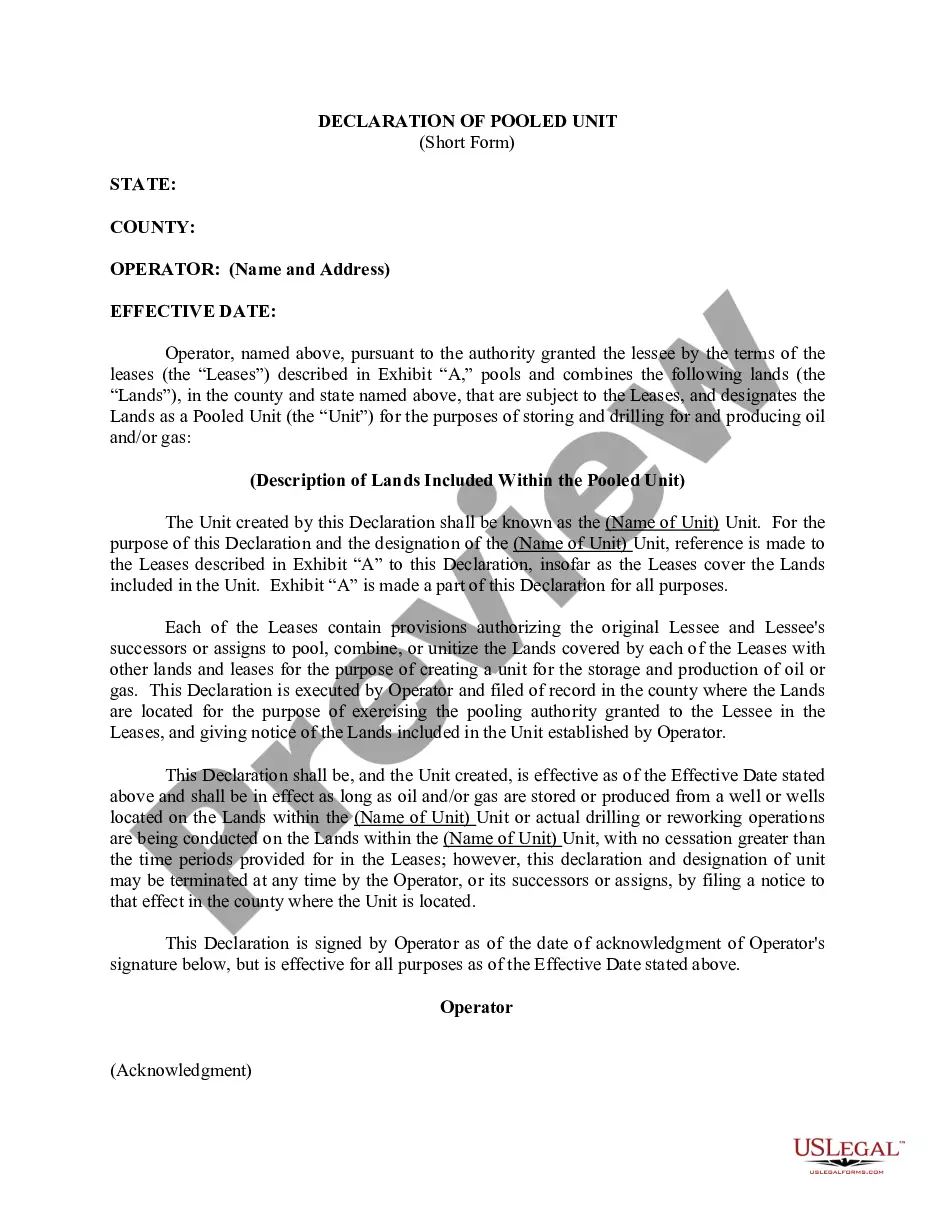

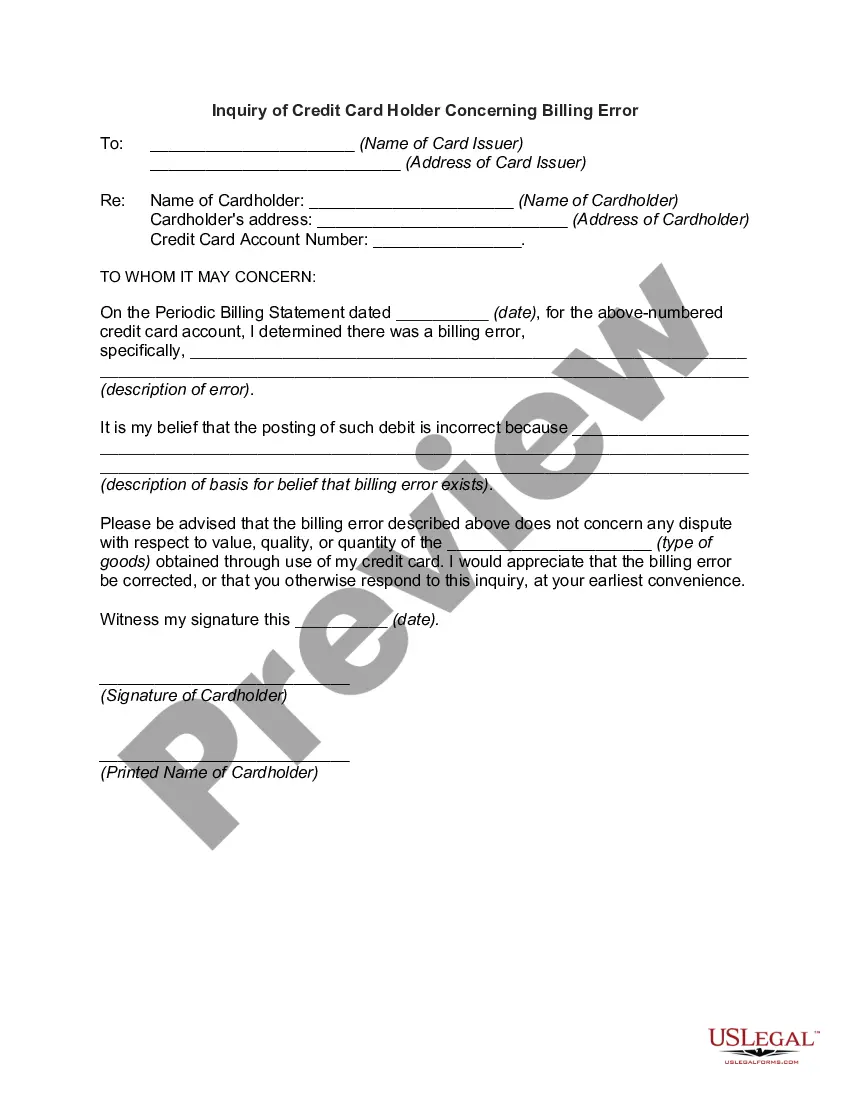

Title: Mississippi Inquiry of Credit Cardholder Concerning Billing Error — Detailed Overview and Types Introduction: The Mississippi Inquiry of Credit Cardholder Concerning Billing Error is a process initiated by credit cardholders residing in Mississippi to address any billing errors or discrepancies encountered on their credit card statements. This inquiry allows cardholders to seek correction and resolution from the credit card issuer in a timely and efficient manner. In this article, we will provide a comprehensive understanding of the Mississippi Inquiry of Credit Cardholder Concerning Billing Error, its purpose, procedure, and possible types of inquiries. 1. Purpose: The main objective of the Mississippi Inquiry of Credit Cardholder Concerning Billing Error is to protect credit cardholders from erroneous charges or misleading billing practices. Through this process, cardholders can dispute legitimate billing errors, unauthorized charges, fraudulent activities, incorrect interest calculations, inaccurate fees, or any other issue impacting the accuracy or fairness of their credit card billing statements. 2. Procedure: a. Filing the Inquiry: Cardholders must promptly notify the credit card issuer about the billing error within a specified timeframe (usually 60 days) after receiving the statement. The notification should be in writing, preferably using the specific credit card issuer's designated inquiry form. b. Details Required: The inquiry must include clear and concise information, such as the cardholder's name, account number, statement date, description of the error, and the requested correction. c. Supporting Documentation: Cardholders are encouraged to provide any relevant supporting documentation, such as receipts, bank statements, proof of returned merchandise, or any other evidence supporting their claim. d. Issuer's Obligation: Upon receiving the inquiry, the credit card issuer must acknowledge the receipt in writing within a specific timeframe (usually 30 days). Simultaneously, they are obliged to investigate the disputed charge, correct any errors, and provide a written breakdown of their findings. 3. Types of Mississippi Inquiries: a. Unauthorized Charges: A cardholder disputes charges made without their consent or fraudulent activities on their credit card account. b. Unrecognized Charges: Cardholders dispute valid charges that they do not recognize or recall making, potentially indicating payment-processing errors or potential fraud. c. Incorrect Fees: Cardholders dispute fees assessed that they believe are not accurately reflecting the services provided or are in violation of their credit card agreement. d. Calculation Errors: Cardholders