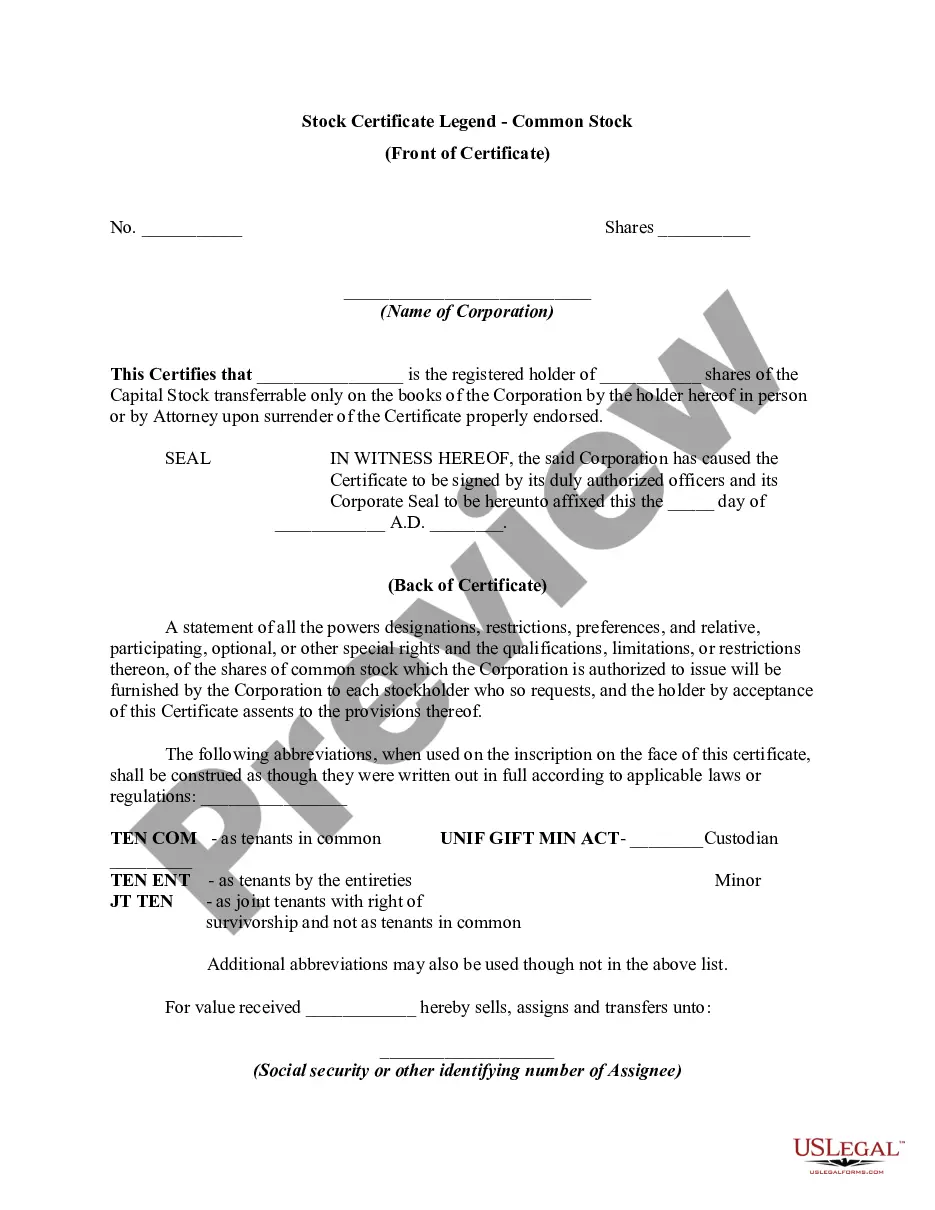

Mississippi Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

You may invest several hours on the Internet trying to find the legitimate record web template that fits the federal and state specifications you will need. US Legal Forms supplies 1000s of legitimate varieties which are analyzed by professionals. It is possible to download or produce the Mississippi Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders from my support.

If you already possess a US Legal Forms bank account, you may log in and then click the Acquire option. Next, you may total, change, produce, or sign the Mississippi Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders. Every legitimate record web template you acquire is the one you have eternally. To get yet another backup associated with a bought kind, check out the My Forms tab and then click the related option.

If you use the US Legal Forms site for the first time, keep to the basic directions listed below:

- Very first, be sure that you have chosen the right record web template for the state/metropolis of your choice. Read the kind outline to make sure you have chosen the appropriate kind. If offered, take advantage of the Preview option to check with the record web template as well.

