In most states, the process for forming a nonprofit corporation is different from the process for forming a for-profit corporation. A nonprofit corporation must file additional documentation with state and federal authorities to be recognized and obtain the advantages of nonprofit status. You can complete and file the paperwork yourself, or use an online document preparation website. Recognition as a nonprofit corporation confers three main advantages: tax breaks for the corporation, tax breaks for donors, and the legal right to solicit donations. In most states, nonprofit corporations are governed by the Model Nonprofit Corporation Act.

Mississippi Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association

Description

How to fill out Resolution To Incorporate ASCAP Nonprofit Corporation By Members Of Unincorporated Association?

US Legal Forms - one of the largest collections of legal templates in the USA - offers an assortment of legal document samples that you can download or print.

By utilizing the site, you will find thousands of samples for business and personal purposes, categorized by types, states, or keywords. You can access the latest versions of documents similar to the Mississippi Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association within moments.

If you hold a subscription, Log In and download the Mississippi Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association from your US Legal Forms library. The Download button will be available on each document you view.

When you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and enter your credentials to register for the account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the payment. Choose the format and download the form to your device.Make modifications. Complete, edit, and print the acquired Mississippi Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association and sign it.All documents you add to your account do not have an expiration date and are yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.Access the Mississippi Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Access all previously obtained documents from the My documents section of your account.

- Ensure you have selected the appropriate document for your city/state.

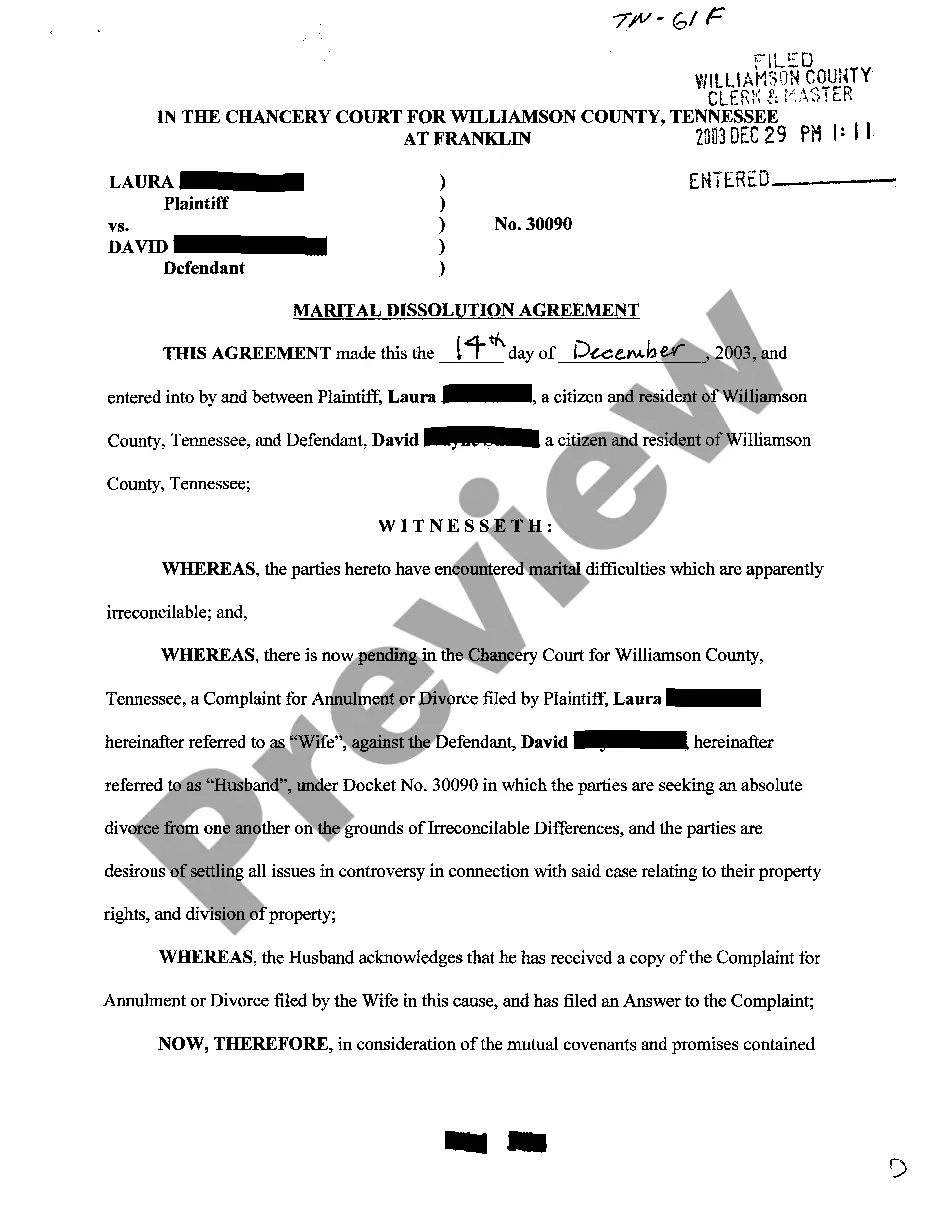

- Click the Preview button to examine the content of the form.

- Review the details of the form to confirm you have selected the correct one.

- If the form does not meet your requirements, utilize the Search bar at the top of the screen to find one that fits.

Form popularity

FAQ

The organizing documents for a non-profit organization generally include the articles of incorporation and bylaws. Articles of incorporation establish the organization as a legal entity, while bylaws outline how it will operate, including member roles and procedures. Having these documents in place is crucial for compliance and governance. If you're unsure about drafting these documents, platforms like uslegalforms can provide templates to help you get started.

profit can be either a corporation or an unincorporated association. Nonprofit corporations are formal entities created under state law, while unincorporated associations operate more informally. If you are considering the Mississippi Resolution to Incorporate ASCAP nonprofit Corporation by Members of Unincorporated Association, you can evaluate which structure best fits your needs. Each option offers distinct advantages for governance and liability.

When recording a resolution in the minutes, the exact wording of the resolution, the names of proposers and seconders, and the names of those voting in favor of or contrary to the resolution should be recorded.

A board resolution template is a manner of documenting decisions made by the company's Shareholders or Board of Directors. The decision can cover anything relevant to the affairs of the organization like a decision extending loans to other companies or when voting for a new member to join the board.

To form a 501(c)(3) nonprofit organization, follow these steps:Step 1: Name Your Mississippi Nonprofit.Step 2: Choose Your Registered Agent.Step 3: Select Your Board Members & Officers.Step 4: Adopt Bylaws & Conflict of Interest Policy.Step 5: File the Articles of Incorporation.Step 6: Get an EIN.More items...?

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.

How to Start a Nonprofit in MississippiName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

Here are eight tips for making a resolution you can keepalthough you'll have to say goodbye to the word resolution!Ditch the usual vocab.Be positive.Be specific.Take baby steps.Tell your friends and family.Give yourself a break.Reward yourself.Don't give up!

Some basic information a resolution should include is the name of the corporation; the date of the board meeting when the resolution was approved; and the names of the board members who attended the meeting, or a statement that all board members or a quorum were present.