Many so-called nonprofits are simply groups of people who come together to perform some social good. These informal groups are called unincorporated nonprofit associations. An unincorporated nonprofit association may be subject to certain legal requirements, even though it hasn't filed for incorporation under its state's incorporation laws. For example, an unincorporated association will generally need to file tax returns, whether as a taxable or tax-exempt entity. Additionally, there may be state registration requirements.

Mississippi Articles of Association of Unincorporated Church Association

Description

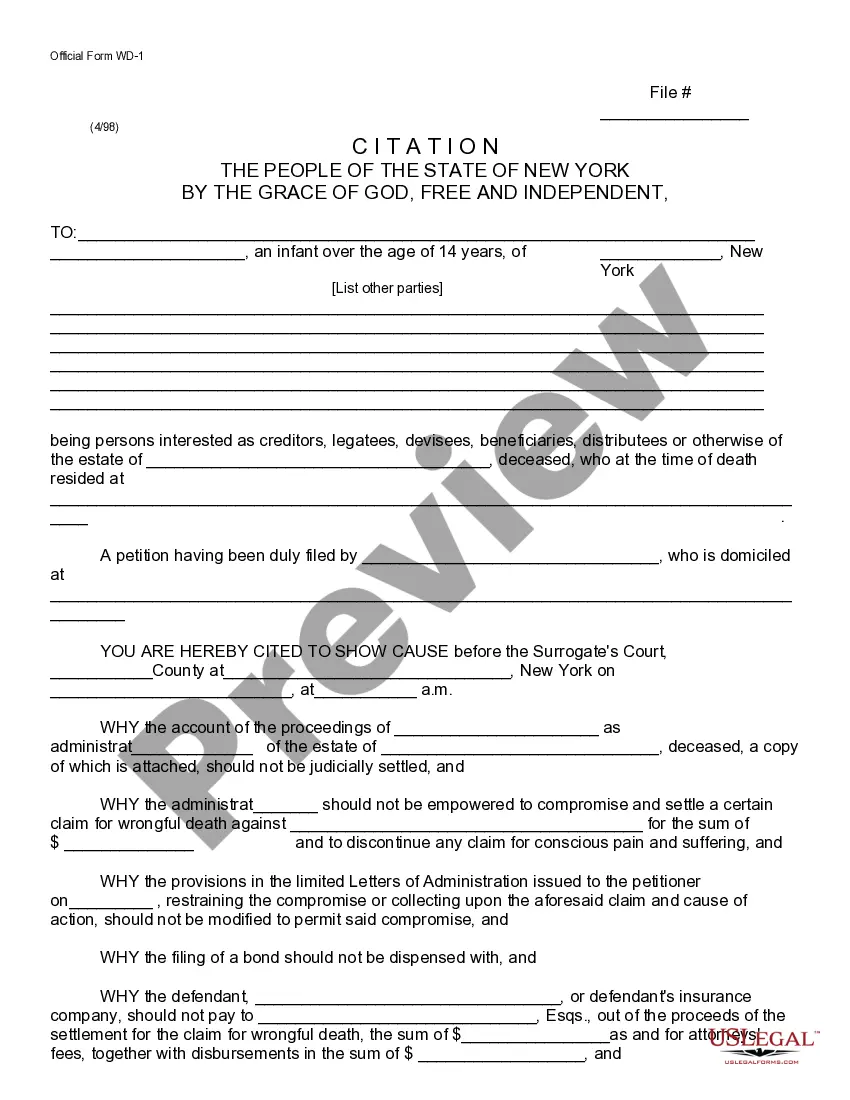

How to fill out Articles Of Association Of Unincorporated Church Association?

US Legal Forms - one of the largest repositories of authentic documents in the United States - offers a vast array of valid template files that you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Mississippi Articles of Association of Unincorporated Church Association within moments.

If you already possess a subscription, Log In and retrieve the Mississippi Articles of Association of Unincorporated Church Association from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the order. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Mississippi Articles of Association of Unincorporated Church Association. Each template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Mississippi Articles of Association of Unincorporated Church Association with US Legal Forms, the most extensive collection of authentic document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Examine the form details to ensure that you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you're satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

The articles of association are critical documents that outline the governance structure of a nonprofit organization, such as a church association. In the context of a Mississippi Articles of Association of Unincorporated Church Association, these articles define the organization's purpose, membership rules, and operational procedures. They provide clarity on how decisions will be made and help ensure legal compliance. If you need assistance in drafting these important documents, consider using the US Legal Forms platform, where you can find templates tailored to your needs.

An unincorporated association does not have a single owner; instead, it operates as a collective group of members. All members share responsibilities and rights within the organization outlined in their Mississippi Articles of Association of Unincorporated Church Association. This democratic structure encourages participation and equal input from every member. It's vital for groups to establish clear guidelines to define member roles and ensure smooth operations.

Despite their benefits, unincorporated associations face potential drawbacks, primarily regarding liability and legal recognition. Members of an unincorporated association may be personally liable for the organization's debts and obligations, which can be a significant risk. Additionally, without the formal structure provided by the Mississippi Articles of Association of Unincorporated Church Association, navigating legal matters may become complicated. It’s essential for members to understand these limitations and consider professional advice when necessary.

One significant benefit of an unincorporated association is the ease of formation, as it typically requires fewer formalities and paperwork compared to a corporation. With a Mississippi Articles of Association of Unincorporated Church Association, members maintain control over their organization while enjoying flexibility in governance. Additionally, there are usually lower costs associated with operating an unincorporated association. This structure allows groups to focus on their mission without getting bogged down in bureaucracy.

The purpose of an unincorporated association often centers around collaboration among members for a common goal, such as religious, social, or charitable activities. By forming a Mississippi Articles of Association of Unincorporated Church Association, members can outline their mission, governance structure, and operational guidelines. This framework allows for smooth decision-making and enhances the group's focus on its objectives. In essence, this association serves as a foundation for shared purpose and community.

profit can indeed be an unincorporated association. In Mississippi, many religious organizations operate without formal incorporation, relying on the Mississippi Articles of Association of Unincorporated Church Association to define their structure and governance. This approach allows groups to function with flexibility while still adhering to state guidelines. For organizations seeking to establish themselves, using our platform, US Legal Forms, provides a reliable resource for drafting these essential documents.

An unincorporated association may need to file a tax return depending on its income and activities. Generally, these organizations must report their income to maintain compliance with IRS regulations. Therefore, it is advisable for associations in Mississippi to consult tax professionals, particularly if they are involved in fundraising or other revenue-generating activities, to understand their obligations.

Yes, Mississippi provides Articles of Organization as a necessary step for forming an LLC. This document is essential for detailing the structure and purpose of the LLC. However, for unincorporated associations, like church groups, filing the Mississippi Articles of Association of Unincorporated Church Association serves as the appropriate organizing document, ensuring compliance with local regulations.

Yes, every LLC must have Articles of Organization as a foundational document for its formation. This document outlines the structure, purpose, and operational guidelines of the business. In Mississippi, unincorporated church associations operate differently; while they might not need formal LLC documentation, filing the Mississippi Articles of Association of Unincorporated Church Association can help establish legal recognition.

A nonprofit organization is a formal entity recognized under state and federal law, which typically involves registration and compliance with specific regulations. In contrast, an unincorporated association is a more informal group that may not require state registration. In Mississippi, the Articles of Association of Unincorporated Church Association can help clarify the purpose and governance of your group without the complexities of formal nonprofit status.