Title: Understanding the Mississippi Assignment of LLC Company Interest to Living Trust Description: In this article, we will delve into the details of the Mississippi Assignment of LLC Company Interest to Living Trust, an important legal process that allows individuals to transfer their ownership in an LLC to a living trust. This comprehensive guide will provide you with valuable insights and key information regarding this assignment in Mississippi. Keywords: Mississippi, Assignment of LLC Company Interest, Living Trust, LLC ownership transfer, legal process, transfer of ownership, living trust benefits, Mississippi LLC laws 1. Introduction to the Mississippi Assignment of LLC Company Interest to Living Trust: Learn about the significance of the Mississippi Assignment of LLC Company Interest to Living Trust, a legal document that enables the smooth transfer of LLC ownership to a living trust. Discover the specific requirements and conditions associated with this process. 2. Benefits of Transferring LLC Ownership to a Living Trust in Mississippi: Understand the advantages and benefits of assigning your LLC's company interest to a living trust. Explore how this legal arrangement can protect your assets, provide succession planning options, and offer privacy benefits. 3. The Process of Assigning LLC Company Interest to a Living Trust in Mississippi: Gain a step-by-step understanding of the process involved in assigning LLC company interest to a living trust in Mississippi. Learn about the necessary legal documents, filing requirements, and the role of the LLC operating agreement. 4. Different Types of Mississippi Assignment of LLC Company Interest to Living Trust: Highlight any specific variations or types of LLC ownership transfers to living trusts that exist within Mississippi's legal framework. These variations could include partial transfers, full transfers, or transfers based on specific conditions. 5. Legal Considerations and Documents Required for the Assignment: Explore the legal aspects surrounding the Mississippi Assignment of LLC Company Interest to Living Trust. Discuss the crucial documents required, such as the Assignment of LLC Company Interest form, Articles of Organization, and the Living Trust Agreement. 6. Compliance with Mississippi State Laws and Regulations: Provide an overview of the Mississippi state laws and regulations that govern the Assignment of LLC Company Interest to Living Trust. Emphasize the importance of adhering to these laws to ensure a valid and legally binding transfer. 7. Implications on Taxes and Reporting Requirements: Examine the potential tax implications that may arise from transferring LLC ownership to a living trust in Mississippi. Discuss important factors such as income tax, estate tax, and compliance with state and federal tax reporting requirements. 8. Seeking Legal Assistance for the Assignment Process: Suggest the importance of seeking professional legal assistance when undertaking the Mississippi Assignment of LLC Company Interest to Living Trust. Encourage readers to consult with an attorney familiar with trust and LLC laws to ensure a smooth and error-free process. By providing a detailed exploration of the Mississippi Assignment of LLC Company Interest to Living Trust, this article aims to equip readers with the necessary knowledge and understanding navigating this legal process effectively.

Mississippi Assignment of LLC Company Interest to Living Trust

Description

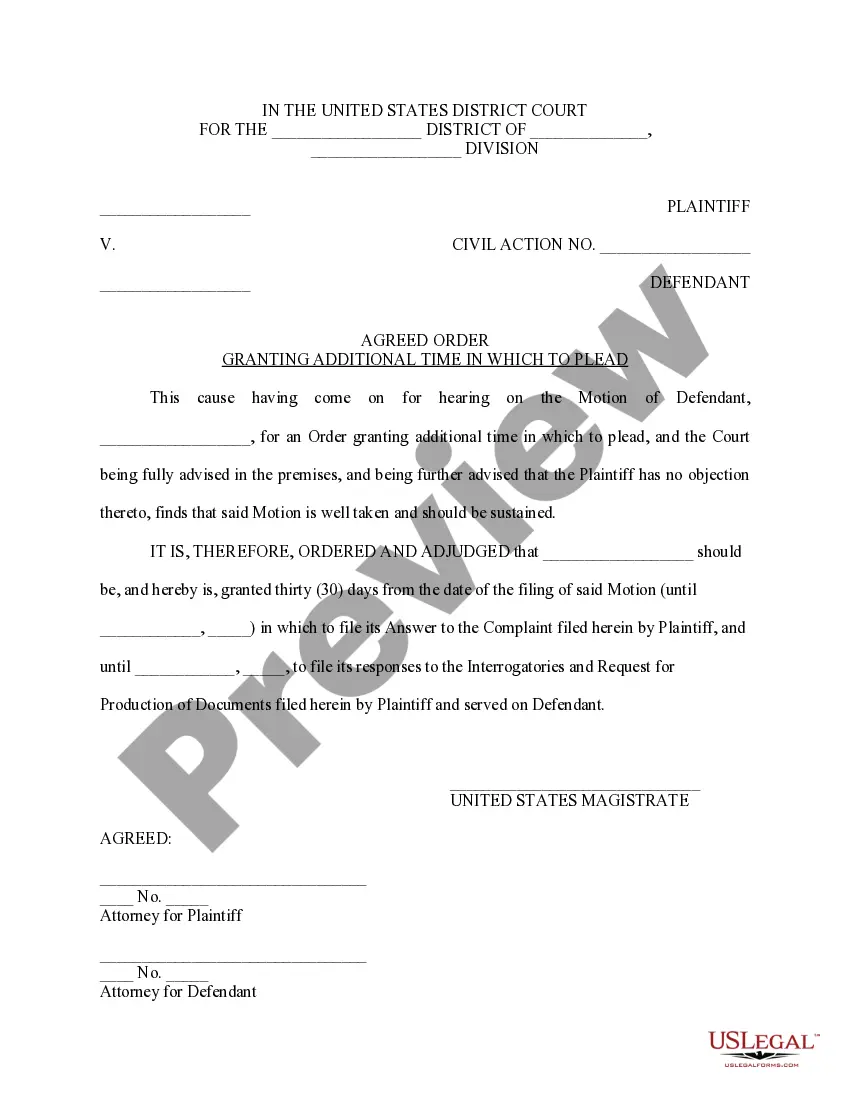

How to fill out Mississippi Assignment Of LLC Company Interest To Living Trust?

Are you inside a position that you need to have paperwork for possibly organization or person purposes nearly every time? There are tons of legal record templates accessible on the Internet, but locating kinds you can rely is not effortless. US Legal Forms delivers a huge number of type templates, just like the Mississippi Assignment of LLC Company Interest to Living Trust, which can be written in order to meet federal and state requirements.

If you are currently informed about US Legal Forms site and get a free account, basically log in. Next, it is possible to down load the Mississippi Assignment of LLC Company Interest to Living Trust template.

Should you not offer an account and would like to begin using US Legal Forms, abide by these steps:

- Find the type you want and ensure it is for your right metropolis/region.

- Use the Review switch to review the form.

- See the description to actually have selected the proper type.

- In case the type is not what you are trying to find, make use of the Research discipline to find the type that fits your needs and requirements.

- If you get the right type, simply click Get now.

- Pick the pricing program you would like, complete the required information to create your bank account, and pay for an order using your PayPal or charge card.

- Pick a practical document format and down load your backup.

Get each of the record templates you might have bought in the My Forms food list. You may get a further backup of Mississippi Assignment of LLC Company Interest to Living Trust whenever, if needed. Just go through the needed type to down load or printing the record template.

Use US Legal Forms, one of the most substantial assortment of legal varieties, to save lots of time as well as avoid errors. The services delivers appropriately produced legal record templates which can be used for an array of purposes. Make a free account on US Legal Forms and commence producing your life easier.