Mississippi Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate

Description

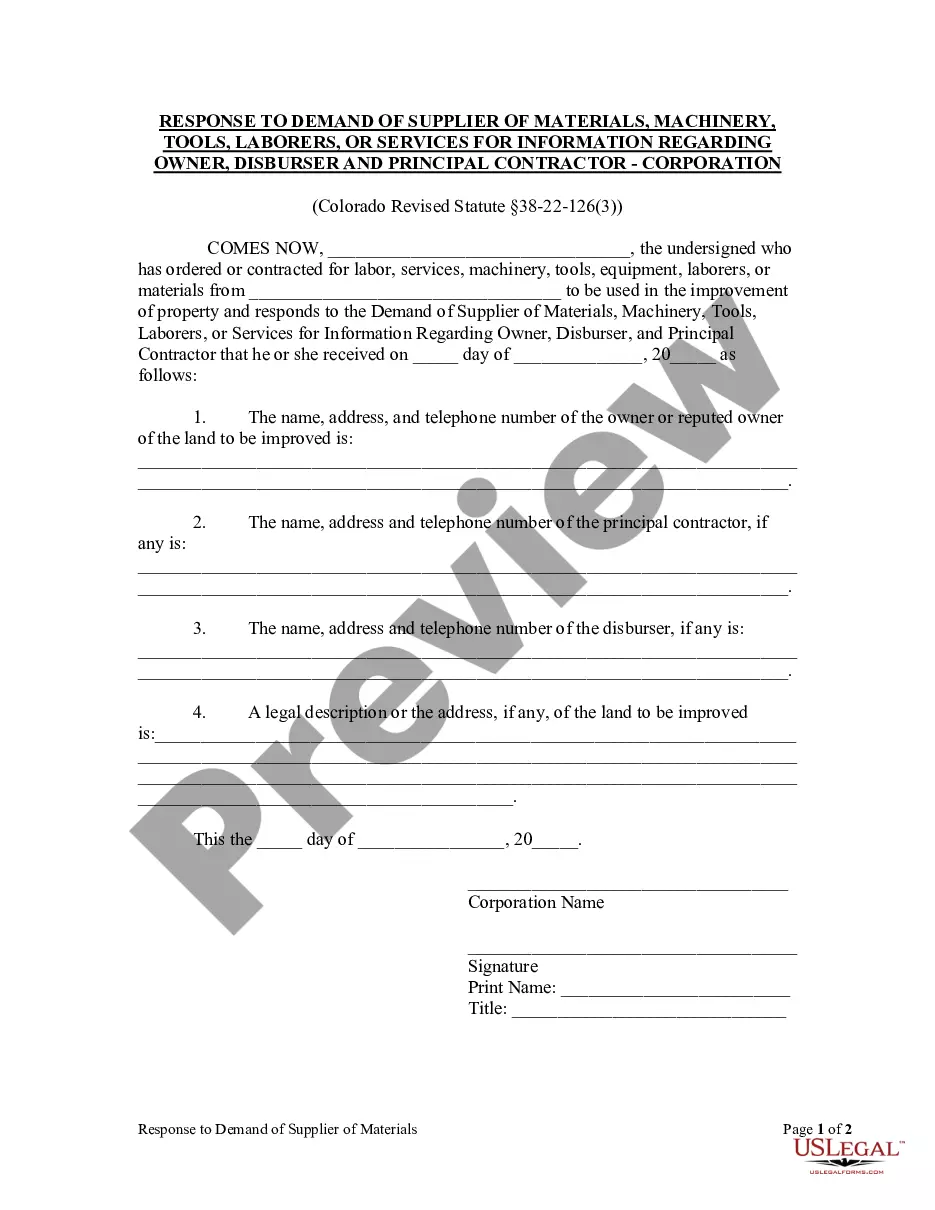

How to fill out Indemnity Bond To Replace Lost, Destroyed, Or Stolen Stock Certificate?

US Legal Forms - one of many greatest libraries of authorized types in the USA - delivers a wide range of authorized document themes you can obtain or printing. While using website, you can find a large number of types for enterprise and person uses, sorted by groups, states, or search phrases.You can get the most recent variations of types such as the Mississippi Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate within minutes.

If you already have a subscription, log in and obtain Mississippi Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate from your US Legal Forms collection. The Obtain switch will show up on each and every develop you view. You gain access to all previously delivered electronically types within the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, here are straightforward instructions to get you started out:

- Be sure you have picked the right develop to your city/area. Click on the Review switch to review the form`s information. See the develop description to actually have selected the appropriate develop.

- If the develop doesn`t match your needs, use the Look for area at the top of the monitor to get the one that does.

- If you are content with the form, validate your option by simply clicking the Purchase now switch. Then, pick the costs prepare you like and provide your qualifications to sign up for an bank account.

- Method the financial transaction. Utilize your Visa or Mastercard or PayPal bank account to finish the financial transaction.

- Select the file format and obtain the form in your system.

- Make adjustments. Fill out, revise and printing and indicator the delivered electronically Mississippi Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate.

Each and every template you included in your money lacks an expiration date and is your own permanently. So, if you would like obtain or printing one more backup, just check out the My Forms section and click on around the develop you require.

Get access to the Mississippi Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate with US Legal Forms, probably the most comprehensive collection of authorized document themes. Use a large number of skilled and status-particular themes that meet your small business or person requires and needs.

Form popularity

FAQ

If an investor does not have or loses their stock certificate, they are still the owner of their shares and entitled to all the rights that come with them. If an investor wants a stock certificate, or if it is lost, stolen, or damaged, they can receive a new one by contacting a company's transfer agent.

If you misplace your stock certificate or believe it was stolen or destroyed, you should immediately contact your transfer agent, or business that handles the records for the company of the stock you hold, and request that a "stop-transfer" order be put against it, similar to what you would do with a lost check.

The owner must buy an indemnity bond to protect the corporation and the transfer agent against the possibility that the lost certificate may be presented later by an innocent purchaser. The bond usually costs between two or three percent of the current market value of the missing certificates; and.

The lost instrument bond guarantees the owner of the lost document will indemnify the bank or other entity for any loss it suffers because of the duplicate securities or other issued instruments.

The shareholder should make an application for the issue of a duplicate share certificate with the required documents to the company. The documents sent to the company should have the shareholder's signature whose share certificate is lost or misplaced.

When dealing with an estate that includes shares without a certificate, a new one can be requested from the registrars of the company (if known). However, they may impose conditions before granting you with a replacement certificate.

The owner must buy an indemnity bond to protect the corporation and the transfer agent against the possibility that the lost certificate may be presented later by an innocent purchaser. The bond usually costs between two or three percent of the current market value of the missing certificates; and.

The fee for this service is normally around 1% of the value of the shares represented by the missing share certificate, making it a cost-effective service.