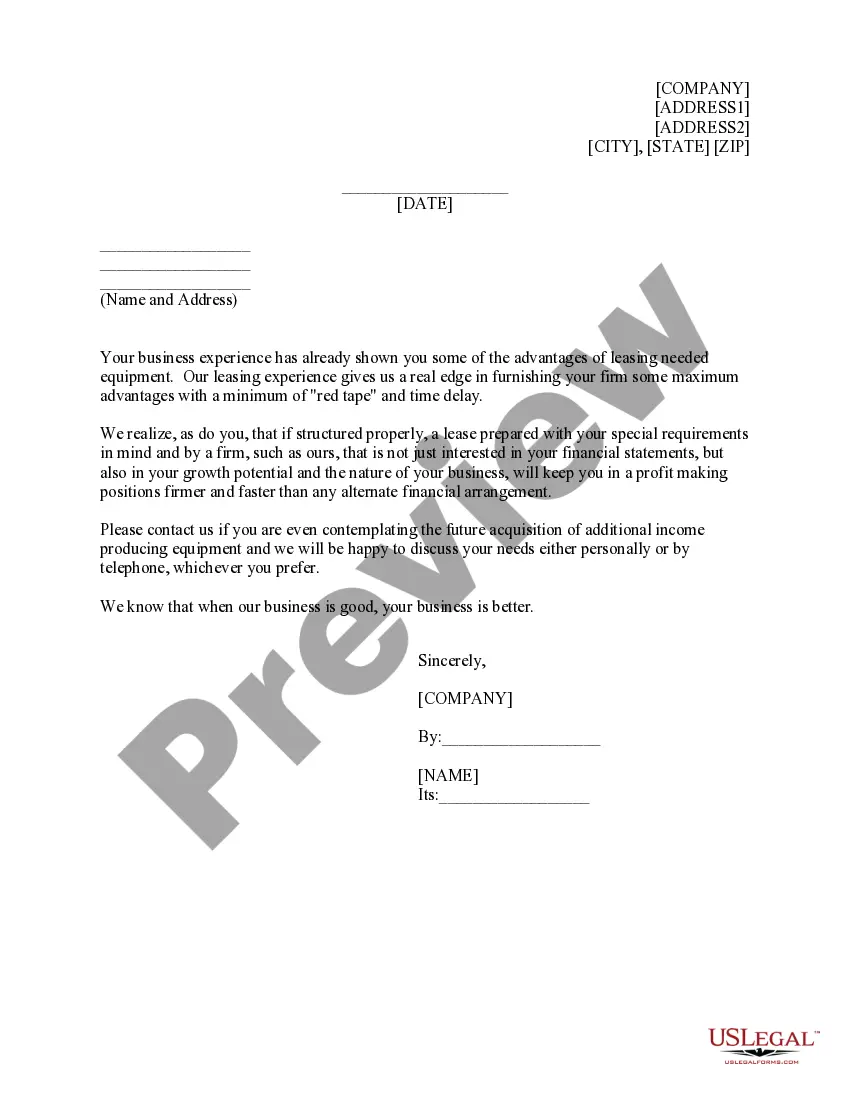

Mississippi Sample Letter for Promotional Letter - Equipment Financing

Description

How to fill out Sample Letter For Promotional Letter - Equipment Financing?

Selecting the appropriate legal document template can be a challenge. Of course, there are numerous templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Mississippi Sample Letter for Promotional Letter - Equipment Financing, which can be utilized for both business and personal purposes. All of the documents are verified by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Mississippi Sample Letter for Promotional Letter - Equipment Financing. Use your account to browse through the legal documents you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

Select the document format and download the legal document template to your device. Fill out, edit, print, and sign the obtained Mississippi Sample Letter for Promotional Letter - Equipment Financing. US Legal Forms is the largest repository of legal documents where you can find countless paper templates. Utilize the service to download properly crafted documents that adhere to state requirements.

- First, make sure you have selected the correct form for your city/state.

- You can review the form by using the Review button and examine the form description to confirm it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click on the Purchase now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and complete the purchase using your PayPal account or credit card.

Form popularity

FAQ

How to write a letter to sell a productWrite an attractive headline. When writing the headline of your sales letter, it's important to capture the reader's attention as quickly as possible and entice them to continue reading.Explain your offer.Provide proof of value.End with a P.S.

Know Who Your Target Audience is. The first step to writing product descriptions is to define your target audience.Focus on the Product Benefits.Tell the Full Story.Use Natural Language and Tone.Use Power Words That Sell.Make it Easy to Scan.Optimize for Search Engines.Use Good Images.15-Oct-2020

Dear Sir/Madam, We, Company are pleased to introduce you to our new product in the market. We are thankful to you for the trust you showed in our company for (years). The quality standard of the product is guaranteed by us.

How to write a letter requesting a promotionStart with a formal heading. If you choose to send a printed letter to your manager or team lead, start it with a formal heading.Use a professional salutation.State your request.Explain why you are a good fit.Suggest a plan for the transition.Thank them and end the letter.

A job promotion cover letter should clearly explain your interest in the job and delineate how you are qualified for the position. The letter should also recap the experience you have had, your knowledge of your employer's current mission and needs, and the progressive growth you have enjoyed within the company.

Key takeaways:When applying for a promotion, make a data-backed case as to why you should be promoted.In your letter, include the ways your current position makes you well-suited to the new job.Offer specific ways you've made an impact and why you're uniquely qualified to take on the responsibilities required.More items...?13-May-2021

Begin with who you are and where you are from, how grateful you are to have been accepted and that you are excited about the school. Be direct about what the letter is for (financial aid) Briefly talk about why the school is a great fit for you and why you need the money in an straightforward and respectful way.

Get the Reader's Attention An effective sales letter must first capture the reader's attention and entice him to learn more. Open your letter with a surprising fact, funny anecdote or thought-provoking question. Describe the challenges your reader faces so he'll know you understand his plight.

If you know a position has opened up around your company, state your interest directly. Write a brief sentence about why this position appeals to you. If no such position has opened, explain that you're interested in a promotion and why this appeals to you. Keep your tone professional, but express enthusiasm.