Subject: In-Depth Description of Mississippi Sample Letters for Review of Form 1210 Dear [Recipient's Name], I hope this letter finds you well. As per our recent conversation, enclosed within this correspondence, you will find a detailed description of the Mississippi Sample Letters for Review of Form 1210. Please note that there are two different types of sample letters available for your reference: the Request for Review Letter and the Follow-Up Letter. 1. Request for Review Letter: The Request for Review Letter is an essential document that allows individuals, taxpayers, or businesses to formally request a review of their Form 1210, pertaining to Mississippi tax returns. This letter is crucial when discrepancies, errors, or omissions are suspected in the filed form, requiring a thorough review and correction to ensure accuracy and compliance. Key Points to Include: — Begin the letter with a formal salutation and state the purpose of the letter. — Provide the necessary personal or business details, such as name, address, contact information, and taxpayer identification number. — Clearly explain the reason for the review request, discussing the specific concerns or issues identified in the Form 1210. — Enclose copies of relevant supporting documentation, such as receipts, invoices, or any other evidence supporting the claimed deductions or adjustments, if applicable. — Express willingness to cooperate and provide any additional information or clarification required for the review process. — Conclude the letter with a polite request for a prompt review and an expression of gratitude for their attention to the matter. 2. Follow-Up Letter: In case there has been no response or acknowledgement of the initial Request for Review Letter, it becomes necessary to send a Follow-Up Letter to ensure that the review process is initiated or expedited. Key Points to Include: — Start the letter with a courteous salutation and briefly mention the initial date of the Request for Review Letter. — Kindly remind the recipient about the pending review of the Form 1210 and the importance of timely resolution. — Express any concerns or difficulties that may have arisen due to the delayed response, such as financial implications or potential penalties. — Reiterate the willingness to provide any further information or assistance required to expedite the review process. — Politely request an update on the status of the review and an expected timeline for resolution. — Conclude the letter with gratitude for their attention and reiterate the significance of their quick response for a timely tax filing. Please understand that these documents are only sample letters, meant to serve as a guide for individuals navigating their way through the taxation process. It is advisable to seek professional assistance or consult with a tax advisor to ensure accuracy and adherence to Mississippi state regulations. If you have any further questions or require additional information, please do not hesitate to contact me. I am here to provide any assistance you may need throughout this process. Warm regards, [Your Name] [Your Contact Information]

