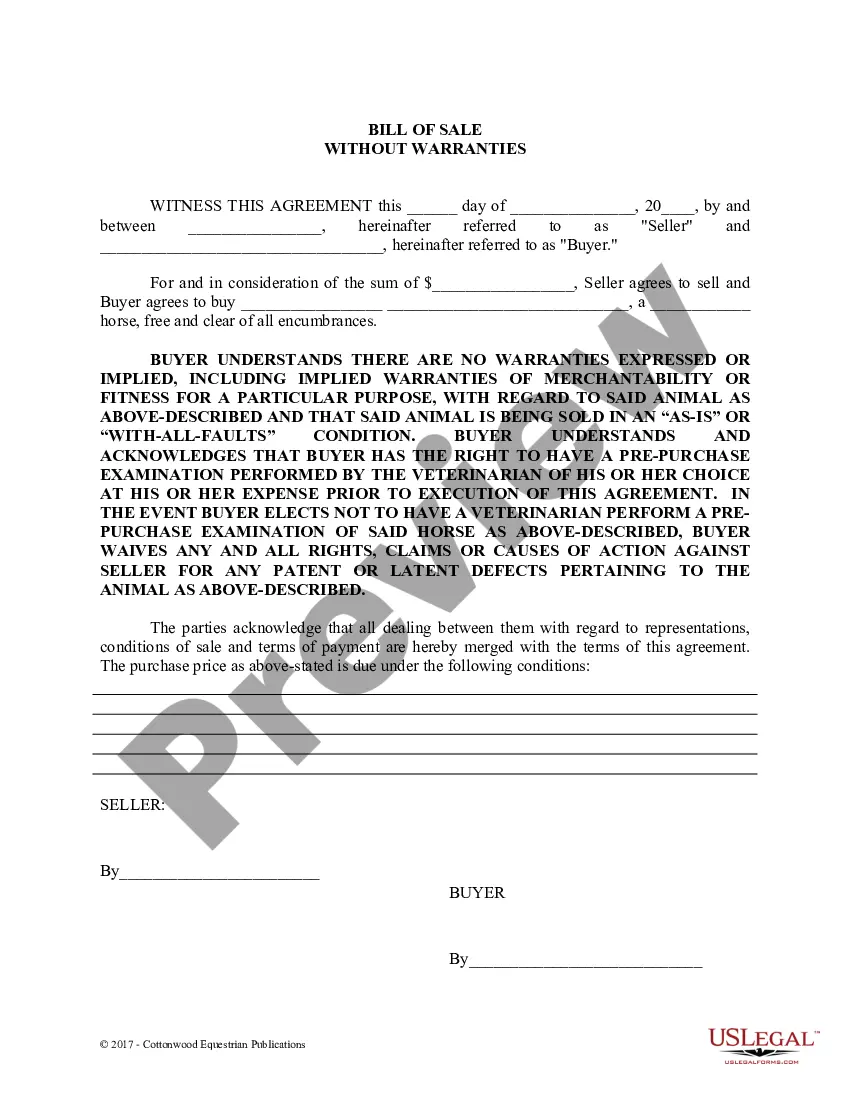

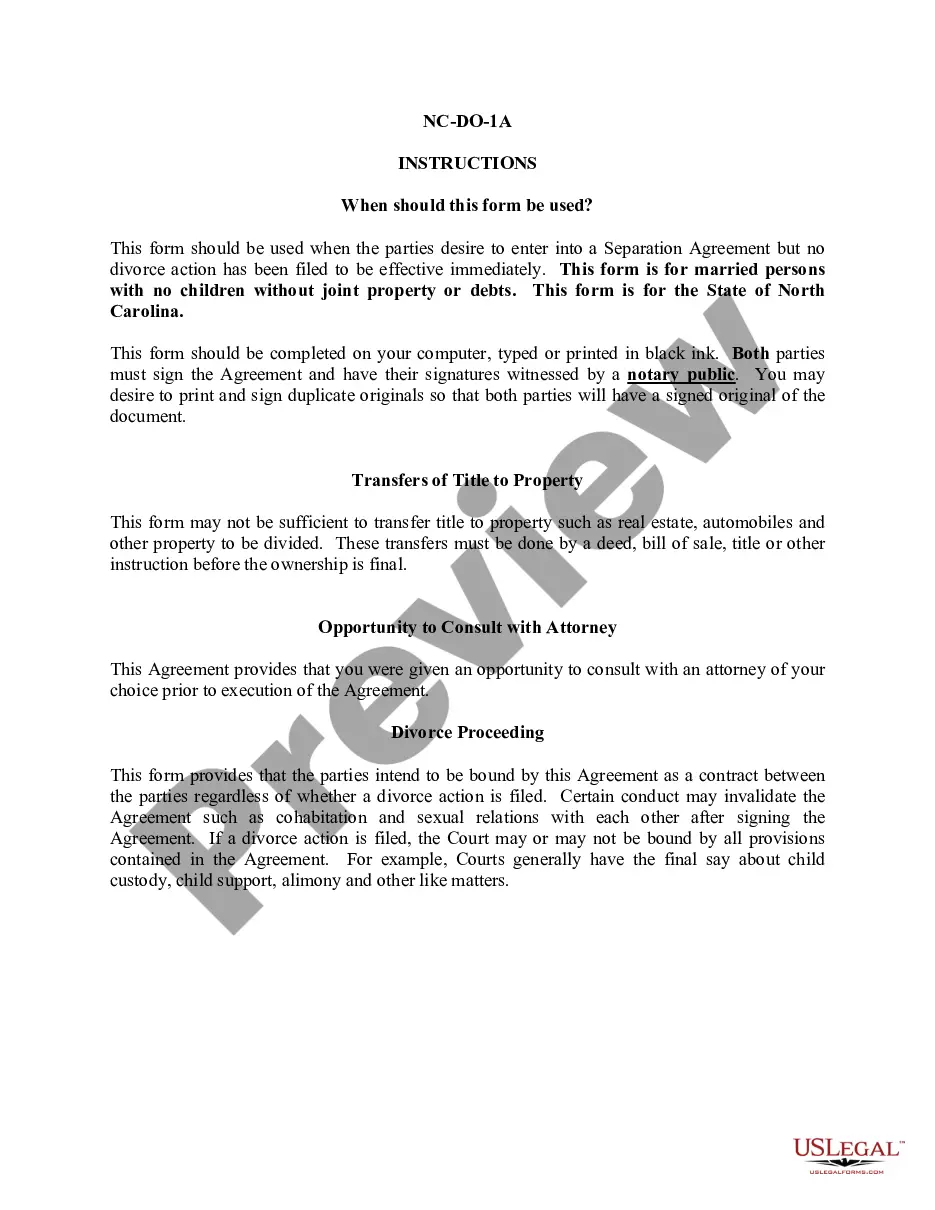

A Mississippi Mortgage Note is a legal document that serves as evidence of a loan secured by real estate in the state of Mississippi. It establishes the borrower's legal obligation to repay the loan amount to the lender and outlines the specific terms and conditions of the mortgage. Keywords: Mississippi Mortgage Note, loan, secured, real estate, legal document, borrower, lender, terms, conditions, repay. There are different types of Mississippi Mortgage Notes, each catering to specific needs and circumstances. Some common types include: 1. Fixed-Rate Mortgage Note: This type of mortgage note defines a fixed interest rate that remains constant throughout the loan term. Borrowers have the advantage of knowing exactly how much they need to pay each month, making budgeting easier. 2. Adjustable-Rate Mortgage Note: Unlike fixed-rate notes, an adjustable-rate mortgage note has an interest rate that fluctuates periodically based on market conditions. The note specifies the index and margin used for rate adjustment, indicating when and how the interest rate will change. 3. Balloon Mortgage Note: A balloon mortgage note features lower monthly payments initially, but a large lump sum payment (balloon payment) becomes due at the end of a fixed period, typically 5 to 7 years. Borrowers must either make the lump sum payment or refinance the loan to avoid defaulting. 4. Interest-Only Mortgage Note: In an interest-only mortgage note, borrowers have the option to pay only the interest on the loan for a specific period, typically 5 to 10 years. After this period, the borrower must start repaying both the principal and interest, resulting in higher monthly payments. 5. Reverse Mortgage Note: A reverse mortgage note is a unique type of loan available to homeowners aged 62 and older. Instead of the borrower making regular mortgage payments, the lender provides funds to the borrower in the form of monthly payments or a line of credit, using the home equity as collateral. 6. Graduated Payment Mortgage Note: This type of mortgage note starts with lower monthly payments that gradually increase over time. This structure is suitable for borrowers who expect their income to increase steadily in the coming years. These different types of Mississippi Mortgage Notes provide flexibility and options for borrowers based on their financial goals and situations. It is essential for both lenders and borrowers to carefully review the terms and conditions of the mortgage note before entering into any agreement.

Mississippi Mortgage Note

Description

How to fill out Mississippi Mortgage Note?

It is possible to commit hrs online attempting to find the legal record template that fits the federal and state specifications you want. US Legal Forms gives a huge number of legal types that are analyzed by pros. It is possible to download or printing the Mississippi Mortgage Note from the services.

If you already have a US Legal Forms profile, you can log in and click on the Acquire key. Next, you can total, edit, printing, or sign the Mississippi Mortgage Note. Each and every legal record template you purchase is the one you have eternally. To obtain one more duplicate of any bought type, check out the My Forms tab and click on the corresponding key.