identify issues related to interest rate calculations, late payment fees, or other charges on their billing statement that do not align with the agreed terms. Conclusion: The Mississippi Inquiry of Credit Cardholder Concerning Billing Error empowers credit cardholders to resolve any billing discrepancies encountered on their credit card statements. By following the specified procedure and utilizing supporting documentation, cardholders can seek proper rectification from the credit card issuer. Understanding the various types of inquiries helps individuals to identify and effectively resolve billing errors or suspicious activities swiftly and accurately.

Mississippi Inquiry of Credit Cardholder Concerning Billing Error

Description

How to fill out Mississippi Inquiry Of Credit Cardholder Concerning Billing Error?

Discovering the right lawful document web template can be a have difficulties. Naturally, there are tons of themes available on the Internet, but how would you get the lawful type you want? Use the US Legal Forms site. The service offers 1000s of themes, like the Mississippi Inquiry of Credit Cardholder Concerning Billing Error, which you can use for business and personal requires. All the forms are examined by pros and fulfill federal and state requirements.

In case you are currently registered, log in for your profile and click the Acquire button to get the Mississippi Inquiry of Credit Cardholder Concerning Billing Error. Make use of your profile to search from the lawful forms you may have purchased earlier. Proceed to the My Forms tab of the profile and acquire an additional backup from the document you want.

In case you are a brand new customer of US Legal Forms, here are simple directions that you should follow:

- Initially, make sure you have selected the appropriate type for the area/region. You are able to look over the shape making use of the Preview button and look at the shape description to make sure it is the right one for you.

- In case the type is not going to fulfill your requirements, utilize the Seach industry to discover the proper type.

- When you are sure that the shape is suitable, go through the Purchase now button to get the type.

- Select the costs strategy you would like and type in the required details. Create your profile and purchase an order utilizing your PayPal profile or charge card.

- Pick the submit structure and acquire the lawful document web template for your device.

- Full, modify and print and indication the received Mississippi Inquiry of Credit Cardholder Concerning Billing Error.

US Legal Forms is definitely the biggest library of lawful forms that you can find different document themes. Use the company to acquire expertly-made paperwork that follow status requirements.