Mississippi Sample Letter for Review of Form 1210

Description

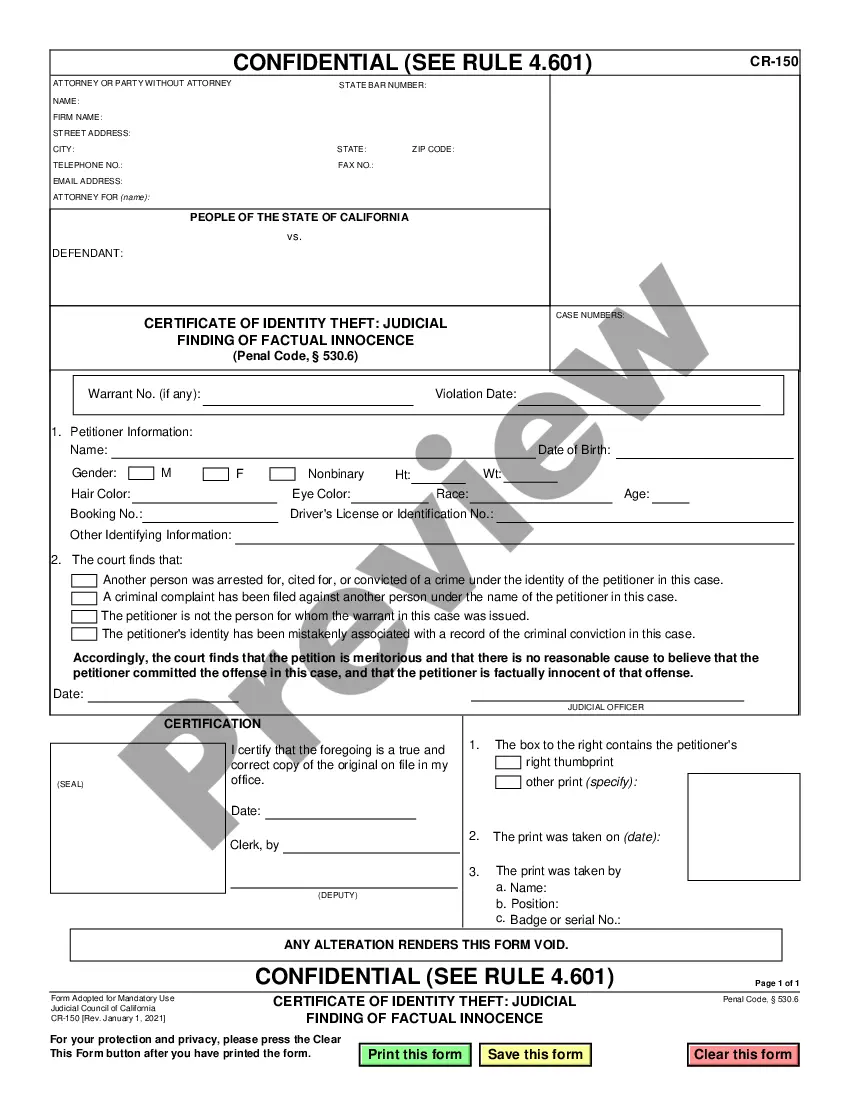

How to fill out Mississippi Sample Letter For Review Of Form 1210?

US Legal Forms - among the biggest libraries of legitimate forms in America - provides an array of legitimate file web templates it is possible to down load or print out. Making use of the web site, you can find a huge number of forms for enterprise and individual functions, sorted by groups, suggests, or search phrases.You can find the newest versions of forms just like the Mississippi Sample Letter for Review of Form 1210 in seconds.

If you have a membership, log in and down load Mississippi Sample Letter for Review of Form 1210 in the US Legal Forms local library. The Down load option will appear on each and every kind you see. You have accessibility to all previously delivered electronically forms within the My Forms tab of your respective account.

If you want to use US Legal Forms the very first time, here are basic guidelines to get you started:

- Be sure you have picked out the correct kind to your city/county. Select the Preview option to analyze the form`s articles. Look at the kind information to ensure that you have chosen the appropriate kind.

- In case the kind does not suit your needs, take advantage of the Search field at the top of the monitor to get the one who does.

- When you are satisfied with the form, affirm your choice by clicking the Get now option. Then, select the prices plan you like and offer your credentials to register for an account.

- Approach the transaction. Make use of your credit card or PayPal account to accomplish the transaction.

- Find the file format and down load the form in your product.

- Make adjustments. Fill out, modify and print out and signal the delivered electronically Mississippi Sample Letter for Review of Form 1210.

Every template you included with your money does not have an expiry day and is yours eternally. So, if you wish to down load or print out an additional copy, just visit the My Forms portion and then click around the kind you will need.

Get access to the Mississippi Sample Letter for Review of Form 1210 with US Legal Forms, by far the most substantial local library of legitimate file web templates. Use a huge number of specialist and condition-certain web templates that meet up with your company or individual needs and needs.

Form popularity

FAQ

Overview of Mississippi Taxes Gross Paycheck$3,146Federal Income16.20%$510State Income4.05%$128Local Income0.00%$0FICA and State Insurance Taxes7.65%$24123 more rows

Mississippi Median Household Income You will be taxed 3% on any earnings between $4,000 and $5,000, 4% on the next $5,000 (up to $10,000) and 5% on income over $10,000. Income below $4,000 is not taxed at the state level.

Mississippi has a 7.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 7.07 percent. Mississippi's tax system ranks 30th overall on our 2023 State Business Tax Climate Index.

Mississippi has a flat 5.00 percent individual income tax. Mississippi also has a 4.00 to 5.00 percent corporate income tax rate. Mississippi has a 7.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 7.07 percent.

Federal payroll tax rates for 2023 are: Social Security tax rate: 6.2% for the employee plus 6.2% for the employer. Medicare tax rate: 1.45% for the employee plus 1.45% for the employer. Additional Medicare: 0.9% for the employee when wages exceed $200,000 in a year.

The 89-350 Mississippi Employee's Withholding Exemption Certificate must be completed by employees so employers know how much state income tax to withhold from wages. This form should be maintained in conjunction with the federal Form W-4.

Yes, a resident of Mississippi is subject to Mississippi income tax on all of his/her wages whether he/she works in Mississippi or in another state.

The graduated 2022 income tax rate is: 0% on the first $5,000 of taxable income. ? 4% on the next $5,000 of taxable income. 5% on the remaining taxable income in excess of $10,000.