Mississippi Combined Declaration and Assignment

Description

How to fill out Combined Declaration And Assignment?

Are you currently in a place in which you need files for either company or personal purposes virtually every day? There are a variety of lawful file templates available online, but discovering ones you can depend on isn`t simple. US Legal Forms provides a large number of kind templates, such as the Mississippi Combined Declaration and Assignment, which can be created to fulfill state and federal needs.

When you are previously informed about US Legal Forms website and also have a merchant account, basically log in. Following that, you are able to download the Mississippi Combined Declaration and Assignment template.

Should you not offer an profile and wish to begin to use US Legal Forms, adopt these measures:

- Find the kind you will need and make sure it is to the right city/state.

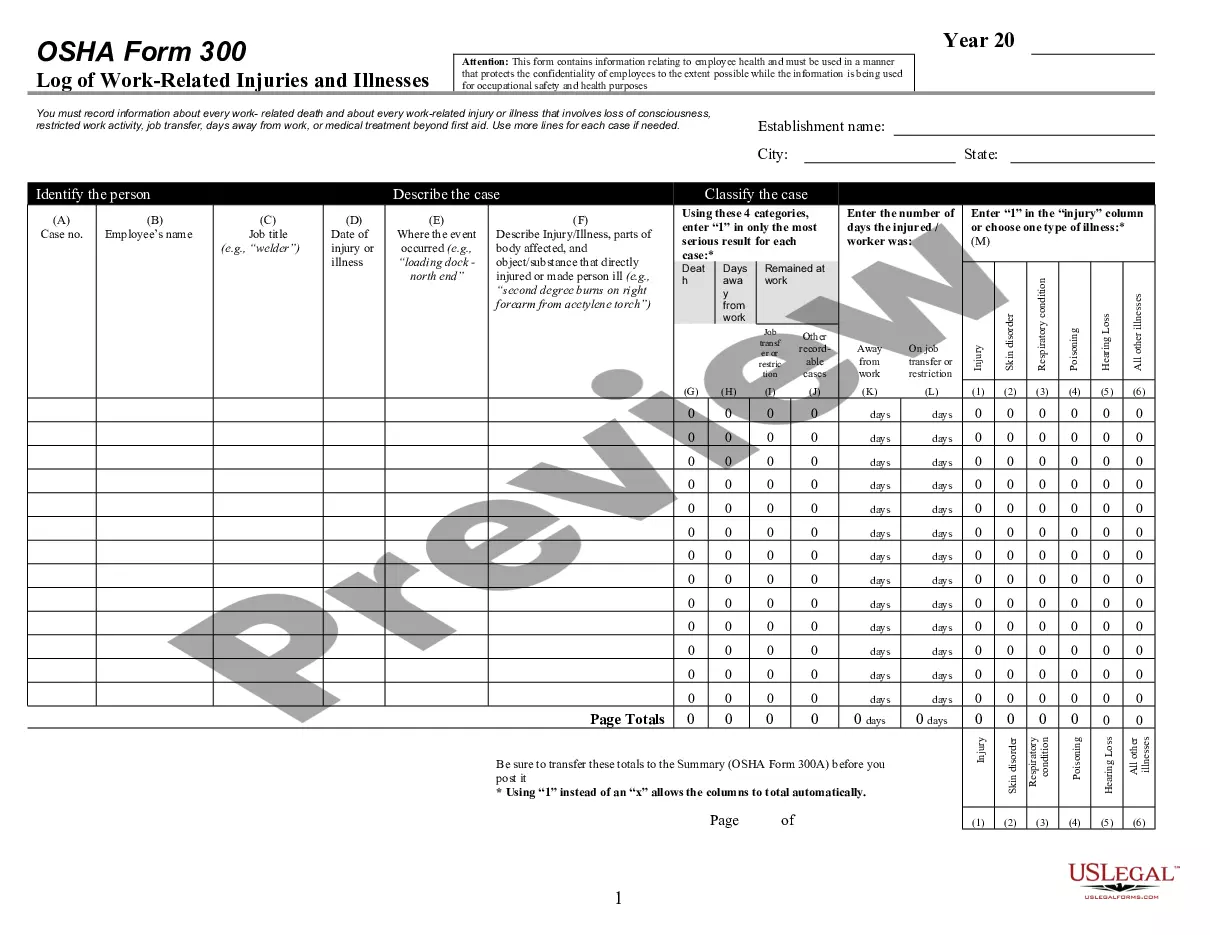

- Utilize the Review option to examine the form.

- Read the outline to ensure that you have selected the right kind.

- In case the kind isn`t what you are searching for, utilize the Lookup field to obtain the kind that fits your needs and needs.

- When you find the right kind, click on Buy now.

- Opt for the costs program you desire, complete the specified details to create your account, and purchase your order with your PayPal or charge card.

- Choose a handy data file structure and download your version.

Find every one of the file templates you possess purchased in the My Forms menus. You may get a more version of Mississippi Combined Declaration and Assignment at any time, if needed. Just click on the essential kind to download or produce the file template.

Use US Legal Forms, by far the most extensive selection of lawful varieties, in order to save efforts and prevent mistakes. The services provides expertly created lawful file templates that you can use for a variety of purposes. Generate a merchant account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

Mississippi has a 7.00 percent state sales tax rate, a max local sales tax rate of 1.00 percent, and an average combined state and local sales tax rate of 7.07 percent. Mississippi's tax system ranks 30th overall on our 2023 State Business Tax Climate Index.

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

A composite return is a return in which a partnership pays the income tax due for some, or all, of its partners. The only partners who are eligible to be included in the composite return are nonresident partners without any activity in Mississippi other than that from the partnership.

A composite tax filing has the advantage of convenience for pass-through entity owners. A combined return accounts for the state tax obligations of either all owners or those who decide to participate. As an owner, you benefit from not being responsible for filing individual returns in multiple states.

Income Tax Brackets The standard deduction in Mississippi is $2,300 for single filers and married individuals filing separately, $4,600 for married individuals filing jointly and $3,400 for heads of household. If itemized deductions are less than the standard deduction, taxpayers receive the standard deduction.

Not every state allows companies to file composite returns. For example, Nebraska, Oklahoma, Tennessee, and Utah don't allow them, while Arizona, New York, and Vermont restrict which companies may use the method.

A consolidated tax return is a corporate income tax return of an affiliated group of corporations, who elect to report their combined tax liability on a single return.

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi Income Tax withheld from your wages. You are a Non-Resident or Part-Year Resident with income taxed by Mississippi.