Mississippi Provisions for Testamentary Charitable Remainder Unit rust for One Life are legal instruments that allow individuals to provide for charitable donations during their lifetime while still retaining income from the assets placed in trust. The Mississippi provisions for a Testamentary Charitable Remainder Unit rust for One Life adhere to the rules and regulations set forth in the Mississippi Code. These provisions allow individuals to create a trust wherein assets are transferred to a trustee, who manages and invests them. The individual or their designated beneficiary receives income from the trust for their lifetime or a specified number of years. After the trust termination, the remaining assets are distributed to one or more charitable organizations or foundations. One type of Mississippi provision for a Testamentary Charitable Remainder Unit rust for One Life is the Charitable Remainder Annuity Trust (CAT). With a CAT, the individual or beneficiary receives a fixed annuity payment each year, which must be at least 5% of the initial fair market value of the trust assets. Another type is the Charitable Remainder Unit rust (CUT). In a CUT, the individual or beneficiary receives a fixed percentage of the trust's fair market value as income each year, evaluated annually. The minimum percentage payout for a CUT is also at least 5%. The Mississippi provisions for a Testamentary Charitable Remainder Unit rust for One Life provide individuals with flexibility in determining the duration of their charitable giving. They can choose to establish a trust that benefits only one life or multiple lives, such as a spouse or loved one, in addition to themselves. The trust can also span a fixed term of years. Mississippi's law permits a maximum term length of 20 years for testamentary charitable remainder unit rusts. These provisions also specify the legal requirements for creating such trusts, including the need for a valid will or trust agreement, appointment of a qualified trustee, and identification of the charitable organization(s) to receive the residual assets after the trust term ends. The use of relevant keywords in the content includes: Mississippi Testamentary Charitable Remainder Unit rust, Mississippi Charitable Remainder Annuity Trust, Mississippi Charitable Remainder Unit rust, Mississippi Trustee, Mississippi Charitable Organization, Mississippi Provision for Charitable Giving, Mississippi Estate Planning, Mississippi Will, Mississippi Trust Agreement.