If you use the US Legal Forms website initially, stick to the straightforward instructions beneath:

- Initially, be sure that you have chosen the proper record template for the county/area of your choosing. Browse the type description to ensure you have picked the correct type. If readily available, use the Preview key to appear from the record template at the same time.

- If you wish to discover one more edition of the type, use the Search field to find the template that meets your needs and specifications.

- Once you have identified the template you desire, just click Buy now to carry on.

- Choose the costs plan you desire, type in your references, and register for an account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal profile to cover the legal type.

- Choose the structure of the record and download it for your device.

- Make alterations for your record if required. It is possible to total, edit and sign and printing Mississippi Mortgage Note.

Acquire and printing a huge number of record web templates making use of the US Legal Forms website, that offers the greatest assortment of legal types. Use specialist and express-certain web templates to handle your organization or person needs.

Form popularity

FAQ

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

To be legally enforceable, a promissory note must meet multiple legal conditions. Moreover, it must contain both an offer of agreement and an acceptance of agreement. All contracts state the type of services or goods rendered and indicate how much they cost.

Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable.

Because there are secured and unsecured loans, you can have a promissory note without a mortgage ? which is considered an unsecured loan. However, you typically can't have a mortgage without a promissory note, ing to Chase Bank. The promissory note is a crucial legal document to protect the lender.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

Promissory Note Vs. Mortgage. A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

Promissory note is supported by a consideration as recited in the negotiable instrument and the evidence adduced in support therefor, the burden is on the defendant to disprove that the promissory note is ... summarised as follows:??Negotiable Instruments Act, S.

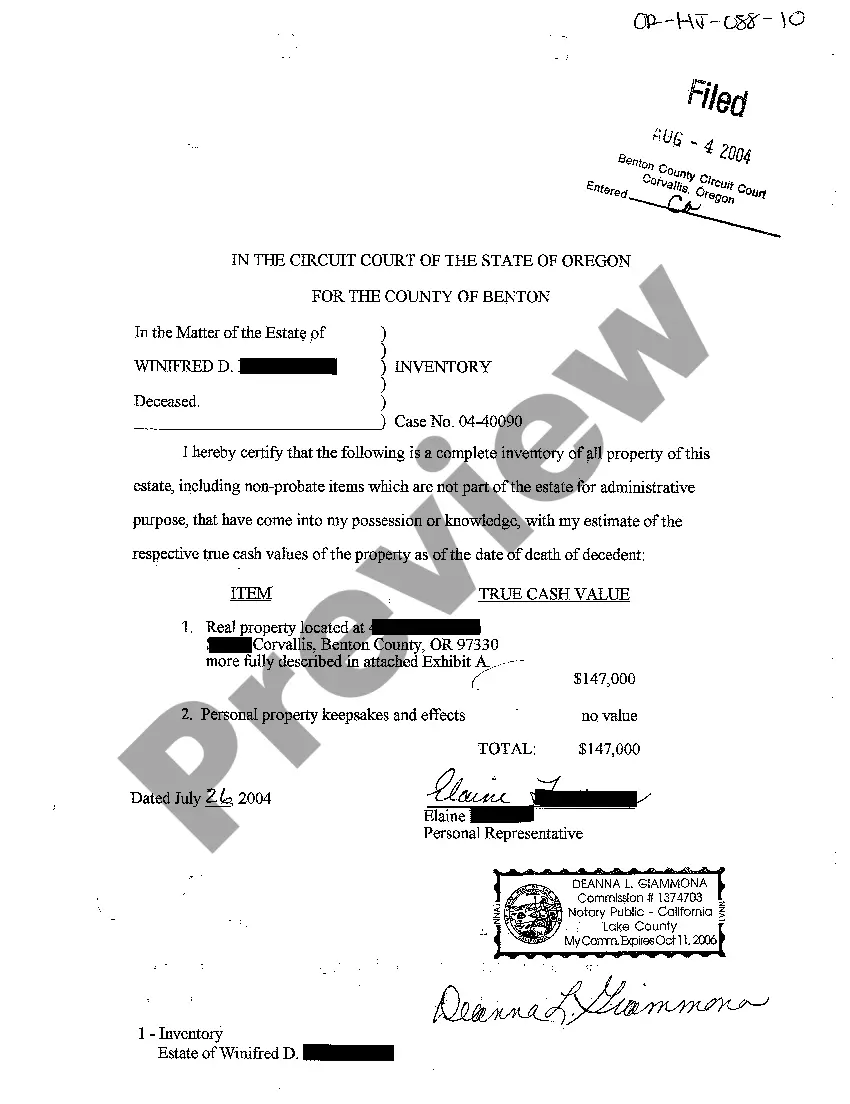

A mortgage note is a legal document in which borrowers agree to terms with the lender, or mortgagee. It is legally binding. Borrowers receive a mortgage note from a lender when taking out a loan for a new purchase or refinance. In some states, borrowers and lenders will use a deed of trust instead of a mortgage.