In this guaranty, two corporations guarantee the debt of an affiliate corporation.

Mississippi Cross Corporate Guaranty Agreement

Description

How to fill out Cross Corporate Guaranty Agreement?

If you want to finalize, obtain, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Take advantage of the site’s user-friendly search function to find the documents you need.

Various templates for business and personal use are organized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to acquire the Mississippi Cross Corporate Guaranty Agreement in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to retrieve the Mississippi Cross Corporate Guaranty Agreement.

- You can also access documents you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to assess the content of the form. Don’t forget to read the description.

- Step 3. If you are unhappy with the form, utilize the Search area at the top of the screen to find other forms in the legal document format.

Form popularity

FAQ

The Pass-Through Entity (PTE) rate in Mississippi impacts how certain business entities are taxed. This rate is crucial for partnerships and S corporations, as it influences tax obligations. Understanding the PTE rate can aid in long-term planning, particularly when considering a Mississippi Cross Corporate Guaranty Agreement, as it can affect financial implications.

Yes, you must file state taxes if you earn taxable income in Mississippi. The amount you owe will depend on various factors, including your income level and deductible amounts. Staying compliant with your state tax filings is important, especially if you plan on entering a Mississippi Cross Corporate Guaranty Agreement, as it reflects your financial responsibility.

In Mississippi, the Department of Revenue is responsible for issuing tax clearance certificates. You must apply through their office and meet any necessary tax obligations before they can issue this document. This certificate is particularly useful when finalizing agreements like a Mississippi Cross Corporate Guaranty Agreement, ensuring all tax matters are settled.

To acquire an IRS clearance letter, you must file Form 4506-T with the Internal Revenue Service. This form allows the IRS to send your tax information to your designated recipient. Having this letter can be beneficial when dealing with financial agreements, including a Mississippi Cross Corporate Guaranty Agreement, as it verifies your standing with federal taxes.

To request a tax clearance letter in Mississippi, you need to submit a clear request form along with your tax details to the Department of Revenue. They may also provide an online option to streamline this process. Obtaining this letter is often necessary for various legal and business purposes, including signing a Mississippi Cross Corporate Guaranty Agreement.

You can request a tax clearance letter in Mississippi by contacting the Department of Revenue directly. They often require you to submit a formal request along with any necessary documentation. Securing this letter can be essential for various transactions, including executing a Mississippi Cross Corporate Guaranty Agreement, as it confirms your tax obligations are cleared.

To obtain a tax verification letter online in Mississippi, visit the Department of Revenue's website. You can request a letter through their online services, where you’ll need to provide your personal and tax information. This process is streamlined for your convenience, and it ensures your tax records are accurate, laying a solid foundation for a Mississippi Cross Corporate Guaranty Agreement.

