Mississippi Sample Letter of Credit

Description

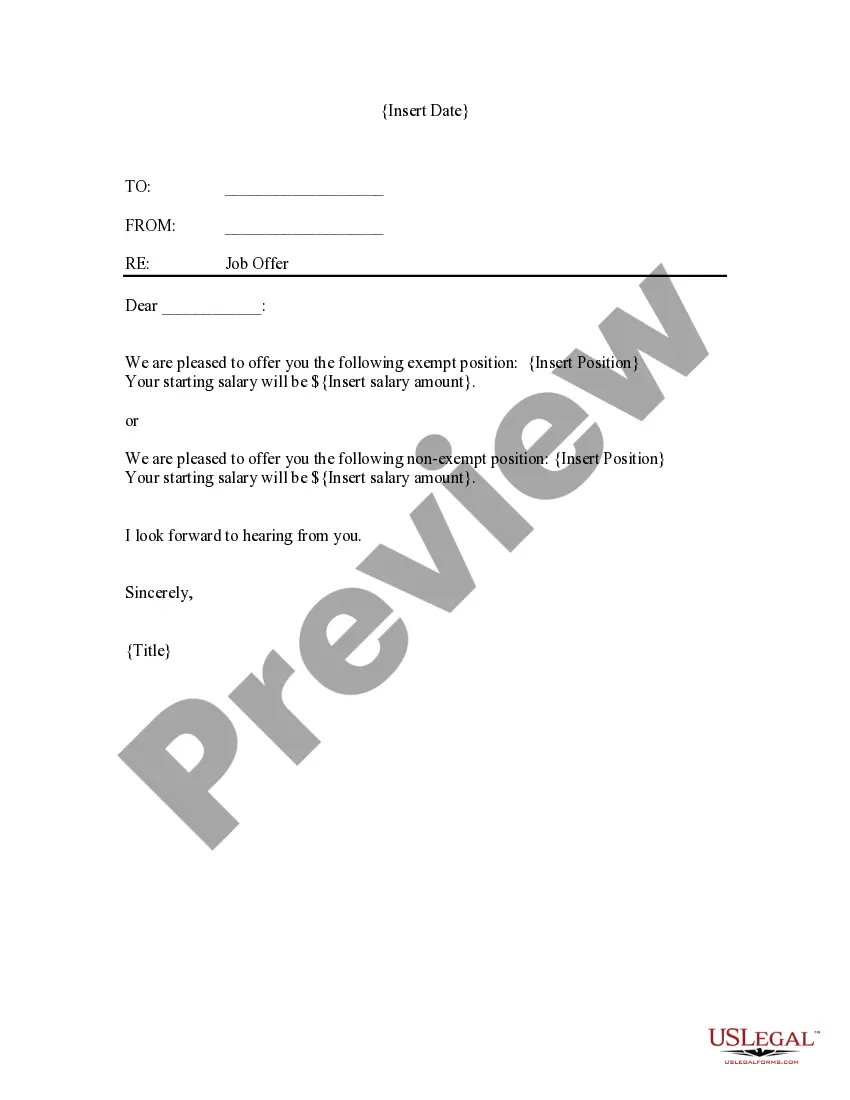

How to fill out Sample Letter Of Credit?

You are able to invest hrs online trying to find the lawful record template which fits the state and federal requirements you require. US Legal Forms provides a huge number of lawful types that are analyzed by pros. You can actually download or print out the Mississippi Sample Letter of Credit from my assistance.

If you already have a US Legal Forms profile, you can log in and click the Obtain button. After that, you can comprehensive, edit, print out, or sign the Mississippi Sample Letter of Credit. Every single lawful record template you get is the one you have eternally. To get an additional backup of any obtained type, check out the My Forms tab and click the related button.

Should you use the US Legal Forms site for the first time, keep to the straightforward instructions under:

- Very first, be sure that you have selected the best record template to the state/city that you pick. Look at the type description to make sure you have picked out the proper type. If readily available, use the Preview button to search with the record template also.

- If you wish to find an additional variation in the type, use the Research discipline to get the template that meets your needs and requirements.

- When you have discovered the template you need, click on Buy now to continue.

- Select the pricing strategy you need, key in your references, and register for your account on US Legal Forms.

- Full the financial transaction. You can use your bank card or PayPal profile to pay for the lawful type.

- Select the formatting in the record and download it to the product.

- Make modifications to the record if necessary. You are able to comprehensive, edit and sign and print out Mississippi Sample Letter of Credit.

Obtain and print out a huge number of record templates while using US Legal Forms site, that offers the most important variety of lawful types. Use professional and status-distinct templates to tackle your organization or individual requirements.

Form popularity

FAQ

A ?draft? must be issued and signed by the beneficiary of the credit and must indicate a date of issue. If the credit indicates, as a ?drawee? of a draft, the Swift code of a bank, the ?draft? may indicate such Swift code or the bank's full name.

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A Letter of Credit is a contractual commitment by the foreign buyer's bank to pay once the exporter ships the goods and presents the required documentation to the exporter's bank as proof. As a trade finance tool, Letters of Credit are designed to protect both exporters and importers.

It will be exposed to the insolvency risk of the applicant, that is, the risk the applicant runs insolvent before it is able to repay the letter of credit. Secondly, the bank will be exposed to a risk of fraud by the seller, who may provide incorrect or falsified documents to receive payment.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A Standby Letter of Credit is different from a Letter of Credit. An SBLC is paid when called on after conditions have not been fulfilled. However, a Letter of Credit is the guarantee of payment when certain specifications are met and documents received from the selling party.