- If you want to get yet another model of the kind, take advantage of the Research field to find the web template that meets your requirements and specifications.

- After you have located the web template you want, just click Acquire now to carry on.

- Pick the prices plan you want, key in your accreditations, and register for an account on US Legal Forms.

- Complete the transaction. You may use your Visa or Mastercard or PayPal bank account to cover the legitimate kind.

- Pick the formatting of the record and download it to your device.

- Make modifications to your record if necessary. You may total, change and sign and produce Mississippi Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders.

Acquire and produce 1000s of record themes making use of the US Legal Forms Internet site, that provides the greatest collection of legitimate varieties. Use expert and state-certain themes to tackle your small business or specific requirements.

Form popularity

FAQ

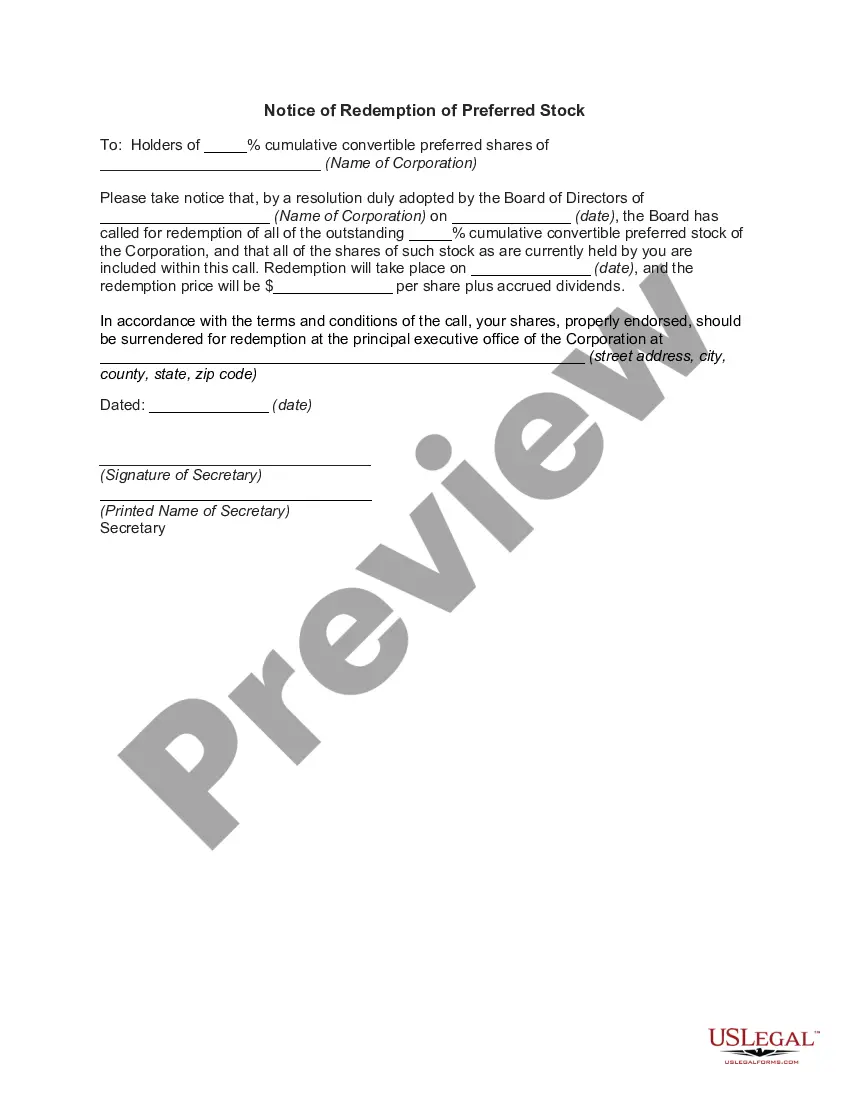

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

Unlike a redemption, which is compulsory, selling shares back to the company with a repurchase is voluntary. However, a redemption typically pays investors a premium built into the call price, partly compensating them for the risk of having their shares redeemed.

When a corporation purchases the stock of a departing shareholder, it's called a ?redemption.? When the other stockholders purchase the stock, it's called a cross-purchase. Typically, the redemption versus cross-purchase decision doesn't impact the ultimate control results.

Most importantly, a stock redemption plan provides tax-free, cash resources to pay a deceased owner's surviving family for their share of the business. Without extra funds available, a business might otherwise have to liquidate or sell assets in order to stay afloat during such a challenging time.