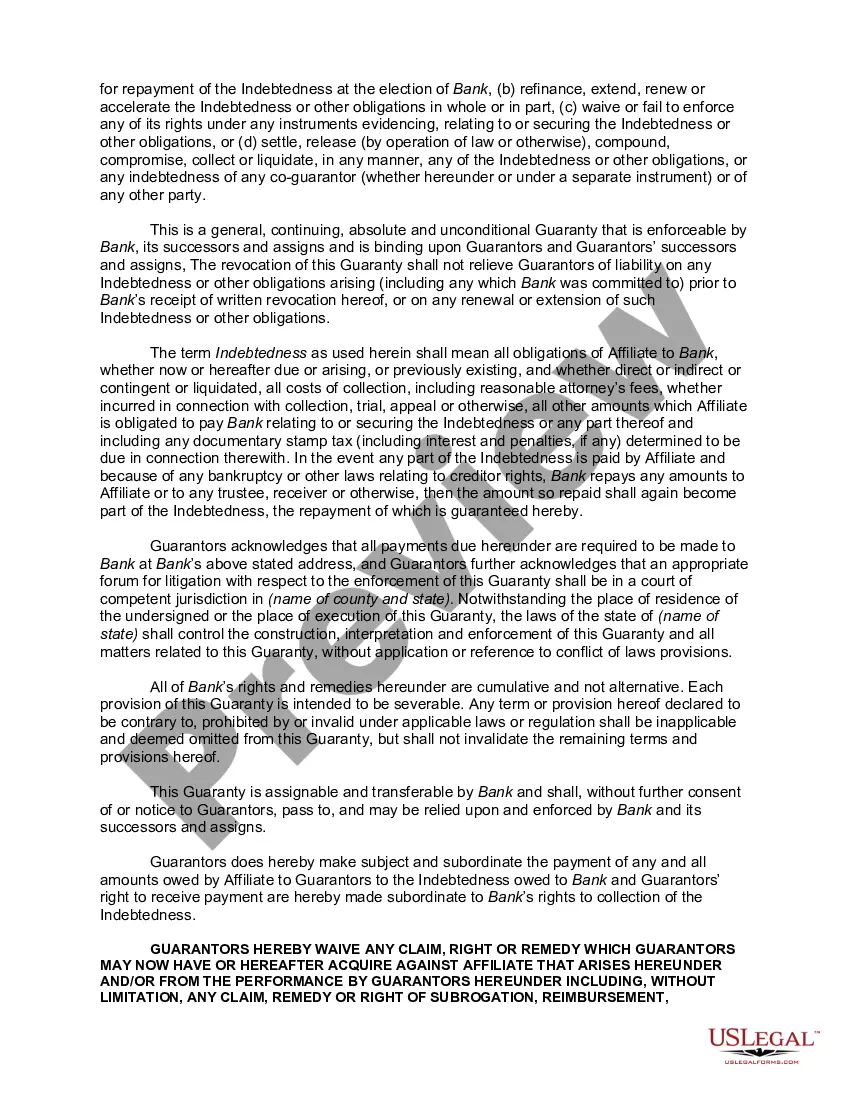

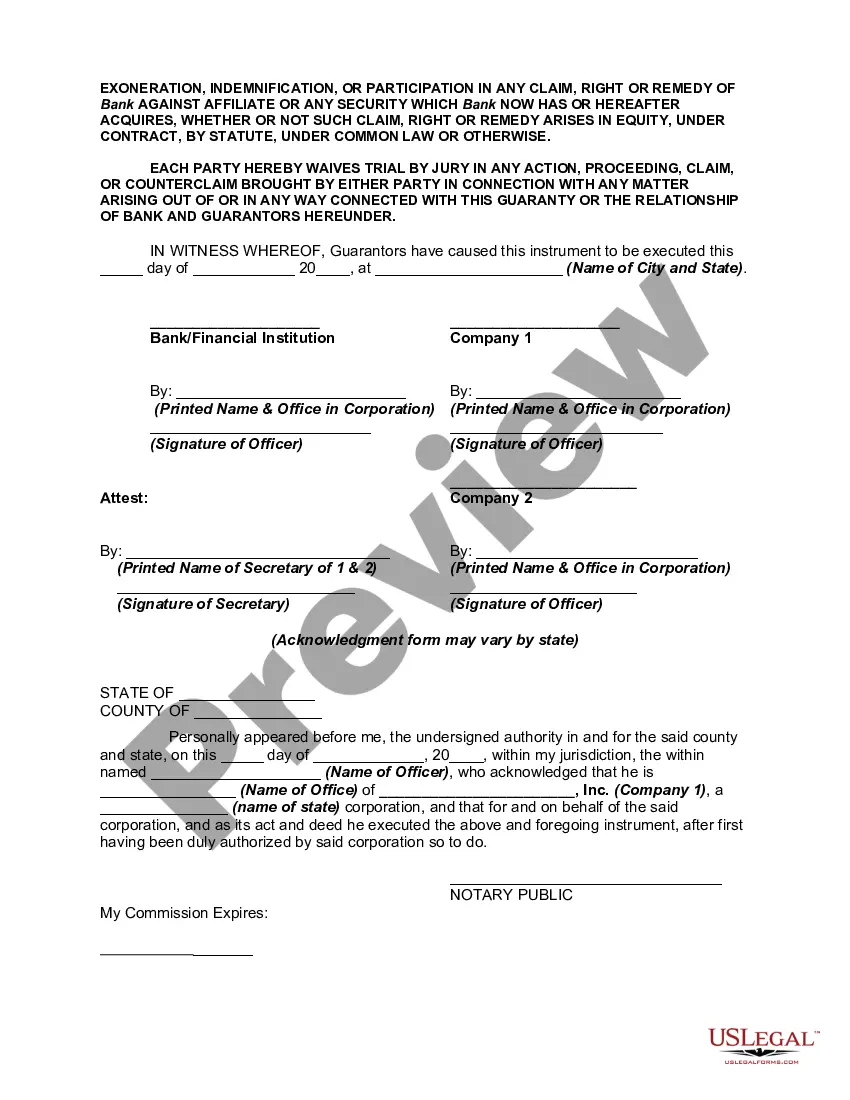

The primary purpose of a Mississippi Cross Corporate Guaranty Agreement is to protect lenders from the risk of default. By ensuring that a third party—often a financially stable corporation—guarantees the repayment, lenders gain confidence in extending credit. Moreover, this agreement facilitates greater access to funding for borrowers who may lack sufficient creditworthiness on their own. Overall, it creates a more secure lending environment.

The parties in a Mississippi Cross Corporate Guaranty Agreement include the guarantor, the borrower, and the lender. The guarantor backs the debt obligations, while the borrower is the entity seeking financing. The lender engages in the agreement to provide the funds with the assurance that the guarantor will step in if needed. Identifying these parties is vital for establishing a clear agreement.

In Mississippi, a Cross Corporate Guaranty Agreement generally requires consideration to be valid. Consideration refers to something of value exchanged between the parties involved, which can be a promise, a performance, or a payment. Without consideration, the guaranty might not be enforceable in a court of law. It is critical to ensure that all necessary elements are met when drafting such agreements.