Mississippi Receipt for Loan Funds is a legal document used to record and acknowledge the receipt of loan funds in the state of Mississippi. It acts as proof of the transaction between the lender and the borrower, ensuring transparency and providing legal protection to both parties involved. The receipt typically includes essential details such as the date of receipt, the amount of money received, the name and contact information of both the lender and the borrower, and any additional terms and conditions agreed upon. This document is often used in various loan transactions, including personal loans, business loans, mortgage loans, and more. Different types of Mississippi Receipt for Loan Funds may include: 1. Personal Loan Receipt: This type of receipt is used when an individual borrows money from another person, such as family members or friends. It outlines the terms of the loan, repayment schedule, and any interest or fees involved. 2. Business Loan Receipt: In the case of a business loan, this receipt is used to acknowledge the loan amount received by a business entity. It specifies the purpose of the loan, repayment terms, and any collateral or guarantees provided. 3. Mortgage Loan Receipt: For real estate transactions involving mortgage loans, this type of receipt is used to document the receipt of loan funds by the borrower. It includes details about the property being mortgaged, the loan amount, interest rate, and repayment terms. 4. Student Loan Receipt: When a student obtains a loan for educational purposes, this receipt is used to confirm the disbursement of the loan funds by the lender. It may include details like the loan amount, interest rate, repayment options, and any deferment or forbearance provisions. 5. Car Loan Receipt: For loans specifically intended for purchasing or financing a vehicle, this receipt is used to acknowledge the receipt of loan funds. It mentions the details of the car, loan amount, interest rate, installment payments, and any applicable penalties or fees. In conclusion, a Mississippi Receipt for Loan Funds is a crucial document that ensures the transparent recording of loan transactions in Mississippi. It serves as evidence of the loan amount received and outlines the terms and conditions agreed upon by both the lender and the borrower. Different types of receipts are used for various loan purposes, including personal, business, mortgage, student, and car loans.

Mississippi Receipt for loan Funds

Description

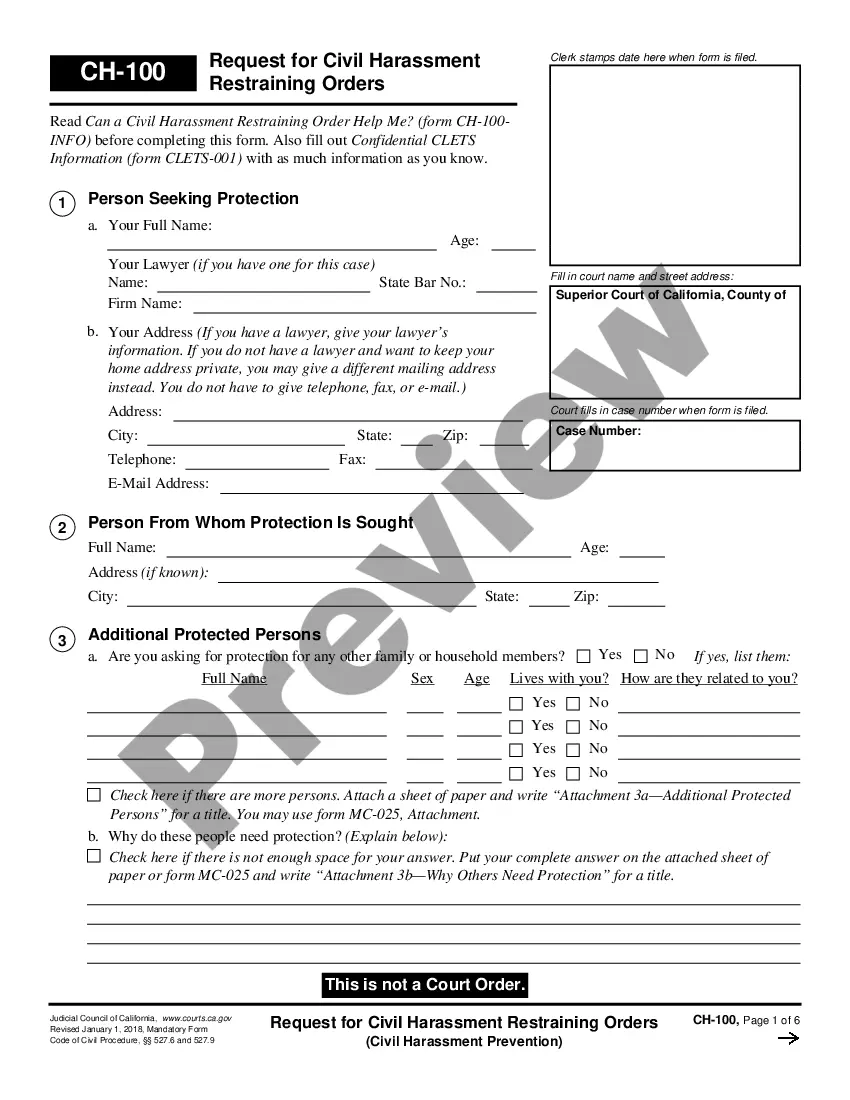

How to fill out Mississippi Receipt For Loan Funds?

Are you presently in the position the place you need paperwork for sometimes organization or person uses almost every working day? There are plenty of authorized document web templates available on the net, but finding types you can trust is not easy. US Legal Forms gives a huge number of kind web templates, such as the Mississippi Receipt for loan Funds, which are composed to fulfill state and federal specifications.

In case you are presently acquainted with US Legal Forms internet site and get your account, simply log in. Afterward, you may acquire the Mississippi Receipt for loan Funds design.

If you do not come with an accounts and would like to begin to use US Legal Forms, follow these steps:

- Get the kind you need and make sure it is for that appropriate town/state.

- Take advantage of the Review button to review the shape.

- Read the information to ensure that you have selected the appropriate kind.

- When the kind is not what you are searching for, utilize the Research area to obtain the kind that meets your requirements and specifications.

- If you obtain the appropriate kind, simply click Get now.

- Select the prices prepare you would like, fill out the required information to create your account, and pay money for the order making use of your PayPal or credit card.

- Pick a hassle-free paper file format and acquire your duplicate.

Get all of the document web templates you might have purchased in the My Forms food selection. You may get a more duplicate of Mississippi Receipt for loan Funds anytime, if necessary. Just click on the necessary kind to acquire or print out the document design.

Use US Legal Forms, by far the most considerable collection of authorized forms, to save lots of time as well as steer clear of errors. The support gives appropriately manufactured authorized document web templates which can be used for a range of uses. Generate your account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

A loan receipt is a document that an insurance policyholder signs to signify that they have received an interest-free loan from an insurance company. These loans are typically given out when a loss has occurred and the policyholder is suing a third party for damages related to that loss.

A payment receipt, also known as a receipt of payment, is a document issued from a business to its customer when they have received payment for provided goods or services. Payment receipts should be issued every time a payment is made on a sale - even if it's a deposit or partial payment.

A receipt is any document that contains the following five IRS-required elements: Name of vendor (person or company you paid) Transaction date (when you paid) Detailed description of goods or services purchased (what you bought) Amount paid. Form of payment (how you paid ? cash, check, or last four digits of credit card)

A receipt is a written acknowledgment that something of value has been transferred from one party to another. In addition to the receipts consumers typically receive from vendors and service providers, receipts are also issued in business-to-business dealings as well as stock market transactions.

receipt agreement is a legal agreement between two parties, usually in a tort case, where the defendant lends money to the plaintiff without any interest. The plaintiff is not required to repay the loan unless they receive compensation from other parties responsible for the same injury.