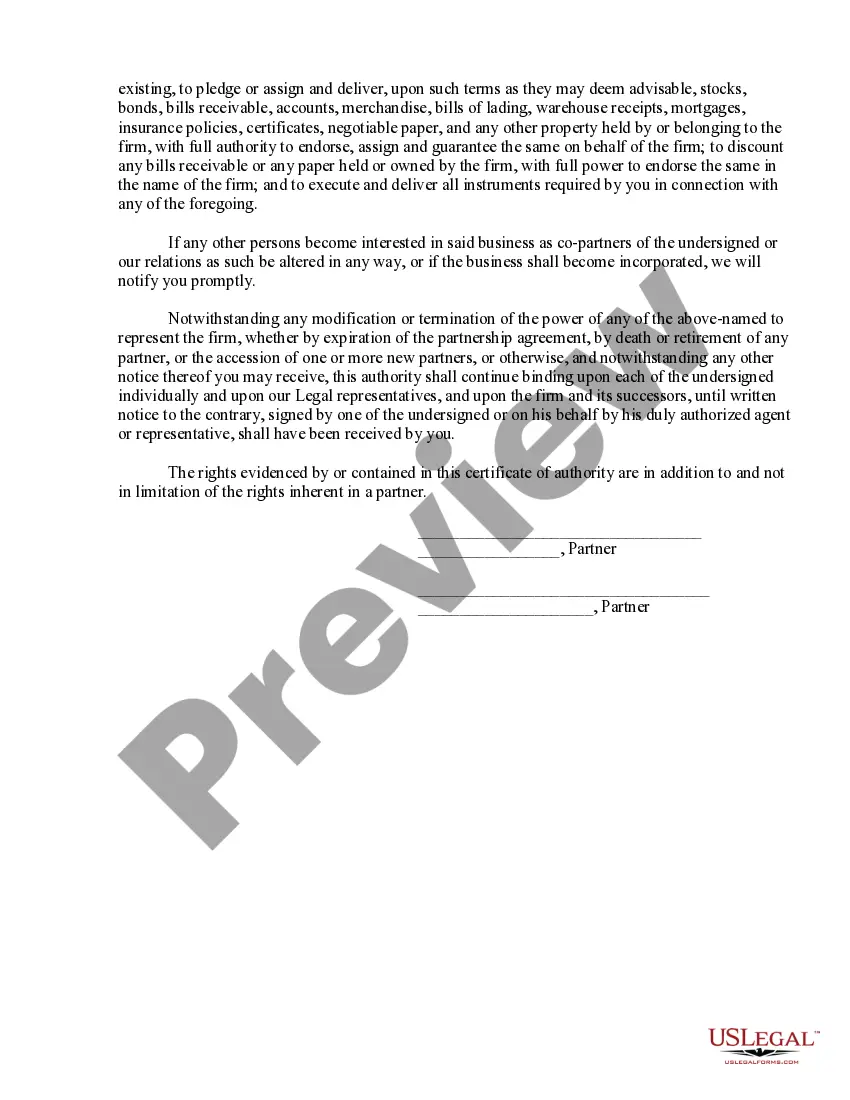

Mississippi Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

You are able to commit hrs on-line trying to find the legitimate document web template that suits the federal and state demands you require. US Legal Forms provides a large number of legitimate types that are analyzed by professionals. It is simple to obtain or printing the Mississippi Authority of Partnership to Open Deposit Account and to Procure Loans from the assistance.

If you have a US Legal Forms account, you are able to log in and then click the Acquire button. Following that, you are able to complete, change, printing, or sign the Mississippi Authority of Partnership to Open Deposit Account and to Procure Loans. Each legitimate document web template you purchase is your own forever. To have another backup of the purchased develop, check out the My Forms tab and then click the related button.

If you use the US Legal Forms internet site for the first time, adhere to the straightforward recommendations below:

- Very first, be sure that you have chosen the correct document web template for the region/metropolis that you pick. See the develop description to make sure you have picked out the appropriate develop. If available, make use of the Review button to search through the document web template at the same time.

- If you would like find another version of the develop, make use of the Lookup field to obtain the web template that meets your requirements and demands.

- When you have found the web template you would like, click on Purchase now to continue.

- Pick the pricing plan you would like, key in your references, and register for a free account on US Legal Forms.

- Full the financial transaction. You can utilize your charge card or PayPal account to cover the legitimate develop.

- Pick the structure of the document and obtain it to your system.

- Make changes to your document if needed. You are able to complete, change and sign and printing Mississippi Authority of Partnership to Open Deposit Account and to Procure Loans.

Acquire and printing a large number of document themes while using US Legal Forms web site, which offers the greatest selection of legitimate types. Use expert and status-distinct themes to tackle your company or specific demands.

Form popularity

FAQ

RFC accounts (Resident Foreign Currency) are bank accounts that can be maintained by resident Indians in foreign currency. These accounts are especially useful for Non Resident Indians (NRI) who return to India and would like to bring back foreign currency from their overseas bank accounts.

Commercial banks are what most people think of when they hear the term "bank." Commercial banks are for-profit institutions that accept deposits, make loans, safeguard assets, and work with many different types of clients, including the general public and businesses.

First-loss Loans or Other GuaranteesIf the project fails to generate sufficient revenue to cover loan payments, a first-loss loan absorbs the loss and leaves other investors protected.

FLDG or 'first loan default guarantee' is an extremely popular term in fintech parlance. Every new-age technology player who wants to partner with large banks or NBFCs offers this guarantee to lenders.

FLDG or 'first loan default guarantee' is an extremely popular term in fintech parlance. Every new-age technology player who wants to partner with large banks or NBFCs offers this guarantee to lenders.

FLDG is an arrangement whereby a third party compensates a lender if the borrower defaults. In an FLDG setup, the credit risk is borne by the loan service provider (LSP) without maintaining any regulatory capital.

A bank is a financial institution licensed to receive deposits and make loans. Banks may also provide financial services such as wealth management, currency exchange, and safe deposit boxes. There are several different kinds of banks including retail banks, commercial or corporate banks, and investment banks.

FLDG is an arrangement whereby a third party compensates a lender if the borrower defaults. In an FLDG setup, the credit risk is borne by the loan service provider (LSP) without maintaining any regulatory capital.

Those that accept deposits from customersdepository institutionsinclude commercial banks, savings banks, and credit unions; those that don'tnondepository institutionsinclude finance companies, insurance companies, and brokerage firms.

Process of NBFC Collaboration between NBFCs and FinTech'sA co-origination scheme agreement needs to be signed by between NBFCF and the FinTech Firm.The FinTech's must sign an Intercorporate deposit agreement with Fund Manager.A separate escrow account must be opened for repayment and disbursement of funds.More items...