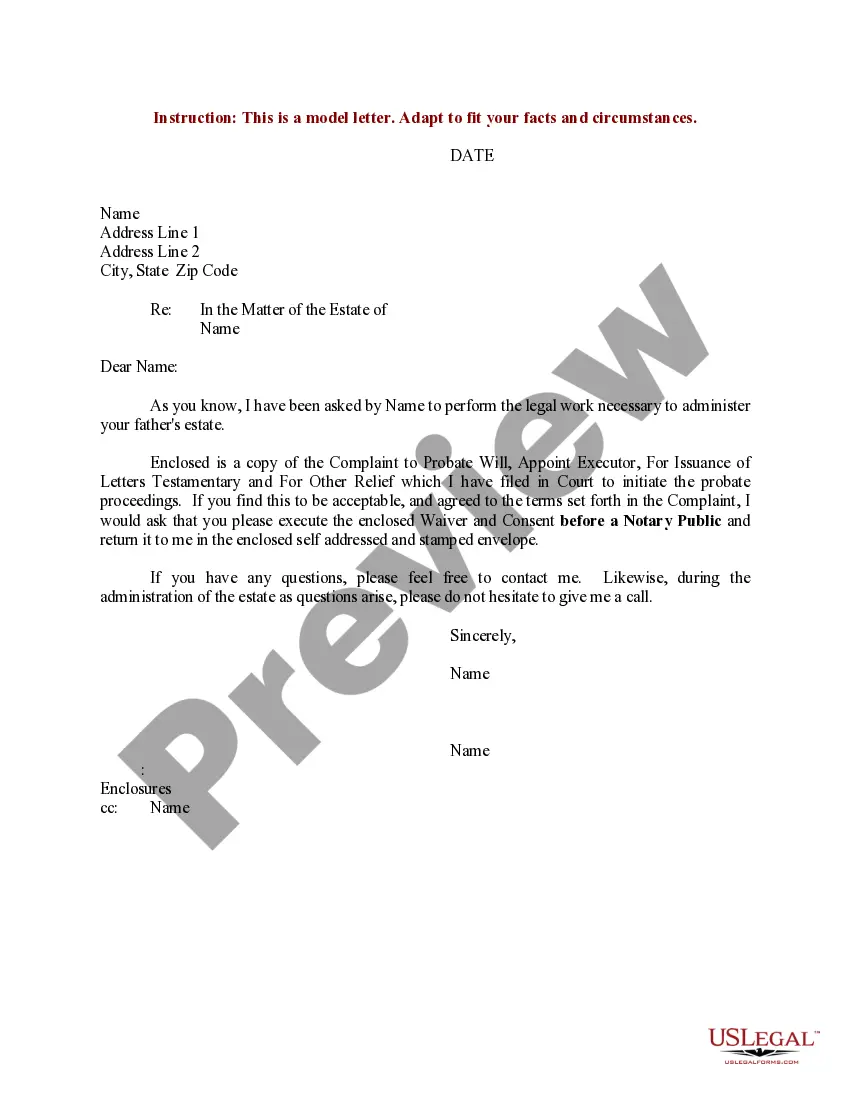

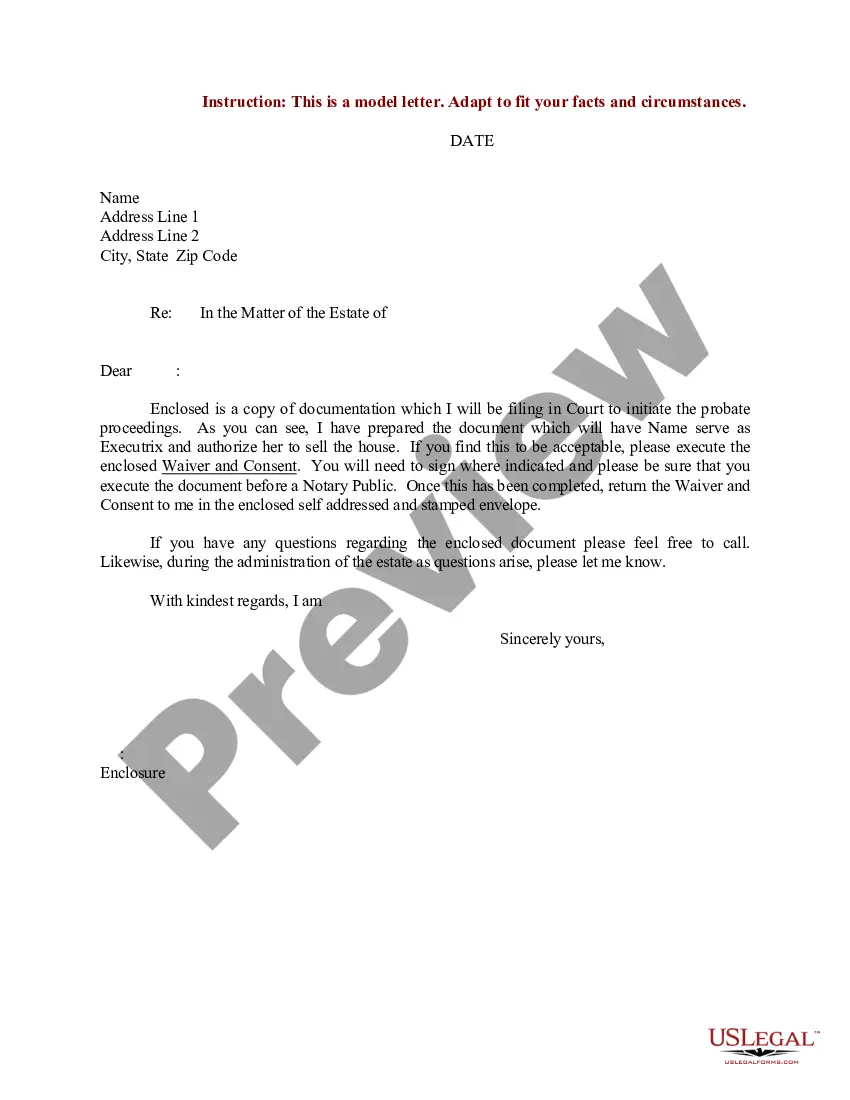

Mississippi Sample Letter for Estate Probate Proceedings

Description

How to fill out Sample Letter For Estate Probate Proceedings?

If you have to comprehensive, down load, or produce legitimate papers web templates, use US Legal Forms, the greatest variety of legitimate varieties, which can be found online. Make use of the site`s easy and practical research to get the files you will need. A variety of web templates for enterprise and person reasons are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to get the Mississippi Sample Letter for Estate Probate Proceedings within a couple of click throughs.

Should you be currently a US Legal Forms client, log in to your profile and then click the Down load option to get the Mississippi Sample Letter for Estate Probate Proceedings. You may also access varieties you previously delivered electronically inside the My Forms tab of your own profile.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape to the appropriate metropolis/land.

- Step 2. Make use of the Review method to look through the form`s content. Never forget to see the outline.

- Step 3. Should you be not happy with the develop, make use of the Look for area towards the top of the monitor to get other versions from the legitimate develop web template.

- Step 4. Upon having found the shape you will need, click on the Buy now option. Opt for the pricing plan you prefer and include your accreditations to sign up for the profile.

- Step 5. Process the financial transaction. You may use your charge card or PayPal profile to complete the financial transaction.

- Step 6. Find the structure from the legitimate develop and down load it on your own product.

- Step 7. Comprehensive, edit and produce or sign the Mississippi Sample Letter for Estate Probate Proceedings.

Every single legitimate papers web template you buy is your own property forever. You might have acces to each and every develop you delivered electronically with your acccount. Click on the My Forms section and pick a develop to produce or down load again.

Contend and down load, and produce the Mississippi Sample Letter for Estate Probate Proceedings with US Legal Forms. There are thousands of specialist and express-particular varieties you can utilize for your personal enterprise or person requirements.

