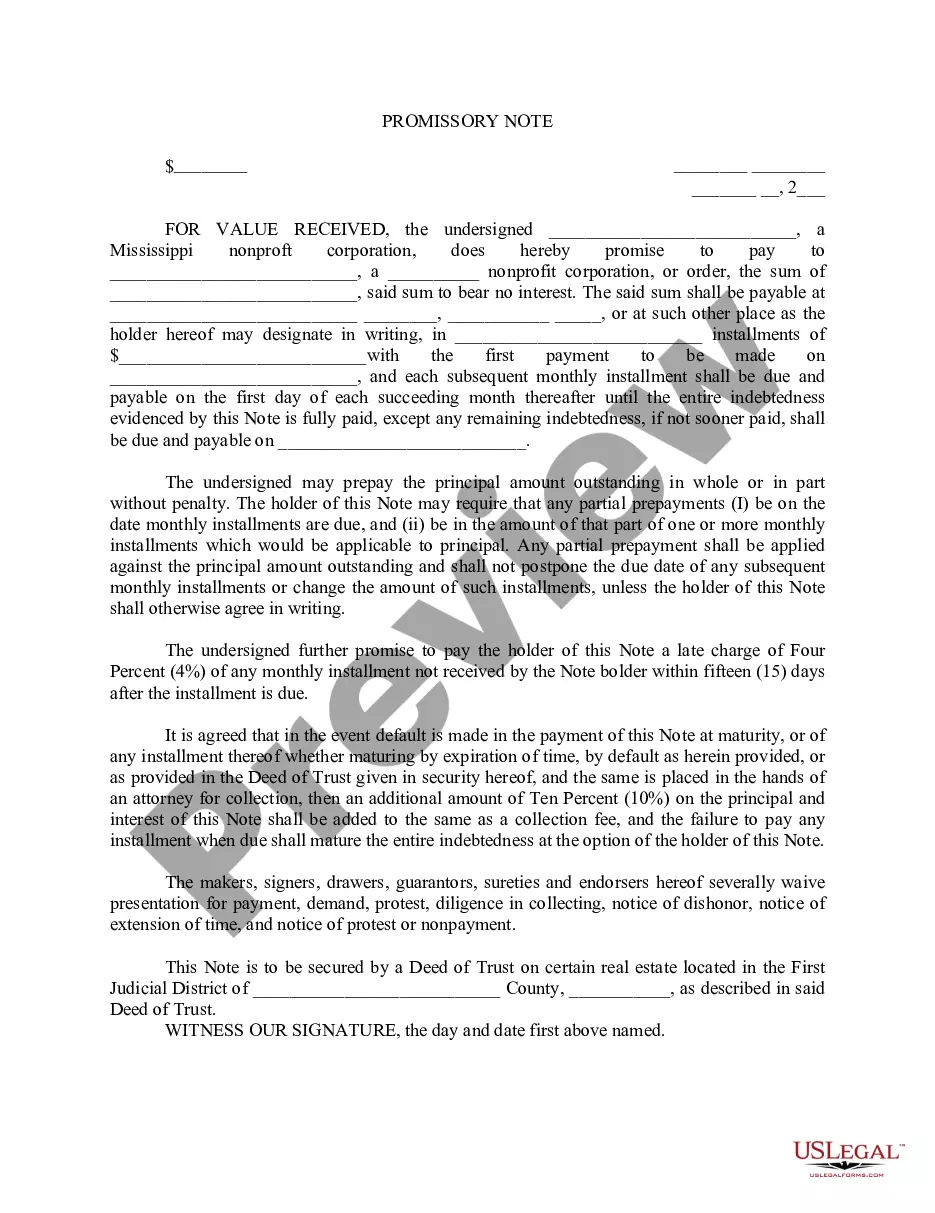

Mississippi Promissory Note College to Church

Description

How to fill out Promissory Note College To Church?

You might spend time online attempting to locate the appropriate document template that complies with the state and federal requirements you are seeking.

US Legal Forms offers thousands of legitimate documents that have been reviewed by experts.

You can conveniently download or print the Mississippi Promissory Note College to Church from our service.

If available, utilize the Preview option to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Obtain option.

- Subsequently, you can complete, modify, print, or sign the Mississippi Promissory Note College to Church.

- Every legal document template you purchase is yours to keep forever.

- To obtain another copy of the purchased form, navigate to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the area/town of your selection.

- Check the form description to confirm you have selected the correct template.

Form popularity

FAQ

Filling out a promissory note, especially in the context of Mississippi Promissory Note College to Church, involves providing specific information. Start by including the principal amount, interest rate, and repayment terms. Then, clearly outline the borrower's details and the lender's details. Make sure both parties sign and date the document for it to become legally binding.

Promissory notes are generally not considered public records; however, certain details may be accessible depending on local laws. It's best to check with your local courthouse or the entity that handled your note. For tailored support, US Legal Forms can assist in understanding the rules surrounding Mississippi Promissory Note College to Church.

If you lose your original promissory note, contact the issuer as soon as possible to learn about their replacement procedures. They should be able to provide guidance on issuing a duplicate. Moreover, using US Legal Forms can help you with the necessary documents to request a replacement for a Mississippi Promissory Note College to Church.

To obtain a copy of a promissory note, reach out to the lender or institution that issued it. You may also be able to download certain forms online if they provide digital access. Utilizing services from US Legal Forms can guide you through retrieving the necessary documents, including templates related to Mississippi Promissory Note College to Church.

Your Master Promissory Note (MPN) can typically be accessed through the financial aid office of your college or university. They maintain records of all promissory notes associated with student loans. If you need further assistance, US Legal Forms offers resources to help you locate and manage your documents related to Mississippi Promissory Note College to Church.

You can obtain a copy of your promissory note by contacting the institution that issued the note. For students, this might be your college's financial aid office. Additionally, using platforms like US Legal Forms can streamline this process, providing templates and guidance specific to a Mississippi Promissory Note College to Church.

Filing a promissory note typically involves recording it with the appropriate authority in your state, such as the county recorder's office. This is particularly relevant for a Mississippi Promissory Note College to Church, as it secures your legal rights. You should keep a copy of the filed document for your records.

When dealing with a promissory note, like a Mississippi Promissory Note College to Church, you'll report the interest income on your tax return. Keep a detailed record of all payments received throughout the year. Consider consulting with a tax professional for guidance on ensuring compliance with tax laws.

A promissory note in a college setting refers to the financial agreement students enter into to cover their educational expenses. This type of note ensures students can pursue their academic goals while managing the financial aspects of their education. When linked to the Mississippi Promissory Note College to Church, this concept highlights the support systems in place that help students navigate their financial futures effectively.