Mississippi Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

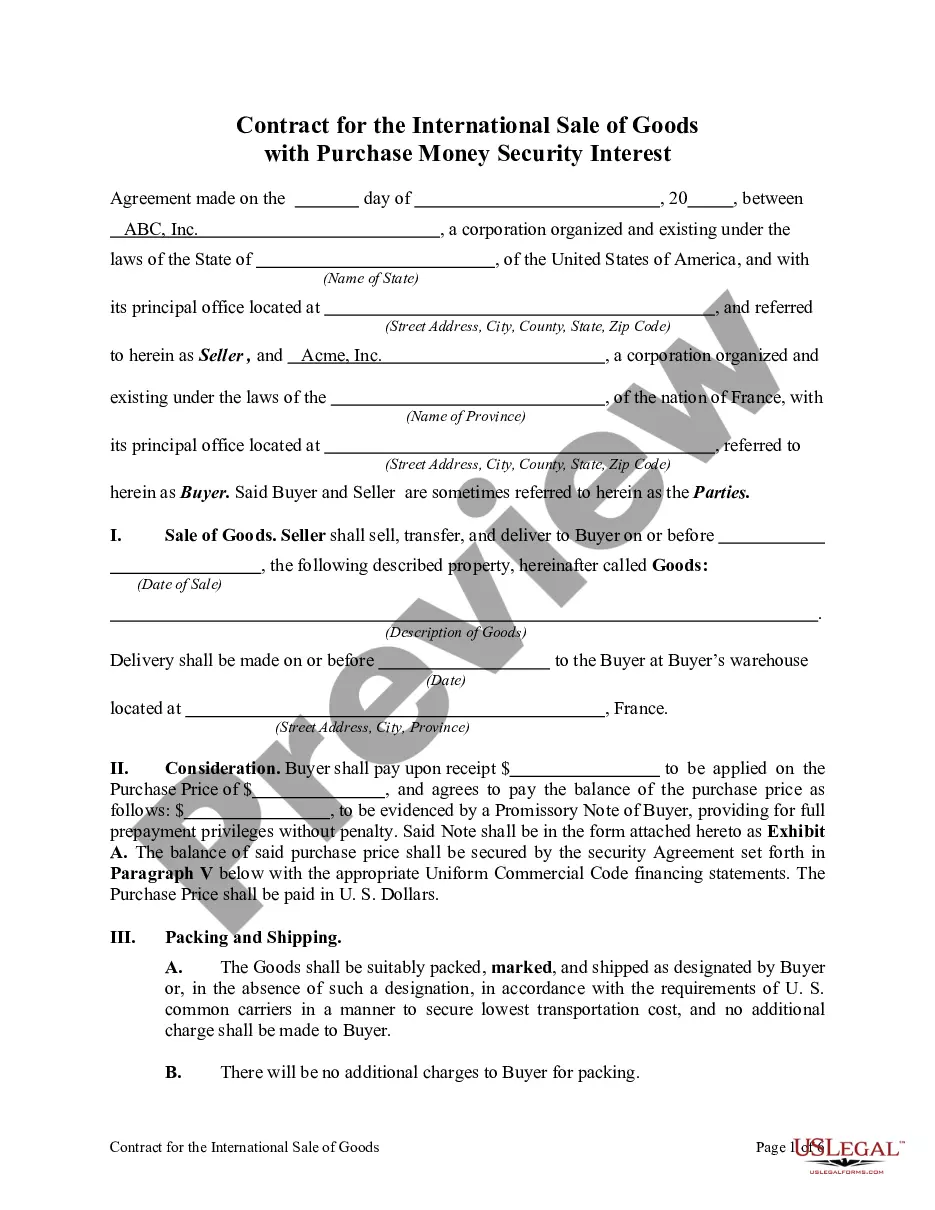

How to fill out Mississippi Provisions For Testamentary Charitable Remainder Unitrust For One Life?

US Legal Forms - one of several greatest libraries of authorized kinds in America - provides a wide array of authorized papers web templates you are able to down load or produce. While using internet site, you will get 1000s of kinds for business and individual uses, categorized by groups, says, or key phrases.You will discover the most recent versions of kinds much like the Mississippi Provisions for Testamentary Charitable Remainder Unitrust for One Life in seconds.

If you already possess a membership, log in and down load Mississippi Provisions for Testamentary Charitable Remainder Unitrust for One Life from your US Legal Forms collection. The Download option will show up on every form you view. You gain access to all earlier saved kinds from the My Forms tab of your own account.

In order to use US Legal Forms for the first time, listed below are basic recommendations to obtain started out:

- Be sure you have chosen the best form for your personal area/area. Go through the Review option to analyze the form`s information. See the form outline to actually have selected the correct form.

- In case the form doesn`t satisfy your requirements, utilize the Research field at the top of the monitor to get the one which does.

- Should you be pleased with the shape, verify your option by simply clicking the Purchase now option. Then, choose the pricing plan you want and offer your references to register to have an account.

- Method the financial transaction. Use your credit card or PayPal account to finish the financial transaction.

- Find the formatting and down load the shape on the system.

- Make changes. Fill up, revise and produce and signal the saved Mississippi Provisions for Testamentary Charitable Remainder Unitrust for One Life.

Each and every web template you put into your account does not have an expiry day and is also the one you have forever. So, if you would like down load or produce an additional version, just check out the My Forms area and then click on the form you will need.

Obtain access to the Mississippi Provisions for Testamentary Charitable Remainder Unitrust for One Life with US Legal Forms, one of the most comprehensive collection of authorized papers web templates. Use 1000s of specialist and express-specific web templates that meet up with your company or individual demands and requirements.

Form popularity

FAQ

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

The testamentary charitable remainder unitrust (CRUT) is beneficial in that it allows for an income stream to be paid to selected beneficiaries after the donor's death.

A charitable remainder trust is a tax-exempt irrevocable trust designed to reduce the taxable income of individuals. A charitable remainder trust dispenses income to one or more noncharitable beneficiaries for a specified period and then donates the remainder to one or more charitable beneficiaries.

You can name yourself or someone else to receive a potential income stream for a term of years, no more than 20, or for the life of one or more non-charitable beneficiaries, and then name one or more charities to receive the remainder of the donated assets.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.

CRUT lie in what the trust pays out on a yearly basis and whether additional contributions are permitted once the trust has been created. With a CRAT, the annuity amount paid each year is fixed. Once you establish a CRAT and make the initial contribution, no further contributions are allowed.

1. Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years.

Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions are not allowed. Charitable remainder unitrusts (CRUTs) distribute a fixed percentage based on the balance of the trust assets (revalued annually), and additional contributions can be made.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years. These income payments are calculated annually using a set percentage rate and the value of the trust's assets.

Benefits of CRUTsimmediate income tax deduction for a portion of the contribution to the trust. no upfront capital gains tax on appreciated assets you donate to the trust. steady income stream for life or many years. federal and possible state income tax charitable deduction, and.