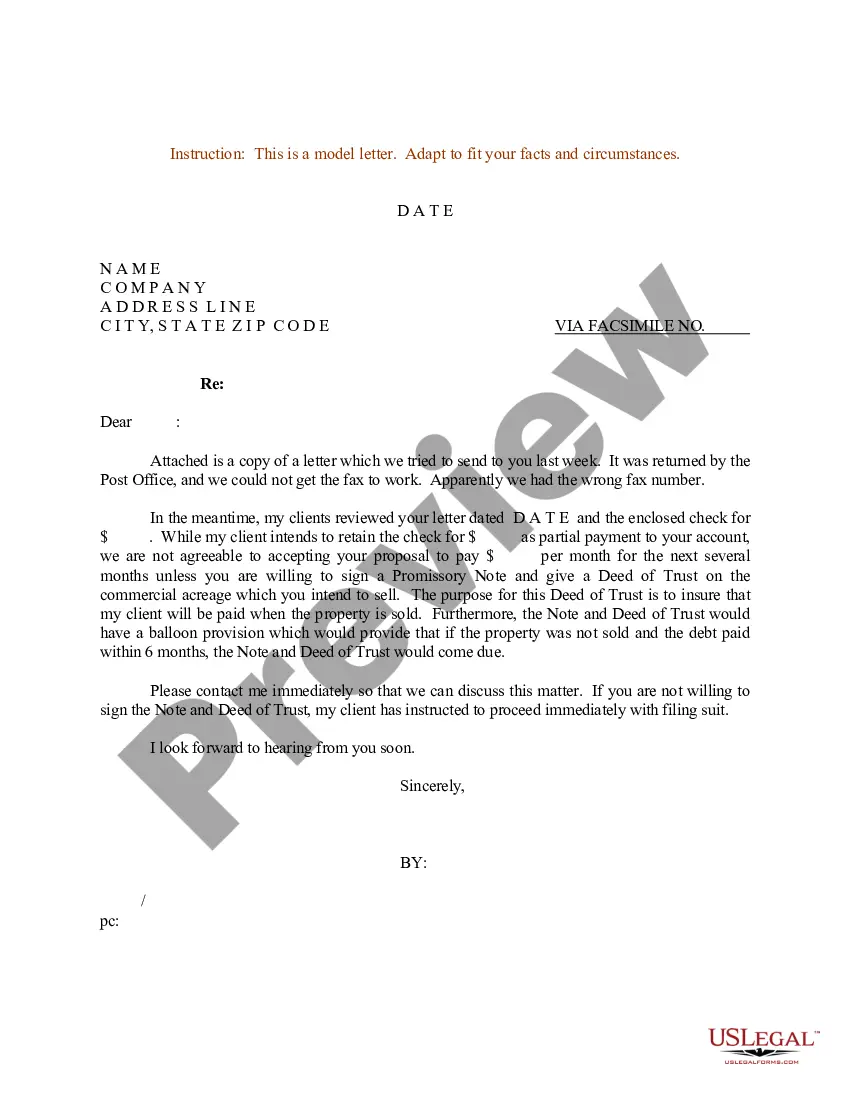

Mississippi Sample Letter for Note and Deed of Trust

Description

How to fill out Sample Letter For Note And Deed Of Trust?

If you have to complete, download, or produce legitimate record web templates, use US Legal Forms, the most important variety of legitimate types, that can be found on-line. Take advantage of the site`s simple and easy handy search to discover the files you will need. Various web templates for enterprise and individual uses are sorted by types and claims, or keywords. Use US Legal Forms to discover the Mississippi Sample Letter for Note and Deed of Trust in a couple of mouse clicks.

In case you are already a US Legal Forms consumer, log in to your accounts and then click the Acquire option to get the Mississippi Sample Letter for Note and Deed of Trust. Also you can gain access to types you previously downloaded from the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for that right metropolis/country.

- Step 2. Utilize the Preview method to look through the form`s content material. Do not overlook to read through the information.

- Step 3. In case you are not satisfied with all the form, use the Research industry near the top of the display screen to locate other versions of your legitimate form web template.

- Step 4. After you have found the shape you will need, click the Get now option. Select the prices plan you choose and include your references to register for the accounts.

- Step 5. Method the deal. You can utilize your charge card or PayPal accounts to complete the deal.

- Step 6. Pick the file format of your legitimate form and download it on the gadget.

- Step 7. Full, change and produce or signal the Mississippi Sample Letter for Note and Deed of Trust.

Each and every legitimate record web template you acquire is the one you have permanently. You have acces to each form you downloaded inside your acccount. Click the My Forms area and pick a form to produce or download yet again.

Contend and download, and produce the Mississippi Sample Letter for Note and Deed of Trust with US Legal Forms. There are many expert and condition-certain types you can use for your personal enterprise or individual demands.

Form popularity

FAQ

Over to the Trustees mentioned hereunder, is hereby acknowledged by the Trustees, who hereby accept the appointment as such Trustees of the said Trust, under the terms and conditions, set out hereunder for the fulfillment of the objects of the Trust, more fully and particularly described and set out hereunder.

A trust deed is a voluntary agreement between you and the people you owe money to (also called your creditors). You agree to pay a regular amount of money towards your debts and at the end of a fixed time the rest of your debts will be written off.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

A Mississippi deed of trust is a document by which an owner's property title transfers to a neutral party (trustee) to serve as security for a real estate loan granted by a lender (beneficiary). The trustee holds onto the property title until the land owner (borrower) pays back the loan in full to the lender.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

The promissory note is held by the lender until the loan is paid in full, and generally is not recorded with the county recorder or registrar of titles (sometimes also referred to as the county clerk, register of deeds, or land registry) whereas a deed of trust is recorded.

A deed of trust can benefit the lender because it typically allows a faster foreclosure on a home. Most deeds of trust have a ?non-judicial foreclosure? clause, which means that the lender won't have to wait for the court system to review and approve the foreclosure process.