Form popularity

FAQ

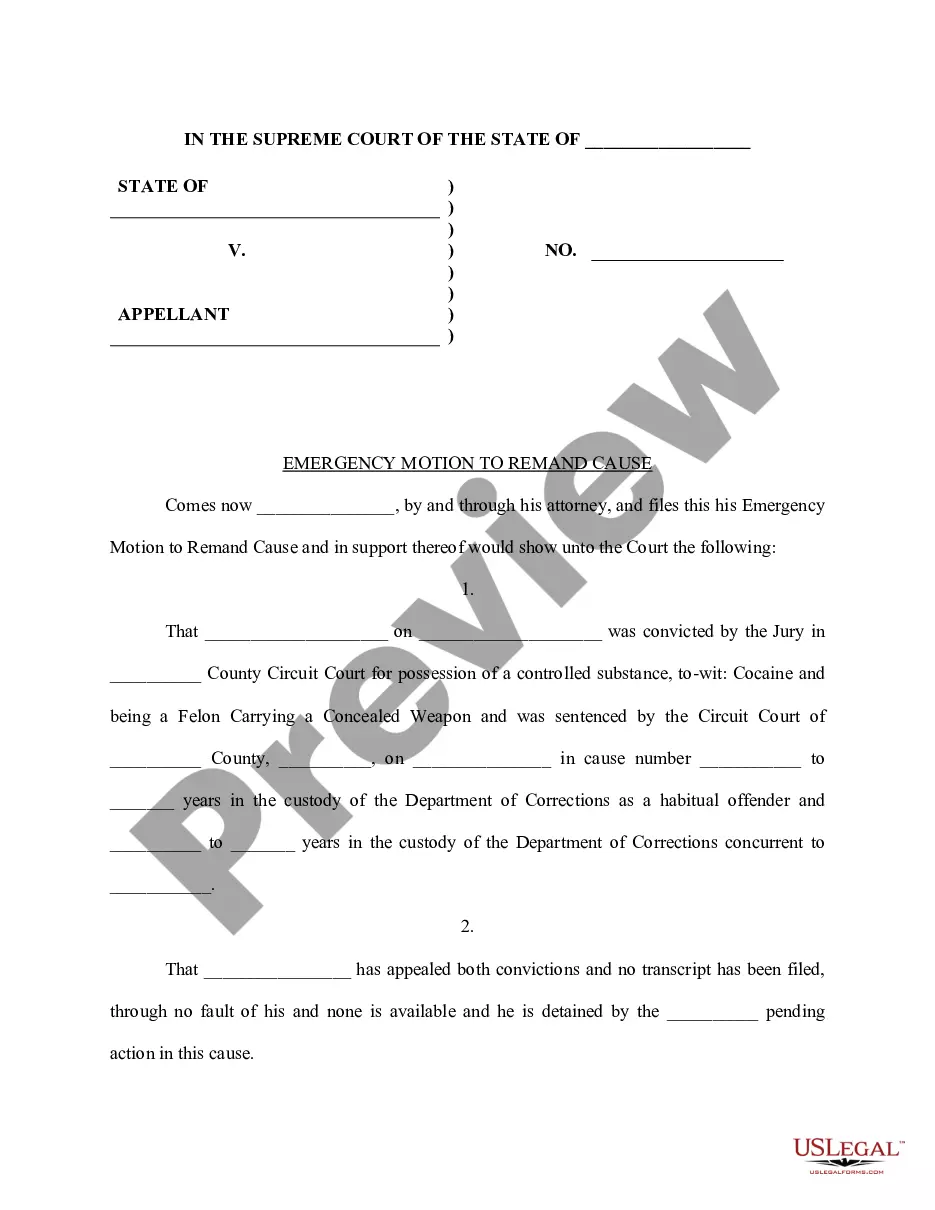

GENERAL OUTLINE OF PROBATE PROCESS IN MISSISSIPPI Establish a Need for Probate. ... Determine Type of Estate. ... Gather Documents. ... Present in ?Chancery Court? for Opening. ... Notify Creditors/Heirs and Sign Affidavit. ... Value and Distribute Assets. ... Heirs Sign to Close. ... Set Hearing for Disputes (judge will determine distribution)

(1) Letters of administration shall be granted by the chancery court of the county in which the intestate had, at the time of his death, a fixed place of residence; but if the intestate did not have a fixed place of residence, then by the chancery court of the county where the intestate died, or that in which his ...

Creditors have a certain time frame, typically 90 days from the date of first publication of notice to creditors, to file their claims for payment. If the estate has enough assets, the debts are paid. If not, creditors are generally paid on a pro-rata basis.

In Mississippi, creditors have 90 days to submit claims against the estate, so probate takes a minimum of three months. To make matters worse, the average estate in the US takes a full year and a half to finally distribute the inheritance money to the heirs.

The entire probate process is not always necessary. If the estate's net value is valued under $50,000, a simplified version of probate can be offered. This is also possible if the assets are bank accounts totaling less than $12,500 or if the probate estate is worth $500 or less.

Simple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

Every estate is different and can take a different length of time to administer depending on its complexity. There is a general expectation that an executor or administrator should try to complete the estate administration within a year of the death, and this is referred to as the executor's year.

If you die with children but no spouse, your children will inherit everything. If you die with one child, your spouse gets half of the intestate property and your child gets the other half. If you die with two or more children, your surviving spouse and children each get an equal share of your intestate property.