Mississippi Loan Agreement for LLC

Description

How to fill out Loan Agreement For LLC?

Finding the right legitimate record design might be a have difficulties. Naturally, there are a lot of themes available on the net, but how would you get the legitimate form you require? Use the US Legal Forms web site. The support provides 1000s of themes, for example the Mississippi Loan Agreement for LLC, that you can use for business and private needs. All the kinds are inspected by experts and satisfy state and federal specifications.

When you are presently listed, log in to the account and click on the Download key to find the Mississippi Loan Agreement for LLC. Utilize your account to look with the legitimate kinds you have acquired formerly. Visit the My Forms tab of your own account and obtain one more copy in the record you require.

When you are a brand new end user of US Legal Forms, here are easy instructions for you to comply with:

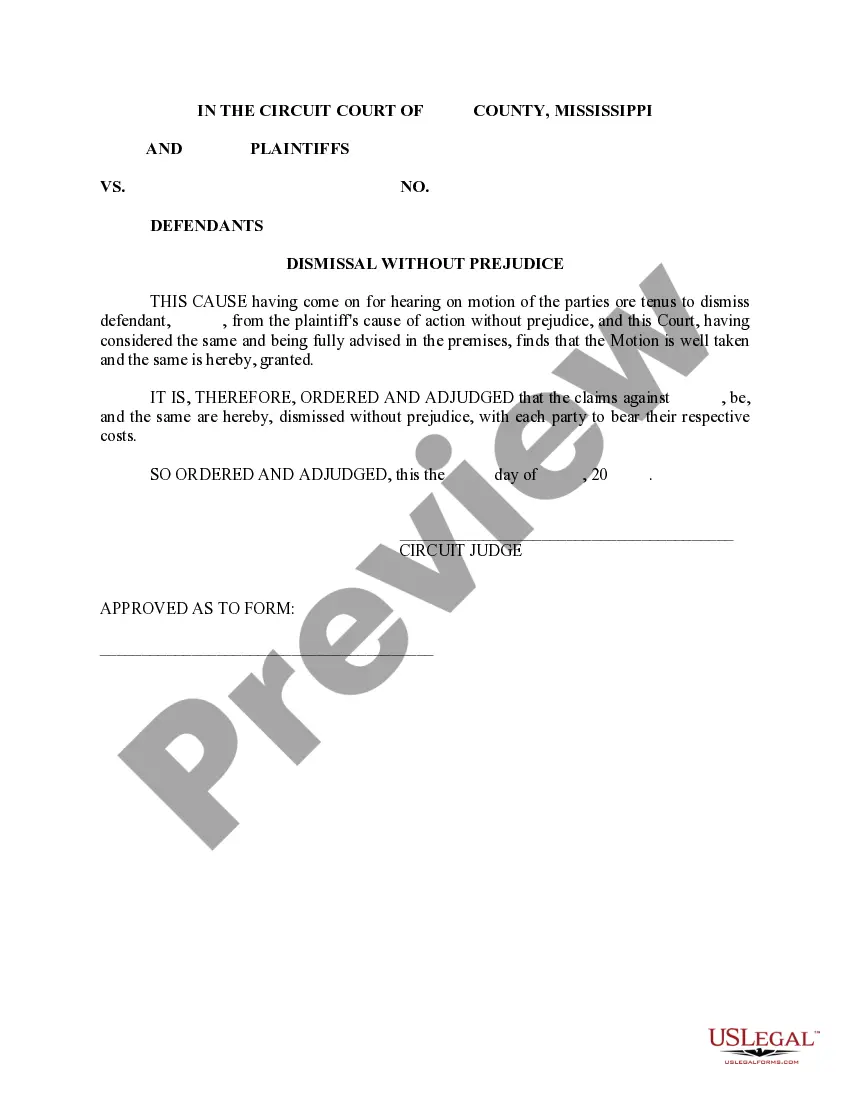

- Initial, be sure you have chosen the appropriate form to your city/region. You can examine the form making use of the Preview key and look at the form outline to make certain it is the right one for you.

- In the event the form is not going to satisfy your needs, use the Seach area to discover the right form.

- When you are sure that the form is proper, select the Buy now key to find the form.

- Opt for the rates program you need and enter the needed info. Make your account and buy your order using your PayPal account or Visa or Mastercard.

- Opt for the file structure and obtain the legitimate record design to the gadget.

- Comprehensive, edit and print out and indication the acquired Mississippi Loan Agreement for LLC.

US Legal Forms is the greatest catalogue of legitimate kinds for which you can discover a variety of record themes. Use the service to obtain professionally-produced papers that comply with express specifications.

Form popularity

FAQ

The filing fee is state specific with the lowest cost being $40 (in Kentucky) and the most expensive cost being $500 (in Massachusetts). Most states' filing fees hover between $50 and $100.

LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a ?pass-through? basis ? all profits and losses are filed through the member's personal tax return. Generally, LLCs are required to pay a one-time filing fee as well as an annual fee.

Mississippi LLC Formation Filing Fee: $50 To bring your Mississippi LLC into existence, you must pay $50 (plus a $4 credit card fee) to file your LLC Certificate of Formation. You must fill out your application online, via the Mississippi Business Services portal.

How much is a Mississippi Business License? Mississippi doesn't have a general business license at the state level, so there are no fees there. However, your business may need a state-level occupational license or municipal-level license or permit to operate.

Do you need an operating agreement in Mississippi? No, it's not legally required in Mississippi under § 79-29-123. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership.

What are the requirements to form an LLC in Mississippi? You must file articles of organization with the Secretary of State and pay a $50 filing fee. The articles must include the LLC's name, registered agent, and principal address.

There are different types of LLCs that can be formed in Mississippi. Single-member LLC: A single-member LLC is owned by one member who is responsible for the business. For tax purposes, the member is typically taxed as a sole proprietor and reports the LLC's profits and losses on their personal income tax return.